Shareholder environmental activism by government pensions is a dangerous form of central planning. It represents government agents arrogating discernment of the public interest from democratic processes to themselves despite lacking superior ability or incentive or legitimacy. It erodes the separation of business and state. It infringes on the right of citizens to own companies unencumbered by arbitrary government interference. It impedes the vital role of market prices in motivating beneficial supply responses to evolving resource scarcity. It distorts public discourse. It harms retirees. AND it plausibly worsens climate change.

Article

Government (public) pensions in the US owned $2.3 trillion in listed equities in 2022.[1] The investment rationale for owning equities—the higher expected return arising from the greater uncertainty of equity owners being the residual claimants of company cash flows—is sound, but it fails to account for the consequences of government agencies exercising shareholder rights to influence business decisions, particularly to advance environmental, social, and governance (ESG) policies. Damages from climate change may be substantial and expected to worsen absent significant curtailments of greenhouse gas emissions (United Nations 2022). Shareholder activism to pursue climate policies has been rationalized as benefiting the targeted companies by mitigating agency conflicts such as short-termism or, per universal owner theory, as benefiting other companies by reducing negative externalities. In the absence of a tax or market price on emissions, shareholders can potentially fill this perceived policy void by pressuring selected companies to reduce their emissions, thus enhancing societal well-being and the market values of other companies.[2]

This article critically evaluates these and other rationales for shareholder environmental activism, describes activism by the California Public Employees’ Retirement System (CalPERS) and the discretion and incentives of government pensions, and identifies reasons that shareholder environmental activism, particularly by government pensions, represents coercive central planning of companies that impairs economic efficiency, democratic norms, and environmental quality.

Rationales for Shareholder Environmental Activism

Setting aside agency conflicts of institutional investors, the equity shareholders of a company theoretically possess the strongest incentive to maximize company value because they are the only constituency that receives only the residual cash flows.[3] Principal-agent conflicts between company shareholders and managers are a major governance challenge (Jensen 1989). Mitigating these conflicts through stronger shareholder rights and governance reforms has been found to enhance company value (Gompers, Ishii, and Metrick 2003). The theory and empirical findings support shareholder engagement.

Scientists’ warnings of worsening damages from anthropogenic climate change (United Nations 2022) suggest that the social cost of emissions exceeds the private cost, a divergence that incentivizes the generation of excessive emissions, a negative externality. A tax on emissions, if it could be set equal to its net externality cost and implemented, could incentivize an optimal amount of emissions (Pigou 1920). Alternatively, if transaction costs are small, then extending property rights to emissions could incentivize price discovery through the voluntary trading of emission rights, leading to an optimal amount of emissions (Coase 1960). A price on emissions could beneficially incentivize producers, consumers, and innovators to account for all costs, and provide the transparency and informational efficiency of prices (Nordhaus 2018, 453). As an example of how property rights can solve potential externalities, Steven Cheung (1973) disproved prior conclusions that apple growers and beekeepers suffer from externalities that warrant government taxes or subsidies, by showing that property rights led to price discovery, mutually beneficial agreements, and resource efficiency.

Yet many governments have neither implemented Pigouvian taxes nor created property rights on emissions, presumably resulting in excessive emissions. This suboptimal outcome could potentially be resolved by equity shareholders pressing companies to reduce emissions as if an optimal Pigouvian tax were implemented or as if property rights on emissions existed.

All three methods—Pigouvian tax, Coasian property rights, and shareholder activism—could theoretically result in the same decrease in emissions to account for externalities. A key difference is that property rights lead to price-discovery through voluntary exchanges of emission rights. The Pigouvian tax relies on a government determining and enforcing the proper tax amount. The third method relies on shareholders determining the proper reduction in exchange-traded company emissions and enforcing it through shareholder activism.[4]

Universal owner theory contends that diversified institutional shareholders can mitigate societal systemic risks and improve portfolio returns by pressuring companies to reduce their negative externalities. Shareholder pressure on a polluter to limit its emissions improves portfolio returns if the loss of the polluter’s value is outweighed by the collective market value gain of the other portfolio companies.[5] Externalities may exist because the costs of mitigation would exceed the benefits, in some cases due to perceived misguided laws, such as the absence of taxes or property rights on emissions. The unwieldy system of checks and balances of democratic processes creates hurdles for citizens to reform laws, which leads some to favor influencing public policy through shareholder activism instead of through democratic processes. “If political change is hard to achieve, action at the corporate level is a reasonable substitute.”[6]

Pressing corporations to limit emissions as an end objective exemplifies stakeholderism, a perspective that the purpose of a corporation is to serve its constituencies (employees, customers, suppliers, communities, environmental advocates, etc.) as end objectives, not solely as means to benefit shareholders. However, to Bebchuk and Tallarita (2020), stakeholderism, though increasingly influential and intended to benefit corporate constituencies, is a form of public relations and it diminishes corporate executive accountability to shareholders without achieving the intended benefits.

In sum, shareholders state different reasons for pressing corporations to curtail emissions. The stated intent of enhancing corporate value could be consistent with shareholder primacy. Other rationales, such as using corporate resources to correct perceived misguided laws or to serve nonshareholder constituencies as end objectives, indicate alternative corporate governance models.

Example: CalPERS Environmental Activism

CalPERS is a California state government agency that manages defined benefit pension funds for state and local government employees. The thirteen-member CalPERS board possesses plenary authority to manage the pension. It comprises four state officials, three appointed by state politicians, and six elected by members (i.e., retirees and employees) (CalPERS 2023).

CalPERS addresses environmental policies through divestments, regulatory lobbying, shareholder activism, public relations, and investment policies. Past Cal-PERS divestments either remain active (tobacco, Iran, firearms, thermal coal) or have been discontinued (South Africa, emerging markets, Sudan). The $440 billion market value of CalPERS assets as of June 30, 2022, was estimated to be $9.9 billion less due to its divestments (CalPERS 2022d).

CalPERS seeks to influence financial regulations by actively participating on regulatory advisory boards.[7] CalPERS successfully lobbied for SEC regulatory changes on proxy solicitations that permitted increased coordination among shareholders (Romano 1995, 44). More recently, CalPERS leveraged its access to the SEC chair and staff to lobby for mandated corporate environmental disclosures.[8]

CalPERS exercises its shareholder rights by filing and voting on shareholder proposals, nominating and voting on company board members, filing proxy solicitations, negotiating with company representatives,[9] engaging in public relations, and coordinating with other shareholders. CalPERS cofounded and has remained a leading member of several organizations dedicated to shareholder environmental activism.[10] Joining these organizations and coordinating with other members can strengthen shareholder bargaining positions.[11] CalPERS closely collaborates with Climate Action 100+ (CA100), “an investor-led initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change” (CA100 n.d., homepage). CA100 scores companies on a benchmark of ten climate indicators: emissions reductions over various time periods to net zero by 2050, decreased fossil fuel exploration and no “unsanctioned” investments, lobbying and memberships that promote the Paris Climate Agreement, the board’s climate focus and expertise, executive compensation being contingent on company climate measures, disclosures of numerous climate measures, and “Just Transition.” A CalPERS goal of such collaboration is that “by 2050 all of these companies need to have reduced emissions by an order of 80 to 90 percent” (Anne Simpson in CalPERS 2021, 115). CA100 members press companies, often successfully, to take actions that increase their climate scores.[12] CA100 coordinated a campaign by government pensions in California and New York to hold the board of a Texas energy company “accountable on climate change.”[13]

During 2022, CalPERS led negotiations with twenty-two CA100 companies, more than any other CA100 member. The CA100 lead negotiates with company board members and executives, “ensuring” that lobbying and compensation are aligned with the Paris Agreement, emissions curtailment, and climate disclosures (CalPERS 2022c, 21–22), and coordinating shareholder actions until the company accepts these conditions.[14] CalPERS withholds its votes or votes its equity shares against directors of companies judged by CalPERS as insufficiently pursuing favored climate policies. During the 2021–22 proxy season, CalPERS voted against ninety-five directors at twenty-six CA100 companies “for not having an adequate net zero 2050 commitment, TCFD [environmental] disclosure, or board oversight of climate-related risks” (CalPERS 2022c, 19).[15]

During 2022, CalPERS voted for 72 of the 148 environmental shareholder proposals, including most proposals on corporate climate lobbying, emission reductions, and emissions reporting. Over the three proxy seasons through 2022, Cal-PERS filed ten shareholder proposals on similar company climate policies; six were “successfully negotiated” and thus withdrawn before voting. CalPERS also filed about twenty proxy solicitations, many climate-related (CalPERS 2022c, 19–21). CalPERS voted for numerous energy company shareholder proposals,[16] and urged shareholders to support proposals to align company lobbying with the Paris Agreement.[17] Noting that some energy companies require external financing, CalPERS pledged to “continue to engage financial sector companies on their climate-related underwriting practices,” emphasizing the risks of lending capital to energy companies from fossil-fuel assets losing value (26, 42).

