In 2013, the New York Times heralded a “surge of new, economically minded scholarship on slavery,” purportedly rectifying decades of neglect of this subject. This new school of thought exhibited a penchant for exaggerating its own novelty, even dubbing itself the “New History of Capitalism” (NHC) and echoing the claim of newness in books such as The Half Has Never Been Told, by Cornell’s Edward Baptist. It was an odd claim for its proponents to make.

The economic dimensions of slavery have consistently ranked among the most heavily investigated topics in the academic literature since at least 1958—the year of a landmark empirical investigation into plantation economics by Alfred H. Conrad and John R. Meyer. Today this literature boasts thousands of works by economists and historians alike. What was different about the “new history”? As Brown University’s Seth Rockman puts it, this “wave of new scholarship . . . has positioned southern slaveholders as architects of a capitalist system,” thereby rejecting the idea that plantation slavery was a premodern or anti-industrial throwback. This relatively simplistic assertion carries substantial ideological implications. The 19th-century cotton industry, contends Harvard’s Sven Beckert, shows “capitalism’s illiberal origins,” with slavery constituting the “beating heart of this new system.” His paraphrase of the work of departmental colleague Walter Johnson is even more blunt: “Slavery [is] not just . . . an integral part of American capitalism, but . . . its very essence.”

The NHC came under intense fire from other experts, and not only for its anti-capitalist politicking. As with most theories that attempt to reduce economic development to a single product or industry, its empirical claims about the U.S. cotton sector fell flat. Baptist, for example, employed novel accounting practices of his own invention to suggest that slave-produced cotton and its derivatives amounted to a full half of the United States’ gross domestic product before the Civil War. In a typical year, the actual number hovered around 5 or 6 percent. Economic historians made quick work of several core NHC books, finding evidence of seemingly deliberate misquotations, misrepresented sources, and above all else a general unfamiliarity with the previous half century of academic literature on the subject.

But a casual reader of the New York Times’ 1619 Project would find no indication of how poorly the NHC literature has fared in the last decade. To the contrary, contributor Matthew Desmond—a sociologist with no expertise in the history of slavery—adopts the NHC literature as his own in a blistering essay that faults a slavery-infused American capitalism for rising inequality, environmental destruction, failures to expand the welfare state, insufficiently progressive federal income taxes, and a long list of related 21st-century progressive discontents about economic policy. The overarching message: Capitalism is brutal, that brutality derives from slavery, and our national reckoning with slavery’s legacy must therefore alter the very nature of our economic system to allow expansive government interference in the economy. The New History of Capitalism’s case for linking capitalism to slavery is intended as a case against capitalism itself.

For all their ire over American capitalism, the NHC literature and the 1619 Project never bother to define the term or the system it represents. Eschewing a definition is a feature of this literature, not an oversight. The NHC school “has minimal investment in a fixed or theoretical definition of capitalism,” according to Rockman, though he also is quite sure that it “recognizes slavery as integral, rather than oppositional, to capitalism.” It makes for a curiously circular doctrine—capitalism cannot be defined, and yet it is also definitionally wedded to slavery.

