Thanks to the Federal Reserve’s monetary mismanagement, Americans are suffering from economic whiplash. Americans enjoyed a post-Covid economic boom. Then, they were hit with high inflation. Now, they are staring down a recession in 2023. How did this happen in just three short years?

All roads lead to the Federal Reserve, where chairman Jerome Powell has rejected the quantity theory of money (QTM), a theory which states that inflation and economic growth are inextricably linked to the money supply (measured by M2). It’s a theory that was famously championed by Milton Friedman, who was unquestionably the master of monetarism (read: the QTM).

Powell said in his 2021 semiannual monetary policy report to Congress, “The growth of M2 . . . doesn’t really have important implications for the economic outlook.” Remarkably, this has become one of Powell’s signature messages. For example, in an interview at the Cato Institute just four months ago, Powell, at three points during the program, explicitly stated that the money supply has no impact on the economy, and he said that the money supply “does not play an important role in [the Federal Reserve’s] formulation of policy.”

This point-blank rejection of the QTM is particularly interesting given that Powell himself admits to not understanding inflation. In June 2022, Powell said, “We now understand better how little we understand about inflation.” If he doesn’t understand inflation, why is he so sure that the QTM can’t help?

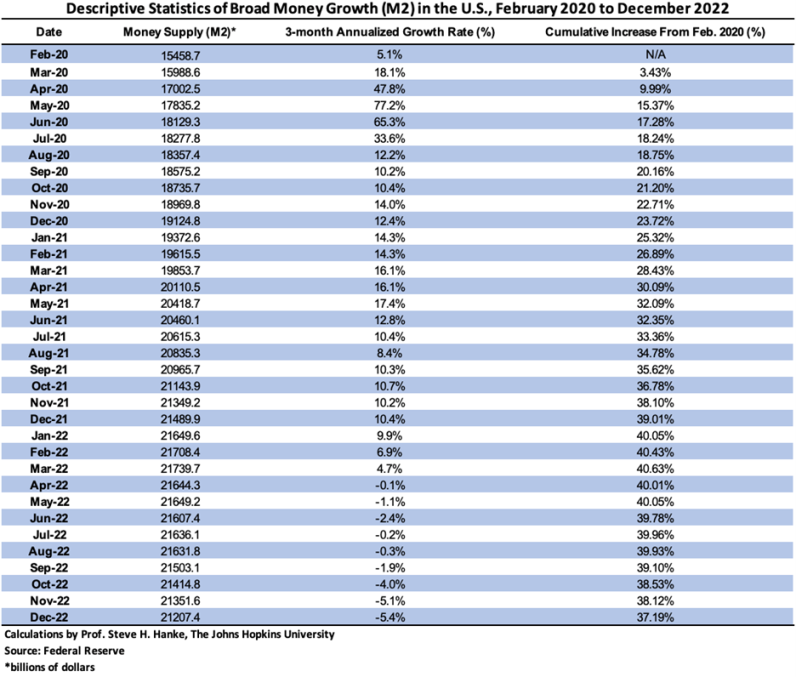

In any case, Powell and the Fed, having rejected the QTM, have no clear sense of direction. As a result, the Fed has made two of its most dramatic monetary mistakes since its establishment in 1913. The table below tells the tale.

The first mistake, from February 2020 to March 2022, involved a rapid, record expansion of the money supply (M2). The three-month annualized growth rate of M2 reached 77.2 percent in May 2020, a rate unprecedented in American monetary history. The effects of this monetary expansion were just as the QTM would predict. Economic activity, with the usual lag of six to 18 months, boomed. Real GDP grew by 7 percent year over year in the fourth quarter of 2021, and, by September 2021, unemployment had fallen by 10 percentage points, from its April 2020 peak of 14.7 percent to 4.7 percent. The undesirable, but predictable, effect of this monetary explosion soon followed—inflation, with the usual lag of twelve to 24 months, reached a 40-year high of 9.1 percent per year in June 2022.

If the first monetary mistake is equivalent to putting your car’s gas pedal to the floorboard in heavy traffic, the second mistake is analogous to immediately putting your car in reverse and throwing yourself through the windshield. In May 2022, when the Fed announced its quantitative-tightening program, the money supply began shrinking. By December, the three-month annualized growth rate of M2 had sunk to a stunning -5.4 percent. This flipped the year-over-year growth rate of M2 into negative territory. Given the usual lag of six to 18 months predicted by the QTM, a recession is right around the corner.

The recent Q4 2022 U.S. GDP figures confirm what’s showing up on the QTM dashboard: a looming recession. Although the middling headline growth rate of 2.9 percent year over year sparked a sigh of relief in the White House and some corners of the financial press, a closer analysis indicates that storm clouds are on the horizon. The best proxy for aggregate domestic demand is final sales to domestic purchasers (FSDP). In Q4 2022, the annual growth rate of FSDP plunged to 0.95 percent, the lowest annual rate of growth since Q1 2010 (excluding the Covid pandemic).

Thanks to the Fed’s monetary mistakes, the U.S. will experience a recession in 2023. For the suffering American whiplash victims, 2023 will not bring relief.