Versus other state agencies, CalPERS owes fiduciary duty to different principals, which might be expected to lead it to support different policies, yet CalPERS “is aligned with goals of the California Climate Policies,” “strongly advocated for the transition to electric and zero-emission vehicles,” and “engaged companies to publicly support California’s authority to set new Clean Air Act vehicle emissions standards” (CalPERS 2022c, 16, 38). For example, in 2020 CalPERS filed proxy solicitations for Ford and General Motors, urging their shareholders to vote for extensive lobbying disclosures (CalPERS n.d.), information potentially valuable to California environmental agency responses to legal challenges. Consistent with its climate advocacy, “CalPERS has a long history of allocating capital to sustainable investments” (CalPERS 2022c, 32).

CalPERS’s preeminence in shareholder environmental activism has coincided with poor investment performance across various time periods and measures of return. Over all trailing periods from two to ten years through June 30, 2022, the CalPERS investment return was lower than 80 percent (or worse) of the consultant universe of pension fund returns (CalPERS 2022b, 3). The CalPERS one-year return as of June 30, 2021, was 21.3 percent, the lowest of the thirty-six state and local pensions in the Reason Foundation database, the lowest in a range from 21.3 percent to 34.9 percent (Niraula 2021). CalPERS returns over the five years through 2012 trailed 99 percent of large public pension funds (Malanga 2013). For the tenyear period ending June 30, 2018, the CalPERS portfolio underperformed a standardized benchmark by 2.36 percent per year; only three of the forty-six U.S. public pensions evaluated had worse ten-year excess returns than CalPERS (Ennis 2020, 110). Tensions in CalPERS’s efforts to advance both its environmental agenda and its members’ interests were revealed during a 2018 CalPERS board member election.[18]

Government Pension Discretion and Incentives

Government agencies that manage pensions possess substantial discretion to intervene in company affairs, because regulations and fiduciary obligations are not meaningful constraints, as described next.

Rule of Law Constraints Are Not Meaningfully Limiting

The rule of law constrains government discretion in the affairs of private citizens,[19] and is defended through constitutions and statutes, such as due process protections. One protection, the U.S. Administrative Procedure Act (APA), signed into law in 1946, states that federal agencies may not exceed their statutory authority and that courts can be petitioned to determine whether federal agency actions were compliant with federal statutes or were “arbitrary, capricious, an abuse of discretion, or otherwise not in accordance with law” (APA 1946, § 10(e)1).

The equally enforced principle of the rule of law suggests that employees of a government agency may not arbitrarily impose costs on a law-abiding company, or pressure a company to advance favored public policies as if different statutes exist, or campaign to replace company board members for performing disfavored legal activities such as producing oil. But employees of one type of government agency, government pensions, can do all of these activities, because they engage with companies as an equity owner instead of as a regulator and thus are not bound by comparable rule of law constraints. The powers of government agencies that manage pensions derive from their control over shareholder rights, not from their powers to create or enforce regulations. Hence their discretion to intervene in company matters is essentially undiminished even if they are subject to laws comparable to the APA. Government pension discretion to intervene in companies is constrained in the sense of being generally limited to exercising various shareholder rights and public relations, but extraordinary in the sense of being able to exercise these rights against any held company for any reason.

These broad discretionary powers of government pensions could be exploited to pursue ancillary objectives and appear incompatible with the principle of fairness underlying due process, equal enforcement, and equal protection.

Fiduciary Duties Are Not Meaningfully Limiting

Over centuries, financial agents gained discretion as their responsibilities grew more complex and required more judgment (Sanders 2014, 547). The increasing complexity rendered it unproductive to attempt to identify all possible contingencies in a contract. In response, under the contract theory of fiduciary duty, an adopted solution was to provide financial agents with the discretion sufficient to be able to flexibly respond to future conditions while discouraging agents from exploiting their discretion by requiring that agents act as fiduciaries for the principals.[20]

For corporate and many public pensions, the fiduciary duty of loyalty requires that the designated agents manage the pensions solely for the specified principals (Schanzenbach and Sitkoff 2020, 400). The California constitution mandates that California public pensions be managed solely for two sets of principals: members (participants: government employees and retirees), and member employers, and that members be prioritized over employers.[21] Legally, sole-interest trustees may not leverage their positions to advance their “personal views concerning social or political issues or causes,” nor serve as agents for the individuals who appointed or elected them to the pension board (Dunning 2020, 49, 53).

Legally, government pension trustee decisions are subject to independent judicial review. But absent proof of direct self-dealing, to prove a breach of the fiduciary sole-interest rule beyond a reasonable doubt, a plaintiff would need legal standing in the proper court, and would likely need to prove that mixed motives influenced the trustee decision.[22] A plaintiff would also likely need to prove that the alleged breach caused a certain decrease in pension investment returns,[23] by isolating the effect of the trustee decision from other influences. A plaintiff may also need to prove that the lower returns curtailed actual or expected benefit payments, i.e., that impaired public pension returns were not offset by increased taxpayer contributions.[24] Even if the plaintiff were to prevail, the judge determining a remedy would be constrained by the pension governance design specified in the constitution and statutes. Private sector fiduciaries are similarly shielded,[25] though private sector pension activism is somewhat constrained by market forces, as later described. The Sisyphean difficulty of proving fiduciary breach indicates that fiduciary duty lacks deterrence value.[26]

For example, from 2004 until his May 2008 departure, the CalPERS CEO Federico Buenrostro Jr. pressed staff to allocate capital to favored companies for non-investment reasons.[27] He was later prosecuted by federal officials and found guilty of corruption and fraud for receiving bribes from agents of CalPERS contractors.[28] This multiyear CalPERS malfeasance revealed that all potential checks (legal fiduciary duties, external fiduciary counsel, internal counsel, board members, other executives, staff, state attorney general, state judicial system, etc.) failed to prevent or correct it, and also revealed that the remedy relied on proven evidence of self-dealing (bribery) and the involvement of federal officials.

For government pensions, the substantial discretion is consistent with the contract theory of fiduciary duty, but the other half of the social contract, the duty of financial agents to act solely for their principals, appears to provide minimal deterrence value. The problem described next is that this broad discretion is conjoined with a design of government pensions that confers incentives misaligned with the interests of one of its two principals, government employers, and by extension with the interests of taxpayers and of many private sector shareholders.