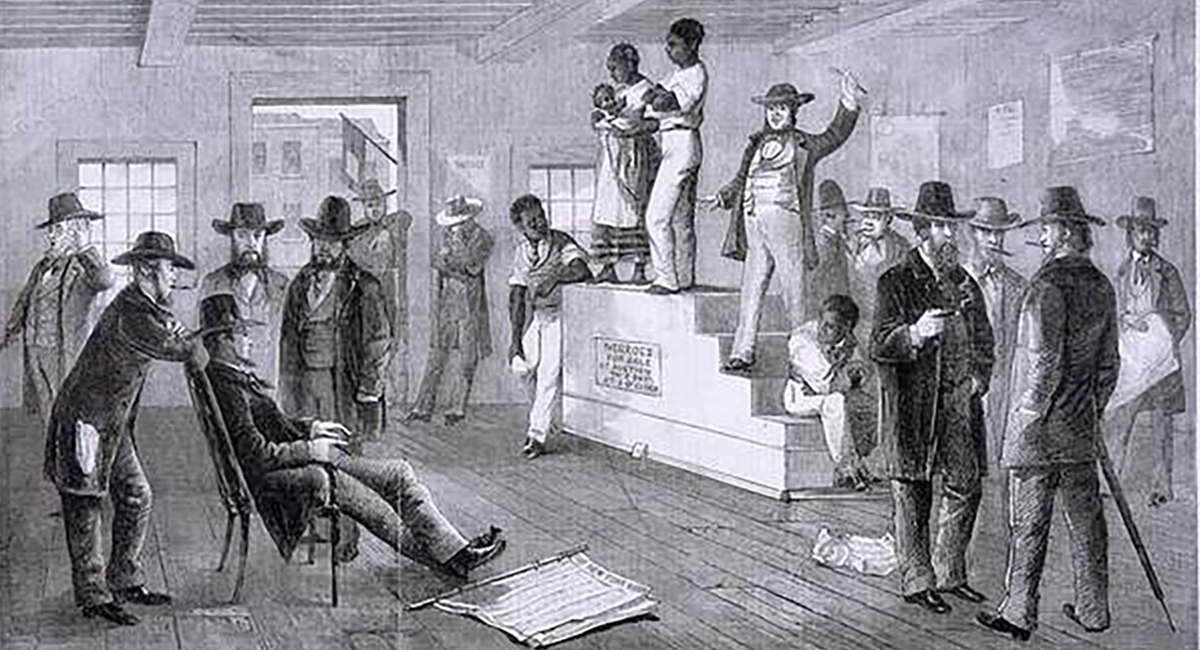

In practice, American slavery benefited from immense government support. Federal appropriations sustained the Fugitive Slave Act and subsidized slave patrols to return escapees to the South. Although an extraordinary example, the rendition of escaped slave Anthony Burns from Boston in 1854 cost the federal government an estimated $40,000 (over $1 million today when adjusted for inflation)—most of it spent on a massive military escort after a group of abolitionists attempted to free Burns from a federal courthouse. Antebellum federal statutes not only prioritized fortifications and armories to deter the threat of slave revolts. They also included provisions to censor abolitionist literature from the mail; to fund “internal improvements” in the ports, canals, and railroads used to ship slave-produced cotton; to subsidize a domestic textile industry built around the South’s raw materials; and even to create government credit and monetary policies that favored large plantation owners. Indeed, several of the Confederate secession proclamations of 1860–61 aired common grievances about the threatened loss of these and other tax-dollar-subsidized federal obligations to slavery.

Policies of this type are hallmarks of what is commonly referred to as “mercantilism”—an economic system in which government policy aims to cultivate a symbiosis between public expenditures and strategically selected beneficiary sectors of production. In shirking long-standing definitions, the NHC literature simply rebrands the same policies as extensions of “capitalism.” The final sleight of hand in this semantic game is to equate the relabeled slave-based economic system with something resembling a noninterventionist laissez-faire economic theory, thereby saddling 21st-century free-market economic policy—tax cuts, budget balancing, even opposition to the Green New Deal—with the moral baggage of plantation slavery.

There’s a problem with the NHC’s genealogical lesson, though—it’s almost entirely false, the product of a willfully negligent intellectual history. The economic doctrines that we most readily associate with free-market theory originated in the late 18th and early 19th centuries among the intellectual followers of Adam Smith. Although Smith is best known as a founding figure of modern economics, his works also expressed deep antipathy toward slavery. “The persons who make all the laws . . . are persons who have slaves themselves,” Smith wrote in 1763, reflecting on the problem of slavery in the New World colonies. “The profit of the masters was increased when they got greater power over their slaves”—power that arose from intertwining their enterprise with the legislature. In short, Smith attacked precisely what the NHC literature has rebranded as “capitalism.”

The free-market “capitalist” designation is similarly difficult to reconcile with how slavery’s 19th-century defenders saw themselves. Economic theory obtained its pejorative moniker as “the dismal science” from an episode in 1849. Commenting on an economic recession in the British West Indies, the essayist Thomas Carlyle placed the fault on a social-scientific theory “which finds the secret of this universe in ‘supply and demand,’ and reduces the duty of human governors to that of letting men alone.” This “dismal science” had made common cause with “Exeter Hall philanthropy”—a reference to the London meeting hall where the Anti-Slavery Society gathered—to embrace the “sacred cause of black emancipation, or the like,” and “to fall in love and make a wedding of it.” Economics, and specifically its laissez-faire iteration, was “dismal” to Carlyle because it advanced the cause of abolitionism.

Nor was Carlyle alone in this observation. Anti-slavery men embraced it. In the decades before the American Civil War, British reformer Richard Cobden advanced economic noninterventionism and free trade, anti-colonialism, and abolitionism as interrelated foundational principles of a classical-liberal philosophical system. His many converts included abolitionist U.S. senator Charles Sumner as well as Frederick Douglass. The latter met with Cobden while touring Britain to promote the anti-slavery cause, and credited his free-trade Anti–Corn Law League for the strategies it provided to the cause of emancipation.

Slave-owners in the United States took notice as well. George Fitzhugh, the leading pro-slavery theorist of the late antebellum era, was a proud Carlylean acolyte. His 1854 text Sociology for the South mounts an aggressive defense of the economic “order” provided by slavery, as contrasted with the chaos of the unregulated free market. “Political economy is the science of free society,” he declared, echoing Carlyle. “Its fundamental maxims, Laissez-faire and ‘Pas trop gouverner,’ are at war with all kinds of slavery.” Just as Cobden united free markets and abolitionism, Fitzhugh wedded anti-capitalism to slavery. It is hard not to see shades of Marx and Engels when he declares in a later work that “the interest of the capitalist” is “to allow free laborers the least possible portion of the fruits of their own labor; for all capital is created by labor, and the smaller the allowance of the free laborer, the greater the gains of his employer.” Similar anti-capitalist thinking swept across the Southern planter class, with James Henry Hammond boasting in 1858 that “our slaves are hired for life” in contrast with the North’s free laborers, “hired by the day, not care[d] for, and scantily compensated.”

The enmity between slavery and capitalism posited in these writings reveals just how far the politicized history of the New History of Capitalism and its 1619 Project derivatives have drifted from evidentiary moorings. What follows is a succession of basic errors of fact and reasoning. In one such example we find Desmond appealing to the very existence of accounting books on plantations as if they somehow prove slavery’s capitalistic nature—he labels them the Microsoft Excel spreadsheets of the 19th century. One wonders whether the NHC scholars would make the same inferences about the role of accounting books in Soviet central planning—the infamously elaborate attempts to construct a society-wide balance sheet through quantified surveys of raw materials, labor capacity, and production targets. Remove a free and functional market mechanism, and the need for complex internally managed allocation schemes increases.

Ironically, in this final point, Fitzhugh hit upon a kernel of truth—the slave-plantation system was a miniaturized exercise in central planning. But its costs in human lives were not some capitalist innovation, presaging progressive grievances with the market economy today. They were a feature of the philosophical delusion of most autocracies—one that imagines it can order and organize society by design.