Taking cues from his economic advisers, President Joe Biden has announced a proposed 25 percent minimum tax on the wealthy as a centerpiece of his “Bidenomics” plan. This “billionaire tax,” which he outlined in a speech last month, is premised on the notion that the U.S. tax system provides too many breaks to the highest earners. As Biden claimed in his remarks, “billionaires pay an average of—guess what?—less than 8 percent in federal taxes—less than 8 percent on a yearly basis.” To drive home the point, the President declared that this is a “lower federal tax rate than a firefighter, a teacher, a cop” pays.

Biden’s contentions are meant to shock his listeners into believing that the federal tax system is steeply regressive, penalizing the working class at the behest of the rich. His statistics, however, are complete nonsense.

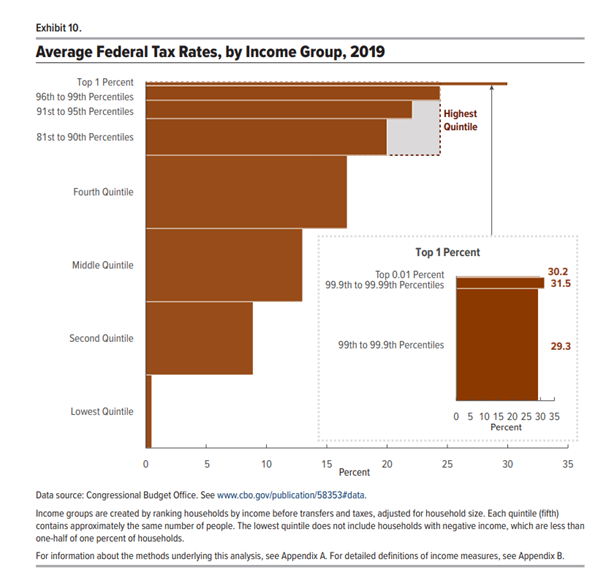

According to Congressional Budget Office statistics for 2019 (the most recent year with data), the heaviest tax burdens still fall squarely on the highest income earners. The Top 1 percent of filers pay an average federal tax rate of 30 percent. This number holds among the ultra-wealthy as well. If we restrict our subset to only the top 0.01 percent of earners, a category that generally applies to people with multi-million dollar annual salaries, the CBO estimates an average federal tax rate of 30.2 percent.

By contrast, the average tax rate on the lowest quintile of filers was just 0.5 percent in 2019 – a result of generous tax credits that are designed to relieve the poor of almost their entire federal tax burden. The second lowest quintile paid an average rate of just 8.9 percent in federal taxes.

Why, then, is the President so statistically confused?

The answer comes from his administration’s continued reliance on manipulated tax stats by economists Gabriel Zucman and Emmanuel Saez. In 2019, the New York Times and Washington Post ran splashy headlines declaring that billionaires paid lower tax rates than average Americans, attributing this figure to a new book by Zucman and Saez. A sympathetic press heralded the Zucman-Saez numbers before they ever went through peer review because they appeared to confirm the progressive left’s favored political narrative.

When I placed the Zucman-Saez stats under a microscope, several irregularities emerged. First, they intentionally excluded tax benefits for lower income filers such as the Earned Income Tax Credit, creating an illusion that the poor face a much higher tax rate than they actually do. Second, they manipulated their calculations for assigning corporate tax incidence among the rich, creating the illusion that billionaires only pay a little more than half of the actual rates. As part of the fallout from this discovery, Harvard University reportedly rescinded a job offer to Zucman because his “new” data could not be trusted.

There’s another twist to the story, though. Before Zucman and Saez cultivated the patronage of the media and left-wing politicians, they released an earlier estimate of the total federal, state, and local tax burden of an even smaller slice of the ultra-wealthy. As of 2014, the most recent year of their data, the tax rate for this group stood at 40.6 percent.

Furthermore, as the chart above shows, the total tax burden on the ultra-wealthy has hovered just north or south of about 40 percent since the 1960s, subject to a few fluctuations tied to business cycle events and tax code overhauls.

So, no, Mr. President, the wealthiest filers are not paying a lower tax rate than the rest of us. IRS statistics show that America’s federal tax system remains steeply progressive, and no politically motivated data manipulation will ever alter that fact.