Incentives

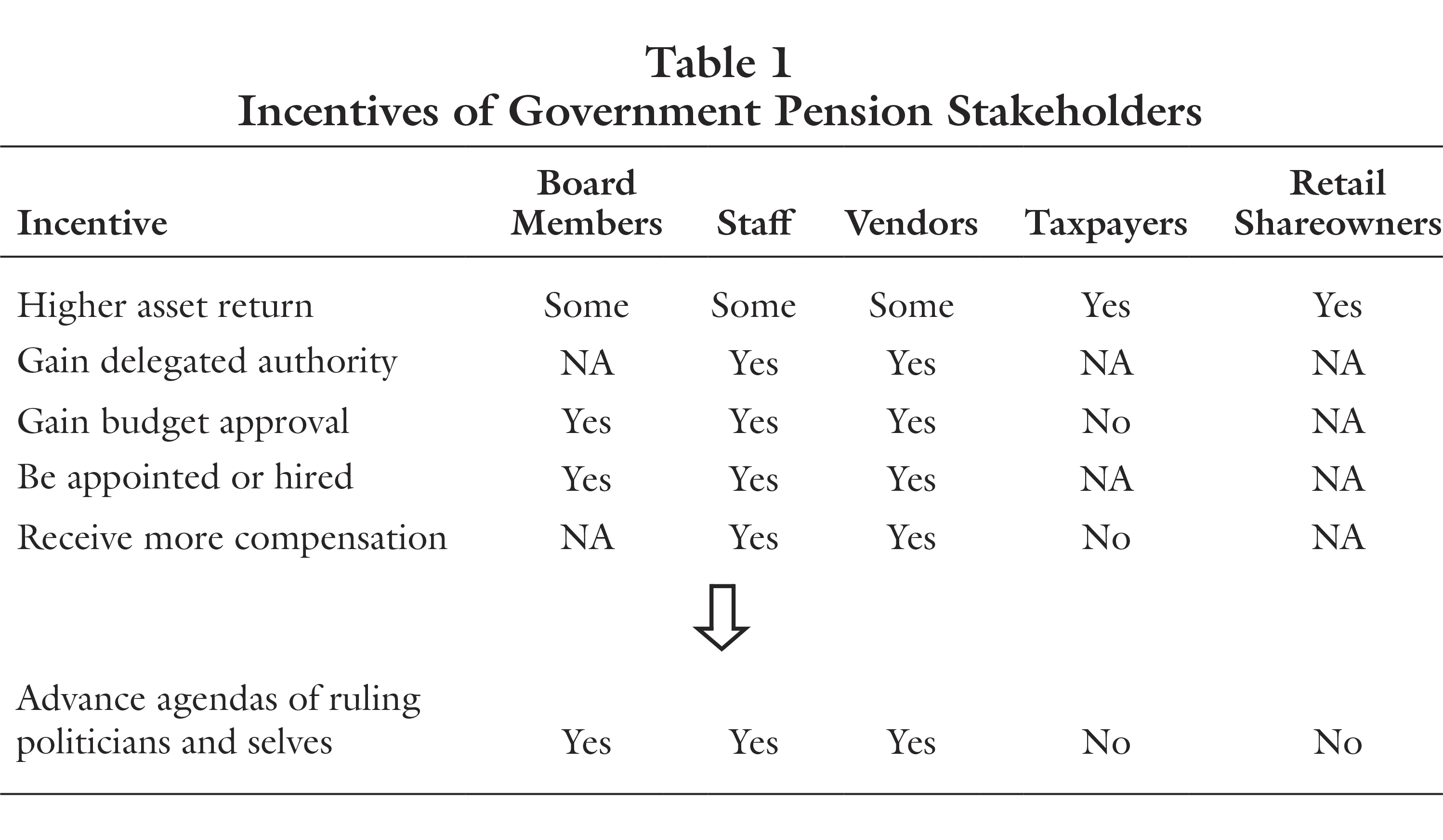

State or local politicians in office typically appoint several members of government pension boards and in some cases approve the pension budgets and can implement pension reforms. These powers of the ruling politicians over government pension board members create shared interests. Government pension staff in turn have reason to be responsive to board member preferences, given the board members’ plenary authority to approve staff compensation, determine the responsibilities to delegate to staff, hire and terminate senior pension executives, approve investment policies, and in some cases approve the pension budget (Romano 1993; Anzia and Moe 2017). Board members and staff of government pensions can act on these incentives through control over asset ownership rights, public relations, and contracts with vendors. Pension board members can select vendors or delegate vendor selection to staff subject to board-approved policies.

Stock market returns proportionately affect the wealth of retail equity investors but have minimal effect on the wealth of pension board members or staff. Shortfalls in government pension funds are primarily borne by taxpayers (Romano 1993, 811), but taxpayer representatives are typically excluded from government pension boards (Romano 1995, 45), an exclusion that precludes a potential counterbalance to incentives to pursue political interests. Government pension boards often comprise several member representatives, even though members receive retirement payment amounts that are essentially guaranteed and independent of investment returns and expenses.[29] That underfunding is predominantly borne by taxpayers lessens member representative incentives to prioritize investment returns. These incentives are summarized in table 1.

Principal-agent incentives are arguably better aligned for corporate pensions than for government pensions. The primary residual funders are shareholders for company pensions and taxpayers for government pensions. For a company pension, principal-agent alignment derives from the common interest of shareholders and of company executives in a higher company share price. Higher pension investment returns reduce required pension contributions, enhancing company value by retaining more capital for shareholders. For government pensions, misalignment in representation arises from the exclusion of taxpayer representatives from governance boards, despite taxpayers bearing much of the burden of lower pension returns. This incongruence is compounded by the incentive of government pension agents to pursue the agendas of the politicians who approve the pension budget and appoint board members. Due to its governance design, “market discipline operates only weakly on these [public pension] trustees. Political discipline, by contrast, operates strongly” (Mahoney and Mahoney 2021, 862).

Consistent with the ability of shareholders but not taxpayers to represent their interests, many companies but few governments have transitioned from defined benefit pensions,[30] and ESG adoption is lower for corporate pensions.[31] As further evidence of the incentive for political alignment, in 2021, ESG adoption by government pensions within the United States was 70 percent in the Pacific region, 69 percent in the Northeast, and 33 to 50 percent in the other U.S. regions (Callan 2021b). Despite investing in the same capital markets, government pension ESG adoption was highest in the regions predominantly ruled by the political party arguably with a more aligned agenda, and the converse for the other regions.

Costs of Government Shareholder Environmental Activism

Central Planning

Some institutional investors determine public policy objectives, determine roles that companies should serve, and then press companies to serve these assigned roles—quintessential central planning. A common example is an investor determining a target change in average global temperature by a certain date, then estimating company emission reductions needed to achieve that social goal, and then applying shareholder rights to pressure companies accordingly.[32]

This central planning paradigm was critiqued by Adam Smith as represented by the “man of system” who views people and companies as pieces on a chessboard to be moved to and fro as directed to implement predefined societal outcomes.[33] Friedrich Hayek contended that much valuable information is local, company-specific, and unknown by central planners.[34] Milton Friedman (1981, 7–11) emphasized the vital role of market prices in discovering and reflecting supply and demand, the role of prices in determining profits incentivizing suppliers to efficiently adapt to evolving resource scarcity and consumer preferences, and incentivizing consumers to beneficially respond to innovation and changes in resource scarcity.

Market conditions and processes—consumer preferences, resource scarcity, price discovery, and voluntary exchanges—are often invisible and silent, so their vital roles in a market economy may be underappreciated. Voluntary exchanges are spontaneous. Their outcome is uncertain. Where they will lead no one can know. To allow voluntary exchanges, the cells of capitalism, is to accept the uncertainty of the outcomes of this organic and spontaneous process.[35] In contrast, attempting to impose predefined societal outcomes causes consequences that are deleterious, though perhaps not immediate or obvious. As Frédéric Bastiat noted, while individuals naturally observe and focus on “the seen,” sound public policy also considers the unseen and often more consequential subsequent effects.[36]

But these lessons are ignored by shareholders who direct companies to pursue social goals such as climate policies. Shareholders determining standard target reductions in energy production or emissions across companies ignore Hayek’s lesson that much relevant information is local and company specific, and presume to know better than the company executives who possess more specialized knowledge of each company.

Shareholder directives to reduce emissions and thus energy production on a set schedule also ignore Friedman’s lessons by diminishing the roles of market prices in business decisions. Companies setting fixed target emissions or production amounts through agreements with activist shareholders lose the flexibility to adjust supply in response to evolving market prices and other conditions such as innovation, which leaves companies and economies less resilient.

For example, after years of resisting, Shell and BP executives acceded to demands by shareholder climate activists.[37] In December 2018 Shell agreed to substantially reduced customer and supplier emissions near term and to net zero by 2050, climate-aligned lobbying and staff compensation, and third-party verification (Shell 2018). After 2018, shareholder activists successfully pressured BP and other European energy companies to accept similar climate policies (Drollette 2021, 79–80). In 2021 and 2022, European natural gas prices soared.[38] Despite extremely high prices conveying scarcity and incentivizing profit-seeking companies to boost their production, European natural gas production declined 3.2 percent per year (7.0 percent annual decline excluding Norway) from 2018 through 2022. During the tenyear period through 2022, European natural gas production declined 2.6 percent per year (5.6 percent annual decline excluding Norway) (Energy Institute 2023, tab “Gas Production – Bcm”). From 2018 through 2022, Shell’s annual natural gas production declined 45 percent.[39]

Continued declines in natural gas production despite high and rising prices represent an anomalous negative sloping supply curve. European natural gas prices continued to serve their intended role of conveying scarcity, but since 2021 have failed to serve their intended role of motivating a beneficial supply response by domestic producers. Diminished resilience of European economies is a cost of shareholder central planning.

Estimating Company Externalities Is a Central-Planning Calculation

Universal owner theory contends that shareholders can improve total portfolio returns by pressing selected companies to lessen their externalities, such as emissions. But estimating externalities, unpriced effects,[40] requires enormous subjectivity and unavailable information. A net externality is the sum of positive and negative unpriced effects. Estimating the negative externality of emissions at minimum involves estimating the effects of emissions on many climate metrics, and in turn on the incremental costs and revenues of all companies and on the net value of all incremental unpriced effects for all people over a defined time period.

