If you’ve worried that the Federal Reserve would wait too long to address inflation concerns, you can take comfort from recent statements by members of the Fed’s rate-setting committee suggesting they might eventually be willing to shift away from easy-money policies. The problem is that the instruments in the Fed’s toolbox for lifting rates are potentially more harmful than they once were—and using them is likely to induce pangs of regret.

The Fed’s traditional tools—the discount rate, reserve requirements and open market operations—have evolved into considerably different mechanisms since the 2008 global financial crisis. The Fed now relies on its ability to pay interest on the reserves held by banks as its primary means for conducting monetary policy versus more subtle techniques for influencing supply and demand for reserves through open market operations. The Fed has also become a massive player in the market for U.S. government debt, which gives it a significant impact on the demand for Treasury securities, affecting prices and yields across maturities.

Considering that excess bank reserves held in depository accounts at the Fed grew from less than $2 billion in August 2008 to more than $3.8 trillion currently, and that Fed holdings of Treasury securities increased over the same period from less than $500 billion to more than $5 trillion, it is clear the Fed’s clout has risen enormously. Its earlier holdings equaled about 5% of total U.S. government debt; its current holdings are 18%.

It seems almost quaint to recall the days when contractionary monetary policy meant the Fed’s attempts to raise the interest rate at which banks loaned excess reserves to each other—called the federal-funds rate—by selling relatively meager amounts of Treasury debt at prices slightly below the going market price to increase yields.

The whole thing worked only because banks actively sought to avoid keeping excess reserves in Fed depository accounts that paid no interest; they much preferred to make profitable loans to the private sector. If a bank purchased Treasury debt from the Fed, its reserve account was debited for the amount, reducing the total supply of reserves—putting upward pressure on the fed-funds rate. As that rate increased, so did other interest rates.

These days the question isn’t whether the Fed will start selling off Treasury securities, but how soon and by how much it will begin to reduce the pace of accumulation. Would a mere “tapering” by the Fed from its current $80 billion a month in Treasury purchases bring about an economic contraction?

Even more concerning are allusions to the Fed’s potential use of its main tool—raising the interest rate paid on reserve balances—to counter inflationary pressures. Congress authorized the Fed to pay interest on reserves as part of the Emergency Economic Stabilization Act of 2008. More than a dozen years later, the “administered” rate now stands as the foremost instrument in the Fed’s toolbox.

This seems oddly heavy-handed, given that the anticipated heavy inflationary pressures from quantitative easing never materialized after the 2008 financial crisis. But when Fed Chairman Jerome Powell sought to soothe today’s concern about future inflation by stating in April that “we have the tools to address such pressures if they do arise,” he knew full well that increasing the interest rate paid on banks’ stockpiled reserves is the Fed’s principal mechanism for doing so.

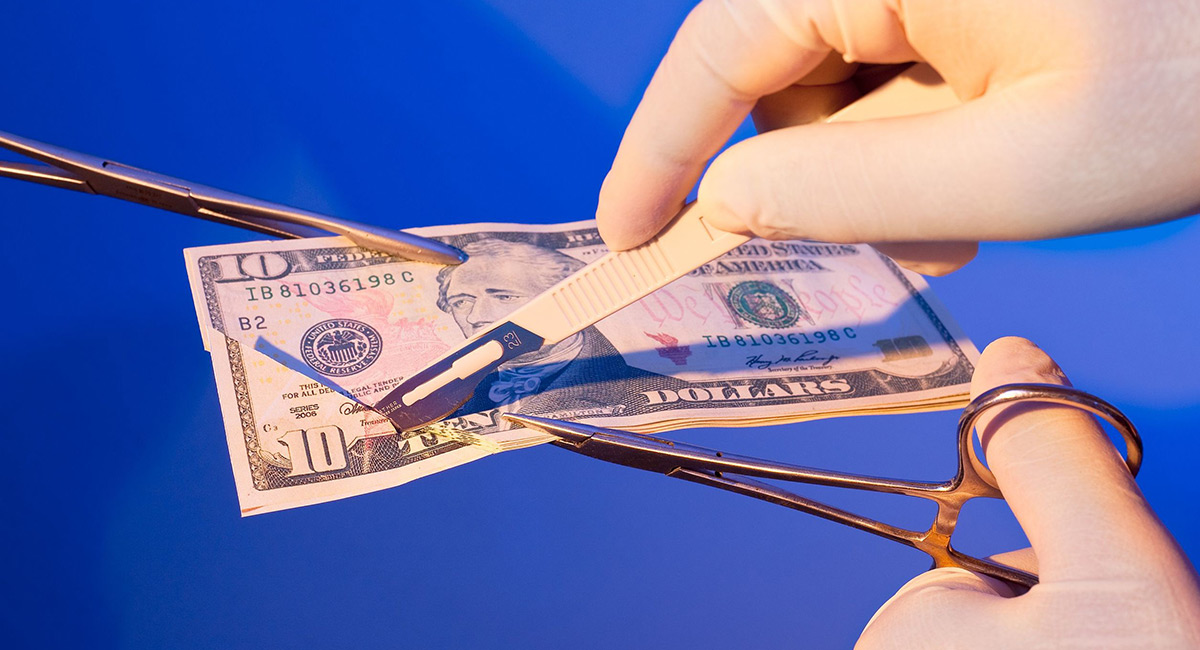

The Fed’s dominance in credit markets means that using its tools to control inflation has become a precarious undertaking. The Fed new tools are blunt instruments. One misplaced maneuver can rip through financial markets like a buzz saw.

Markets will be quick to respond to any deviation from the Fed’s stated intention to maintain its “accommodative stance” by continuing to target near-zero interest rates and by continuing to purchase $80 billion a month in Treasury securities (as well as $40 billion in agency mortgage-backed securities)—as the Fed’s monetary-policy committee unanimously agreed on April 28.

The fundamental question is whether the Fed’s use of its tools will hurt the real economy while trying to tame the inflationary pressures unleashed by the government’s monetary and fiscal stimulus. If banks anticipate passively receiving higher interest income from their reserve balances, they may be tempted to continue getting paid by the Fed rather than make loans to private borrowers, inhibiting the recovery of small businesses and suppressing economic growth.

A hike of 25 basis points won’t make or break the future of free-market capitalism. It isn’t the interest rate itself but the Fed’s mechanisms for conducting monetary policy that pose the danger. By empowering the Fed to lift interest rates by increasing the rate paid on bank reserves rather than having to sell Treasury securities and whittle down its own enormous holdings, Congress enabled the central bank to become a behemoth.

At this point, it would be difficult to reverse Congress’s error. Regulatory issues involving capital, liquidity and leverage ratios have become more complex under the Fed’s “ample reserves” regime. It remains to be seen whether commercial banks can be weaned off their unhealthy dependence on Fed largess, which rewards them for increasing their reserves rather than enlarging their loan portfolios. The situation is further complicated by the U.S. government’s dependence on the Fed’s readiness to purchase Treasury debt to fund deficit spending.

All we know for certain is that increasing government power begets increasing government power. And that vicious circle does imperil the future of free-market capitalism.