To estimate the positive externality from oil production, consider that oil is refined and transformed into many products. For each product, at each stage of the supply chain to the final consumer, a transaction occurs only if the buyer perceives that the value exceeds the price, implying value added. This positive consumer surplus depends on prices and unobservable demand curves that embody many variables such as consumer preferences for substitute and complementary goods and services. Suppliers of oil products employ people, creating spillover benefits.[41] A greater supply of oil products leads to lower prices for consumers and companies, a boost to profits that might outweigh the effect of emissions. With a greater supply of oil products, research costs can be spread over more revenue, incentivizing more research and likely more innovation, in addition to other benefits of greater economies of scale and scope. Low-income citizens spend a greater share of their income on energy, so they disproportionately benefit from greater supply and lower energy prices, another benefit.[42] Some products provide beneficial public-good attributes, such as the national security and diplomacy benefits of domestically produced oil and gas. These enormous benefits of inexpensive and abundant energy exist even if unmentioned and presumed to be zero. All of these calculations and more would need to be known and accounted for and continuously updated by an omniscient central planner.[43]

Government agency interventions in companies can also cause costs such as rent seeking that should be accounted for when tallying externalities.[44] Also, rather than benevolent impartial calculators of externalities, government-agent interests incentivize bias.[45] Further, an optimal response to an externality depends not only on the initial net unpriced effect, but also on other responses to it (Nye 2008). These considerations suggest that a claimed externality is a tenuous rationale for shareholder intervention.[46]

Implementing Central Planning Is Coercive

To achieve their stated objectives, shareholder social activists must not only be omniscient and impartial calculators of societal costs and benefits. They must also ensure that their directives are implemented by companies, either through persuasion or coercion.

Company leaders have reason to be skeptical that shareholder climate proposals enhance company value. Emissions attributed to an energy company correspond to a certain amount of production. For operational decisions such as production, company executives likely believe with reason that they possess superior company-specific knowledge and incentive to increase company value than climate activists. Company executives also undoubtedly understand that serving shareholders sometimes conflicts with the pursuit of other objectives. Executives also have reason to understand the objectives of shareholder groups, including government agencies. Per public choice theory, government-agent incentives, such as the incentive to cater to well-organized interest groups,[47] sometimes misalign with broader public interests (Shaw n.d.). Company leaders are therefore often unlikely to be persuaded.

If persuasion fails, shareholders can apply coercion through coordinated activism. Shareholder “engagement,” “stewardship,” and “dialogue,” pleasant connotations notwithstanding, that reveal different perspectives can lead to actions to “hold boards accountable.”[48] The Climate Action 100+ mission to “ensure” company compliance implies that coercive tactics are applied as needed. The Principles for Responsible Investment (2019, 7) advised “an increase in investors’ ambition and assertiveness,” and for shareholders to be “less focused on the risks and returns of individual holdings, and more on addressing systemic or ‘beta’ issues such as climate change.” Company leaders subjected to coordinated shareholder campaigns to pursue social goals face a Hobbesian choice, resist or acquiesce. Company leaders are fiduciarily obliged to select the least damaging alternative, though over time they can respond to onerous shareholder costs by delisting the company from stock market exchanges or selling disfavored assets.

Separation of Business and the State

Shareholder activism on societal risks such as climate change can lead to closer collaboration between companies and governments, particularly when the shareholder is a government agency pressuring companies. Klaus Schwab (2020), the founder and executive chairman of the World Economic Forum, which hosts its annual meeting in Davos, Switzerland, advocates for greater collaboration between companies and governments to jointly address complex societal problems. But closer collaboration is at odds with Milton Friedman’s defense of business-state separation as foundational for human freedoms. “Few trends could so thoroughly undermine the very foundations of our free society as the acceptance by corporate officials of a social responsibility ... a fundamentally subversive doctrine” (Friedman 1962, 161). Business-state separation constrains business leaders from dominating public policies,[49] and politicians and bureaucrats from intervening in business decisions. It thus enables citizens to own companies unburdened by arbitrary government interference. Business-state separation results in power, the ability to allocate resources, being more decentralized and dispersed. The market “enables economic strength to be a check to political power rather than a reinforcement” (20). With separation, companies can provide customized services in response to varied preferences, lessening the need for society to determine and conform to a common solution (19).

But when shareholders press business leaders to use corporate resources to pursue social goals as ends, they must decide which goal and which corporate constituencies to serve, adopting the role of elected representatives.[50] Conflicts among corporate constituencies would likely lead to calls for an entity to arbitrate; that entity would likely be a government.[51] The problem is not a government arbitrating among competing interests, but doing so by subjectively intervening in individual companies instead of adhering to a more limited role of creating and enforcing laws. Company acceptance of social responsibilities leads to company decisions driven more by “political mechanisms, not market mechanisms” (Friedman 1970), company resources redirected from serving customers to serving the ruling politicians, companies becoming more similar to government agencies, and the company executive becoming “in effect a public employee, a civil servant” (Friedman 1970).

Government Ownership of Companies Impairs Returns

A company that is partly owned by a government agency, irrespective of whether the agency manages a pension, is to some degree a state-owned enterprise (SOE), an example of state capitalism. A company with a higher government ownership share is more likely to be classified as an SOE, though a “government may exercise significant influence over corporate decisions even when it owns a small number of shares” (IMF 2020, 47 n1).

“SOEs generally have low productivity, distort competition, and can be plagued by corruption” (IMF 2020, 66). Companies partly owned by a government, even at a minority stake, are significantly less productive, and companies majority-owned by governments are less productive in every sector (57). National oil companies “are significantly less profitable and efficient than their private peers” (54). “The literature consistently finds superior performance of private and privatized companies over public [partly or fully government-owned] companies in both the energy and financial sectors.... Multiple national and cross-national studies have shown the benefits of privatization” (World Bank 2020, 34). IMF and World Bank research extensively documents that even partial government ownership of companies results in misaligned incentives, misallocated resources, and diminished profitability,[52] findings contrary to claims that ownership and associated shareholder activism by government agencies improves company value.

Fiduciary Unaccountability Impairs Returns

Institutional investors subject to the fiduciary “sole interest rule” are legally obliged to exercise their shareholder rights solely to improve financial returns.[53] An assertion that an investor can simultaneously seek to maximize financial returns and pursue social goals presumes an absence of trade-offs and opportunity costs in business decisions, a premise contrary to intuition and observations that business trade-offs are common (Bebchuk and Tallarita 2020, 119–21).

Shareholder social activism is sometimes couched as beneficially mitigating company short-termism (CalPERS 2022c, 3–7). But a view that corporate efforts to address societal systemic risks remedies short-termism conflates two distinct concepts: corporate externalities and time horizon (Roe 2022, 2–3). For example, if a flawed design of corporate compensation incentivizes undue executive focus on short-term profits, the solution is to adjust compensation policy to improve incentive alignment, not to press the company to adopt social mandates under the guise of long-termism.

Some shareholders lobby regulators to require greater company disclosures of environmental measures, and pressure companies to estimate and report more environmental metrics than legally required.[54] The effect is increased regulatory reporting, litigation, and activist costs, as disclosures enable activists to set target values, and press company leaders to meet these targets.[55] To be fiduciarily compliant, sole-interest shareholders must expect that imposing these costs onto companies will increase their market values. Similarly, sole-interest shareholders can pressure companies to curtail their energy production irrespective of energy prices if the sole intent is greater company value. In practice, of relevance is not the reasonableness of such expectations or claims, but the exceptional difficulty of disproving them in a court of law.[56]

If universal owner theory, or UOT (shareholders pressing companies to lessen their externalities), were to gain legal acceptance, then sole-interest shareholders could concede that their actions are expected to or even intended to impair the value of a targeted company, while still remaining fiduciarily compliant by expecting an increased market value of the total portfolio.[57] Given the vast subjectivity of estimating externalities, legal acceptance of UOT would permit institutional shareholders even greater discretion to target any company with impunity. Shareholders could extend UOT to its logical conclusion by purchasing controlling interests in companies with the highest ratios of estimated negative externalities to market value, and hiring company board members to direct management to destroy all plant and equipment. Even if UOT does not become a fiduciarily accepted rationale, shareholder discretion and coordination conjoined with mixed motives poses risks for disfavored companies. For example, since Shell acceded to climate activist demands on December 3, 2018,[58] the underperformance of Shell equity shares versus an index of global energy companies implies a $97 billion loss for Shell shareholders.[59] On February 1, 2019, BP announced support for a shareholder proposal coordinated by Climate Action 100+ for BP to align with the Paris Climate Agreement, including curtailing emissions and linking compensation of 36,000 BP employees partly to emissions reductions (BP 2019). The subsequent underperformance of BP equity shares versus an index of global energy companies corresponds to a $60 billion loss for BP shareholders.[60]

Government Agency Discretion versus Democratic Norms

Government agency central planning is more invidious than loss of economic efficiency. Government agencies pressuring private citizens to implement these plans threaten democratic norms. First, the total influence that results in any law, regulation, or public policy is 100 percent, so increased relative influence by government agencies implies diminished relative influence by private citizens.

Second, government pension activism to pursue favored public policies conflicts with the role of government agencies being disinterested apolitical implementers of laws and regulations. In addition to lobbying, government pensions influence public policies when they press companies to take actions as if laws were different—for example, as if taxes or prices existed on greenhouse gas emissions, or as if laws mandated additional company climate disclosures, or as if the Paris Climate Agreement were legally binding on U.S. companies despite not being ratified by the U.S. Senate. In each case government agencies bypass democratic processes to advance their favored policies. This approach has been rationalized as compensating for perceived misguided laws or policies, particularly those attributed to flawed or unwieldy democratic processes.[61] But democratic hurdles to some are protections for others. To Friedman (1970), frustration with the checks and balances of democracy does not warrant “seeking to attain by undemocratic procedures what they cannot attain by democratic procedures.” A societal cost is the potential decay of bypassed democratic processes. Another cost is the inability of citizens to hold shareholders accountable for their influence on public policies.

Third, while control of ownership rights over vast pools of capital enables agents of government pensions (board members and staff) to exert disproportionate influence over public policies, they are unlikely to be superior arbiters of the public interest, because they are typically legally mandated to serve the interests of the members (government employees and retirees), and the interests of any subset of citizens sometimes diverge from the public interest, and because their incentives are to serve members and ruling politicians. The employees of a government agency are not a representative subset of the state or locality, and neither are board members elected only by current or retired government employees.

Fourth, a government pension in one state that burdens companies in another state could motivate retributive actions by government pensions in the other state, risking escalating damage and discord.[62]

Fifth, government pensions possess complete discretion regarding which held companies to target with shareholder activism. Through imposing costs onto selected companies to pursue favored public policies, government agencies can arbitrarily select companies to be sacrificed for an alleged public interest.[63] A government agency, irrespective of the rationale or whether it controls asset ownership rights, being able to select and impose costs onto any law-abiding company for any reason appears incompatible with the rule of law and due process rights of private citizens.

Sixth, some shareholders pressure corporate lobbying through shareholder proposals and voting against board members of corporations engaged in disfavored lobbying.[64] The shareholders of a corporation have a legitimate interest in its activities, including lobbying, but when the shareholder is a government agency, this interest arguably conflicts with protections against government-compelled (or government-restrained) commercial speech. Government-compelled commercial speech must be “purely factual and uncontroversial” (Griffith 2023, 880), but lobbying is neither. Government agencies may not legally compel lobbying, but government pensions circumvent this protection of speech rights by leveraging their shareholder powers to pressure corporate lobbying, in some cases by filing or supporting shareholder proposals directing corporate representatives to publicly justify their lobbying.[65] “Requiring a justification—making someone expressly state and defend their views—is a way of enforcing viewpoint conformity,” especially when a government agency asymmetrically demands viewpoint justification only from ideologically unaligned corporations (931). Further, government-mandated corporate disclosures of immaterial climate information is likely illegal compelled speech (942), suggesting that government pensions pressing corporations to disclose such information may also constitute illegal compelled speech. Setting aside legalities, government pensions burden speech by imposing costs for expressing perspectives deemed nonconforming with government orthodoxy.

Finally, government agencies, through contracts and employment, can tilt the marketplace of ideas, since government contracts confer incentives to vendors to support the interests and views of the funding agency, so that for ideas, “survivability and truth need not significantly overlap” (Callais and Salter 2020, 73). This incentive for shared advocacy is especially powerful for vendors to government pensions given their substantial fees.[66] A cost is asymmetric public discourse.

These examples represent government pensions, ostensibly to advance the public interest, pressing against and conceivably piercing boundaries intended to protect individual liberties. They also reflect the absence of any limiting principle, and a willingness to exploit that absence.

Environmental Activism Plausibly Worsens the Environment

The coercive nature of shareholder activism can also undermine its intended benefit. Wolf et al. (2022, 38–47), authors of the Yale Environmental Performance Index (EPI), report that measures of capitalism and democracy correlate strongly positively with environmental quality. The cross-country correlation of the EPI was 0.70 versus per capita income, 0.65 versus the rule of law, and 0.65 versus the Index of Economic Freedom, a measure of capitalism (41). “Economic development, moreover, correlates strongly with environmental health. This relationship provides support for the suggestion that economic success creates financial capacity that can be (and often is) invested in projects and programs that protect air and water resources” (41). With caveats that multiple variables influence environmental outcomes, the EPI authors conclude that the “2022 EPI’s drivers analysis provides an empirical basis for definitively dismissing the outdated assumption that economic progress comes at the expense of sustainability” (47). The EPI authors, after reviewing their own findings and other research, further conclude that the rule of law and democracy also enhance environmental quality. “Several other studies note a positive correlation between democratic governance and environmental performance, especially over the long-term” (47). Moreover, “wealthy democracies tend to perform better [environmentally] than wealthy autocracies” (39). Overall, “2022 EPI drivers analysis suggests that democratically-elected governments and free markets are best positioned to respond to environmental challenges and adopt policy preferences that drive countries toward a more sustainable future” (46).

As an example of the environmental benefits of markets, East Germany, with sulfur dioxide emissions triple that of West Germany, was rated by the United Nations as the most polluted country in Europe (Pond 1984). Prior to reunification, East Germany’s polluted environment coincided with resource allocation substantially through central planning by government agencies, while West Germany’s healthier environment coincided with extensive reliance on voluntary exchanges. This divergence in environmental outcomes might be explained by East German citizens facing more difficult choices due to less cumulative positive externalities from voluntary exchanges. As another example, the surge of inexpensive U.S. natural gas production since 2005 caused many electric utilities to replace coal with cleaner-burning natural gas as their primary fuel source, reducing emissions of carbon and sulfur (Burney 2020).

Given the Yale EPI authors’ conclusion that democratic capitalism improves environmental quality, if, as reasoned, government pension environmental activism undermines democratic capitalism, then it also plausibly undermines environmental quality. Referencing Bastiat (1850), press releases touting emissions curtailments of activist-targeted companies is “the seen”; the associated impairment of institutions and processes of democratic capitalism and thus also of environmental quality is “the unseen.” For example, shareholder activism contributes to substantial transfers of energy assets from listed (exchange-traded) companies to unlisted companies with inferior environmental practices.[67] Finally, unwarranted optimism that shareholder environmental activism protects the climate may lessen public support for more market-based solutions.[68]

Potential Reforms

The discussed costs derive from the powers of asset ownership conjoined with the incentives of government agencies. As the referenced IMF (2020) and World Bank (2020) research documents, government equity ownership confers incentives to pursue objectives misaligned with resource efficiency and highest-value use. This inherent misalignment could be solved by ending government ownership of the means of production. For example, converting public pensions from defined benefit to defined contribution (e.g., 401[k]) plans would lessen government-agent powers by shifting asset ownership and associated rights from government agencies to individual employees (Romano 1995, 50). Or a law could be enacted that prohibits government equity ownership of for-profit companies.

Absent reforms that fully privatize companies, incentive alignment between taxpayers and government pension agents could be improved if members share some investment risk, such as conditioning pension benefits above a threshold on investment returns net of expenses. That taxpayers are often rationally uninformed, unorganized, and unrepresented relative to other stakeholders of government agencies (Shaw n.d.), and that pension fund shortfalls are predominantly borne by taxpayers, suggest taxpayer representatives should be included on government pension boards.

Conclusion

For equity investments, particularly by government pensions, the siren song of associated shareholder powers to intervene in company affairs to pursue social goals has proven irresistible, motivating demand for supporting narratives and legal defenses such as long-termism and universal owner theory.

Shareholder environmental activism by government pensions is reasoned to represent central planning that transfers influence over business decisions from company executives to government agents with acute agency conflicts and without a limiting principle, reflect extraordinary government discretion over companies and private citizens anathema to the rule of law and due process rights, represent government agents arrogating the discernment of the public interest from democratic processes to themselves despite lacking superior ability or incentive or legitimacy, diminish the relative political influence of private citizens, erode the separation of business and the state, infringe on the right of citizens to own companies unencumbered by arbitrary government interference, impede the vital role of market prices in motivating beneficial supply response to evolving resource scarcity, abridge speech rights through government agencies imposing costs for nonconforming lobbying, distort public discourse, and plausibly worsen climate change. A primary cause of these societal costs is that, unlike market processes, which rely on mutual agreement, government shareholder activism at its core is coercive.

Notes

[1] In 2022, US state and local public pensions held $5.3 trillion in assets, including 42.7 percent in listed (exchange-traded) equities (Public Plans Data 2023).

[2] “Diversified investors should rationally be motivated to internalize intra-portfolio negative externalities” (Condon 2020, 1).

[3] “‘Shareholders, as residual claimants, have the greatest incentive to maximize the value of the firm.’ ... Because they are just residual claimants, only shareholders have ‘the perspective of the aggregate’” (Dent 2008b, 1113, italics in original).

[4] “Self-regulation of externalities through direct contraction of supply brings the market back into efficiency in much the same way as a Pigouvian tax” (Condon 2020, 8).

[5] “What is new here is that large institutional investors can profit by deliberately causing losses to some firms in their portfolios if doing so results in greater gains to other firms in their portfolio” (Coffee 2021, 610 n19). “If a subset of firms in a portfolio impose costs on the broader portfolio through the generation of negative externalities, a portfolio-wide owner should be motivated to curtail those externalities at the source” (Condon 2020, 6).

[6] Hart and Zingales 2017, 249. Some of their reasoning: “We are not that sanguine about the efficiency of the political process. Also, even if the political process is efficient, it might be very difficult to write a regulation that specifies, say, that companies should treat their workers with dignity. It might be better to leave the implementation of this goal to shareholders.”

[7] CalPERS participates on advisory boards of the SEC Investor Advisory Committee; the Public Company Accounting Oversight Board’s Investor Advisory Group; the Financial Accounting Standards Advisory Committee; the Commodity Futures Trading Commission’s Market Risk Advisory Committee and its climate change subcommittee; the International Financial Reporting Standards Advisory Council; the International Sustainability Standards Board’s Advisory Group; and the National Council of Real Estate Investment Fiduciaries (NCREIF) Pension Real Estate Association’s ESG council (CalPERS 2022c, 35).

[8] “CalPERS staff have met with the SEC chair and staff several times over the last two years to discuss the climate-related disclosures” (CalPERS 2022c, 13).

[9] CalPERS staff have “direct discussions with about 2,000 companies a year” (Drollette 2021, 79).

[10] CalPERS convened and cofounded Climate Action 100+, cofounded the ESG Data Convergence Initiative, cofounded the U.N.-convened Net Zero Asset Owner Alliance, and actively participates in Ceres, Principles for Responsible Investment, Asia Investor Group on Climate Change, Institutional Investors Group on Climate Change, Transition Pathway Initiative, United Nations Global Investors for Sustainable Development, and Vatican Dialogue on the Energy Transition (CalPERS 2022c, 34–35).

[11] “Even though CalPERS is such a large pension fund, typically, because we’re diversified, we’ll only own a small part of any particular entity, or fund, or company. So working with others becomes extremely important in our engagement work” (CalPERS 2021, 96, quoting investment director Anne Simpson).

[12] Citing net zero commitments and climate lobbying, “in Europe, investors secured a huge number of significant announcements through private engagement. After an intense period of engagement and the consideration of filing shareholder resolutions and escalation strategies, several resolutions were withdrawn following private commitments from companies” (CA100 2022, 8).

[13] “The oil and gas sector faced its own reckoning this proxy season, with investors demonstrating their willingness to hold boards accountable on climate change. ExxonMobil shareholders elected three new board members to the company’s board. This was backed publicly by three of the largest pension funds in the U.S. and Climate Action 100+ signatories—CalPERS, CalSTRS, and the New York State Common Retirement Fund. This followed extensive engagement coordinated by Climate Action 100+” (CA100 2022, 8).

[14] “For those companies which aren’t willing to make the commitment to make the change, then we have to start not just to request, but to require that companies make the change” (Drollette 2021, 79, italics in original).

[15] For many of its votes against corporate directors (e.g., Chevron 2022), the CalPERS stated reason was “failing to adequately respond to the Climate Action 100+ engagement initiative” (CalPERS n.d.).

[16] CalPERS voted for the following 2022 shareholder proposals for Chevron (emissions targets, audited emissions analysis, methane emission disclosures, conflict-complicit disclosures, racial equity audit, meeting rights) and for Exxon Mobil (emissions targets, audited emissions reports, plastics report, political contributions reporting) (CalPERS n.d.).

[17] In 2021 CalPERS filed a SEC proxy solicitation letter urging shareholder support for a Phillips 66 report “describing if, and how, Phillips 66’s lobbying activities (direct and through trade associations) align with the goal of limiting average global warming to well below 2 degrees Celsius (the Paris Climate Agreement’s goal)” (CalPERS n.d.).

[18] In 2018 a CalPERS board candidate pledged to emphasize investment returns, and stated that CalPERS has “been used more as a political-action committee than a retirement fund” (Atkins 2018).

[19] The “rule of law is a principle of governance in which all persons, institutions and entities, public and private, including the State itself, are accountable to laws that are publicly promulgated, equally enforced and independently adjudicated” (United Nations n.d.).

[20] “Fiduciary duties arise when certain aspects of a contractual relationship are impossible—for reasons of cost and lack of knowledge—to specify... Because there are so many possibilities that cannot be provided for in the contract, courts impose the fiduciary duties of loyalty and care onto the adviser as a way of allowing such an agreement to have value. Ignorance makes holes in contracts—fiduciary duties fill them” (Sanders 2014, 548–49).

[21] “The members of the retirement board of a public pension or retirement system shall discharge their duties with respect to the system solely in the interest of, and for the exclusive purposes of providing benefits to, participants and their beneficiaries, minimizing employer contributions.... A retirement board’s duty to its participants and their beneficiaries shall take precedence over any other duty” (Calif. Const., art. XVI, § 17b).

[22] “Under Supreme Court precedent, therefore, a pension trustee breaches the duty of loyalty whenever the trustee acts other than to benefit the beneficiaries financially. Acting under any other motive, even without direct self-dealing, is a breach of the duty of loyalty” (Schanzenbach and Sitkoff 2020, 404).

[23] “Demonstrating that a financial loss occurred may be the most difficult prerequisite to satisfy when suing for mismanagement of a public pension plan” (Gray 2021, 11).

[24] “Recently, in the ERISA context, the U.S. Supreme Court held in Thole v. U.S. Bank N.A. that a loss to a defined benefit plan participant must consist of the plan participant receiving less than his or her promised benefit, not merely a reduction in the total plan funds.” A similar lower-court ruling applied to a public pension (Gray 2021, 11).

[25] “Rarely can shareholders use litigation to call directors to account. Courts will not intervene unless the board’s conduct is so bad that it evinces ‘intentional dereliction of duty, a conscious disregard for one’s responsibilities’” (Dent 2008a, 1252).

[26] “Formally, state constitutions or statutes often require trustees to consider only the interests of beneficiaries when making investment and voting decisions. As the California and New York pension funds have demonstrated, however, trustees can treat these as check-the-box compliance issues that constrain what trustees may say but not what they may do” (Mahoney and Mahoney 2021, 877). Sanders (2014, 545) has also noted that “CalPERS has to claim that its social investing is based in profit for the fund, because otherwise such investing would be unlawful.”

[27] The CalPERS CEO was “pressing its investment staff to pursue particular investments without evident regard for their financial merits. For example, Buenrostro reportedly intervened in attempts by Aurora Capital Group to secure new investments from CalPERS, noting to the investment staff the substantial political benefits that might come to CalPERS by supporting an investment firm run by an individual who had just been appointed by the Governor” (Khinda, Wellington, and Zimiles 2011, 18). The CalPERS CEO “apparently intervened on behalf of some private equity and real estate managers the CalPERS investment staff would come to call ‘friends of Fred’” (19). “Well-qualified managers were perhaps crowded out in favor of those with better connections” (47). The authors also noted “the excessive nature of some of the fees paid by CalPERS” (42).

[28] “Buenrostro, 67, of Sacramento, is the former Chief Executive Officer (CEO) of CalPERS and admitted that in 2004 he began receiving secret benefits from a placement agent for the purpose of influencing him in the exercise of his powers and duties as CEO. Buenrostro admitted the placement agent gave him approximately $250,000, as well as gifts, domestic and international travel, meals, entertainment, and payment for Buenrostro’s wedding.... In exchange, Buenrostro attempted to influence the CalPERS investment staff and Board to the benefit of the placement agent and his clients.... Judge Breyer also remarked that, ‘without trust, our public institutions cannot function’” (US DOJ 2016).

[29] “Due to state laws, constitutions, and judicial decisions, state pension promises are backed by strong legal protections almost everywhere; public workers know they will actually get what they are promised even if these plans are severely underfunded” (Anzia and Moe 2017, 5).

[30] In 2019, 16 percent of U.S. private sector employees and 86 percent of U.S. state and local government employees had access to defined benefit pensions (US BLS n.d.).

[31] In 2021, ESG adoption in the United States was 20 percent for corporate pensions and 63 percent for government pensions (Callan 2021a, 7).

[32] “And we requested that these companies set targets to reduce their emissions, consistent with holding global warming to 1.5 degrees Celsius” (Drollette 2021, 77).

[33] “The man of system, on the contrary, is apt to be very wise in his own conceit, and is often so enamoured with the supposed beauty of his own ideal plan of government, that he cannot suffer the smallest deviation from any part of it... He seems to imagine that he can arrange the different members of a great society with as much ease as the hand arranges the different pieces upon a chess-board” (Smith 1759, 343).

[34] The “knowledge of the circumstances of which we must make use never exists in concentrated or integrated form, but solely as the dispersed bits of incomplete and frequently contradictory knowledge which all the separate individuals possess... the knowledge of the particular circumstances of time and place” (Hayek 1945, 519, 521).

[35] “Indeed, a major source of objection to a free economy is precisely that it ... gives people what they want instead of what a particular group thinks they ought to want. Underlying most arguments against the free market is a lack of belief in freedom itself” (Friedman 1962, 19).

[36] “In the department of economy, an act, a habit, an institution, a law, gives birth not only to an effect, but to a series of effects. Of these effects, the first only is immediate; it manifests itself simultaneously with its cause—it is seen. The others unfold in succession—they are not seen: it is well for us, if they are foreseen” (Bastiat 1850, introduction).

[37] “According to The Wall Street Journal, Shell executives were initially opposed to these goals—the CEO had described them as ‘onerous and cumbersome’ just six months before—but they eventually capitulated ‘to months of investor pressure’” (Condon 2020, 2). “Now, after having been the targets of aggressive investor engagement, both of those companies have radically changed their positions. Shell’s board has agreed to drastic emissions cuts. BP’s board now supports a shareholder resolution requesting similar emissions targets following ‘constructive engagement’ with Climate Action 100+” (29–30).

[38] The average annual price of European natural gas (EU TTF) ranged from $3.23 to $7.67/MMBtu during 2017 to 2020, increased to $15.87 in 2021, and to $40.36 in 2022 (Shell 2023, tab “Up”).

[39] Shell average daily natural gas production available for sale (million standard cubic feet) declined every year from 5954 in 2018, to 3845 in 2021, to 3272 in 2022 (Shell 2023, tab “UP”).

[40] An externality is “a ‘spillover’ effect that arises whenever an actor fails to take account of the cost or the benefit that an instance of her action has on a third party” (Boudreaux and Meiners 2019, 23).

[41] “Employment is more than just an economic phenomenon. Work is a service. Work is a service to others that helps complete you. It is something that connects you with your community. Work has all sorts of positive spillovers, indirect effects for families, for communities” (Eberstadt 2022).

[42] Energy costs represent 8.6 percent of the gross income of low-income U.S. households (44 percent of citizens), and 3 percent for other households (US DOE n.d.).

[43] “But the government faces the same information problem ... It does not and cannot have the extended information on costs (production functions) and individual preferences (subjective utility functions) that would be necessary to correct apparent externalities” (Lemieux 2021, 22).

[44] “Besides a naïve view that politicians and other government officials will devise ‘optimal’ solutions to ‘correct’ the divergence of private from social cost, those who adopt this Pigouvian stance also fail to consider the social costs of government actions” (Boudreaux and Meiners 2019, 15, italics in original).

[45] “Goals that have political and social values are given a gloss of scientific legitimacy by asserting the legitimacy of contrived numbers in cost-benefit analysis” (Meiners and Czajkowski 2014, 225).

[46] “Externalities must be circumscribed, which is what the constitutional and institutional framework of a free society does” (Lemieux 2021, 24).

[47] For example, in 2003 the CalPERS board president, while also the executive director of a UFCW union council, directed CalPERS interventions in the Safeway-UFCW contract negotiations (Barber 2007, 77–78).

[48] See notes 12–15, 37.

[49] A federal judge objected to management’s “patently illegitimate claim of power to treat modern corporations, with their vast resources, as personal satrapies implementing personal political or moral predilections” (Heyne 1971, 26). See also Dent (2008b, 1124), who observes: “To allow corporate boards to deploy the vast assets of corporations in whatever way they consider socially optimal is to vest them with huge political power.”

[50] “Here the businessman—self-selected or appointed directly or indirectly by stockholders—is to be simultaneously legislator, executive and jurist. He is to decide whom to tax by how much and for what purpose, and he is to spend the proceeds” (Friedman 1970).

[51] “Representation of these constituencies seems inevitably to lead to government participation in corporate control” (Dent 2008b, 1119 n56).

[52] “SOEs’ [state-owned enterprises’] multiple objectives pose several governance and management challenges. Mixed objectives and weak oversight obscure accountability, exacerbate principal-agent challenges, and weaken incentives for performance.... SOEs also reflect the desire of the state or political groups to exert political influence over economic outcomes and resource allocation” (World Bank 2020, 5).

[53] See note 22.

[54] See notes 7–16.

[55] “Standardized disclosures that facilitate the production of an ESG ‘score’ are particularly valuable to political activists. Such disclosures facilitate an ordinal ranking of companies that can serve as a focal point to organize boycotts, demonstrations, and social media campaigns against ‘brown’ companies” (Mahoney and Mahoney 2021, 852). Condon (2020, 31) noted that company disclosure of climate lobbying “would open the companies up to broader public sanction and targeting by environmentalists.”

[56] See note 26.

[57] “Fiduciaries should be able to engage in ESG investing on a portfolio-wide basis in full compliance with the ‘sole interest’ rule so long as they make a finding that their collective strategy should raise returns or lower risks.... Such pressure was in fact successfully applied to Royal Dutch Shell and others in 2018” (Coffee 2021, 637).

[58] See Shell 2018; see also note 37.

[59] The market value of Shell equity shares as of December 2, 2018, was approximately $250 billion. From December 3, 2018, through December 31, 2022, the cumulative total return including dividends was 11.20 percent for Shell US-traded shares (ticker SHEL-US), and 49.92 percent for the S&P 1200 Global Energy Sector Index (ticker SGBXX001), a market-capitalization weighted index of energy companies domiciled in many countries. Over this period, the realized gain of all Shell equity shares was $28 billion ($250B × 11.20 percent), though would have been $125 billion ($250B × 49.92 percent) if the return of Shell equity shares had matched the return of the S&P 1200 Global Energy Sector Index ($28B − $125B = −$97B). For this note and the next, historical returns were sourced from FactSet: Company/Security, Prices, Return Analysis. Historical market capitalizations were sourced from FactSet: Company/Security, Overviews, Capital Structure.

[60] The market value of BP equity shares as of January 31, 2019, was approximately $138 billion. From February 1, 2019, through December 31, 2022, the cumulative total return including dividends was 6.75 percent for BP US-traded shares (ticker BP-US), and 50.12 percent for the S&P 1200 Global Energy Sector Index (ticker SGBXX001). Over this period, the realized gain of all BP equity shares was $9 billion ($138B × 6.75 percent), though would have been $69 billion ($138B × 50.12 percent) if the return of BP equity shares had matched the return of the S&P 1200 Global Energy Sector Index.

[61] See note 6.

[62] See note 13.

[63] “Institutional investors have the economic incentive to function as ‘surrogate regulators,’ sacrificing individual firm profits for the benefit of the broader portfolio” (Condon 2020, 81).

[64] See notes 12–17. A Ceres letter sent to corporate CEOs and board chairs, signed by four government pensions in California and New York and four other Ceres members, read: “We expect those companies that engage with policy makers directly or indirectly through trade associations, lobbying organizations described as charitable organizations that include policy advocacy, or think-tanks taking positions on climate change-related issues to: I. Lobby Positively in Line with the Paris Agreement: Support and lobby for effective measures across all areas of public policy that aim to mitigate climate change risks” (Ceres 2020, 7–8, emphasis in original).

[65] An Exxon Mobil proxy solicitation filed by CalPERS “highlighted CalPERS’ view that shareowners would benefit from improved disclosure of the company’s climate lobbying objectives and how they align with ... the Paris Climate Agreement’s goal” (CalPERS 2022c, 20).

[66] For the one-year period ending June 30, 2021, CalPERS paid vendors $598 million (M) in investment management fees, $123M in investment performance fees, $492M in private equity profit sharing, $318M for consultant and professional services, and $297M in other investment fees and expenses. (CalPERS 2022a, 96–115).

[67] “In response to growing investor, regulator, and stakeholder pressure, companies have begun to sell certain assets to reduce their overall emissions footprint” (EDF 2022, 10). During the period 2017 through 2021, “only 4 of 2995 deals (roughly 0.1%) involved a private buyer with stronger environmental commitments than a public seller” (15 n5). Meanwhile, the percentage of reduced-environmental-commitment transactions increased from 15 percent of deal value in 2018 to 30 percent in 2021 (16).

[68] More generally, the “illusory promise” of stakeholderism likely lessens public support for reforms of laws and regulations that would benefit corporate stakeholders (Bebchuk and Tallarita 2020).

References

Administrative Procedure Act (APA), Pub. L. 79-404, 60 Stat. 237, June 11, 1946.

Anzia, Sarah F., and Terry M. Moe. 2017. Interest Groups on the Inside: The Governance of Public Pension Funds. Unpublished paper, September 2017.

Atkins, Paul S. 2018. California Public Employees Vote against Pension-Fund Activism. Wall Street Journal, October 18, 2018.

Barber, Brad M. 2007. Monitoring the Monitor: Evaluating CalPERS’ Activism. Journal of Investing 16, no. 4 (Winter): 66–80.

Bastiat, Frédéric. [1850] n.d. That Which Is Seen, and That Which Is Not Seen. Unidentified translator. Accessed February 24, 2023.

Bebchuk, Lucian A., and Roberto Tallarita. 2020. The Illusory Promise of Stakeholder Governance. Cornell Law Review 106: 91–178.

Boudreaux, Donald J., and Roger Meiners. 2019. Externality: Origins and Classifications. Natural Resources Journal 59, no. 1 (Winter): 1–33.

BP. 2019. BP to Support Investor Group’s Call for Greater Reporting around Paris Goals. Press release. February 1, 2019.

Burney, Jennifer A. 2020. The Downstream Air Pollution Impacts of the Transition from Coal to Natural Gas in the United States. Nature Sustainability 3 (February): 152–60.

Callais, Justin T., and Alexander William Salter. 2020. Ideologies, Institutions, and Interests: Why Economic Ideas Don’t Compete on a Level Playing Field. The Independent Review 25, no. 1 (Summer): 63–78.

Callan Institute. 2021a. 2021 ESG Survey. San Francisco: Callan Institute.

———. 2021b. Email to author, November 15, 2021.

CalPERS. 2021. Investment Committee videoconference transcript, June 14, 2021. Sacramento, Calif.: CalPERS.

———. 2022a. 2020–21 Annual Comprehensive Financial Report Fiscal Year Ended June 30, 2021. Sacramento, Calif.: CalPERS.

———. 2022b. CalPERS Universe Comparison Report, second quarter 2022. Agenda item 5d, attachment 4. A report produced by Wilshire Advisors, September. Sacramento, Calif.: CalPERS

———. 2022c. CalPERS’ Response to the Taskforce on Climate Related Financial Disclosure (TCFD) and Senate Bill 964. Investment Committee agenda item 6a, attachment 2, November. Sacramento, Calif.: CalPERS.

———. 2022d. Consultant Review of CalPERS Divestments. Investment Committee agenda item 6b, attachment 1. A report produced by Wilshire Advisors, November

———. 2023. Board Members. Updated February 14, 2023.

———. n.d. Notable Proxy Votes. Accessed February 24, 2023.

Ceres. 2020. Ceres 2020 Final Corporate Lobbying Letter, September 30.

Cheung, Steven N. S. 1973. The Fable of the Bees: An Economic Investigation. Journal of Law and Economics 16, no. 1: 11–33.

Climate Action 100+ (CA100). 2022. 2021 Year in Review A Progress Update.

———. n.d. Net Zero Company Benchmark. Accessed February 24, 2023.

Coase. Ronald H. 1960. The Problem of Social Costs. Journal of Law and Economics 3 (October): 1–44.

Coffee Jr., John C. 2021. The Future of Disclosure: ESG, Common Ownership, and Systematic Risk. Columbia Business Law Review, no. 2: 602–50.

Condon, Madison. 2020. Externalities and the Common Owner. Washington Law Review 95, no. 1: 1–81.

Dent Jr., George W. 2008a. Academics in Wonderland: The Team Production and Director Primacy Models of Corporate Governance. Houston Law Review 44, no. 5: 1213–74.

———. 2008b. Stakeholder Governance: A Bad Idea Getting Worse. Case Western Reserve Law Review 58, no. 4: 1107–44.

Drollette Jr., Dan. 2021. Interview: CalPERS’ Anne Simpson on the Climate Change Power of Investment Managers. Bulletin of the Atomic Scientists 77, no. 2: 76–81.

Dunning, Ashley K. 2020. Fiduciary Principles to Guide Public Retirement System Trustees. CalPERS Board of Administration Fiduciary Training. PowerPoint presentation to the CalPERS Board of Administration, January 21, 2020.

Eberstadt, Nicholas. 2022. The Decline of Men in the Workforce. WSJ Free Expression with Gerard Baker. An interview with Nicholas Eberstadt. Audio, 29:47. August 22, 2022

Energy Institute. 2023. Statistical Review of World Energy Data. Microsoft Excel file. Tab “Gas Production – Bcm.” Accessed August 12, 2023.

Ennis, Richard M. 2020. Institutional Investment Strategy and Manager Choice: A Critique. Journal of Portfolio Management 46, no. 5: 104–17.

Environmental Defense Fund (EDF). 2022. Transferred Emissions: How Risks in Oil and Gas M&A Could Hamper the Energy Transition. Gabriel Malek, lead author. New York: EDF.

Friedman, Milton. 1962. Capitalism and Freedom. Chicago: University of Chicago Press.

———. 1970. The Social Responsibility of Business Is to Increase Its Profits. New York Times Magazine, September 13, 1970, 17.

———. 1981. Market Mechanisms and Central Economic Planning. The G. Warren Nutter Lectures in Political Economy. Washington, D.C.: American Enterprise Institute.

Gompers, Paul A., Joy L. Ishii, and Andrew Metrick. 2003. Corporate Governance and Equity Prices. Quarterly Journal of Economics 118, no. 1: 107–55.

Gray, C. Boyden. 2021. Corporate Collusion: Liability Risks for the ESG Agenda to Charge Higher Fees and Rig the Market. Austin, Texas: Texas Public Policy Foundation, June 2021.

Griffith, Sean J. 2023. What’s “Controversial” about ESG? A Theory of Compelled Commercial Speech under the First Amendment. Nebraska Law Review 101 (4): 876–944.

Hart, Oliver, and Luigi Zingales. 2017. Companies Should Maximize Shareholder Welfare Not Market Value. Journal of Law, Finance, and Accounting, no. 2: 247–74.

Hayek, Friedrich A. 1945. The Use of Knowledge in Society. American Economic Review 35, no. 4: 519–30.

Heyne, Paul T. 1971. The Free-Market System Is the Best Guide for Corporate Decisions. Financial Analysts Journal 27, no. 5: 26–27, 72–73.

International Monetary Fund (IMF). The Other Government, chap. 3 in Fiscal Monitor: Policies to Support People during the COVID-19 Pandemic. Washington, D.C.: IMF.

Jensen, Michael C. 1989. Eclipse of the Public Corporation. Harvard Business Review 67 (September–October): 61–73.