Friday’s presidential election in Iran provides us with an invitation to take a look at Iran’s economy. To get a handle on how the economy works and where it’s going, one needs a model of national income determination. For me, a monetary approach to national income determination is what counts. Indeed, in a fundamental sense, it’s a theory of everything. The close relationship between the growth rate of the money supply and nominal GDP is unambiguous and overwhelming.

So, what is Iran’s current monetary temperature? Let’s first determine the ‘golden growth’ rate for the money supply, and then compare the actual growth rate of the money supply in Iran to the golden growth rate. To calculate the golden growth rate, I use the quantity theory of money (QTM). The QTM states that MV = Py, where ‘M’ is the money supply, ‘V’ is the velocity of money, ‘P’ is the price level, and ‘y’ is real GDP.

Let’s use QTM to make some benchmark calculations in order to determine what the golden growth rate is for the money supply. This figure will be the rate of broad money growth that would allow the Central Bank of Iran to hit its inflation target. I have calculated the golden growth rate for the 2010–20 period.

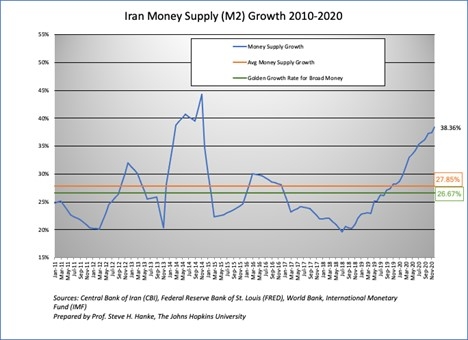

According to my calculations, the average annual percentage real GDP growth from 2010–20 was -0.6%, the average annual growth in total money supply (M2) was 27.9%, and the average annual change in the velocity of money was -5.3%. Using these values and the Central Bank of Iran’s inflation target of 22%, I calculated Iran’s golden growth rate for broad money (M2) to be 26.7%.

How did I get there? The golden growth rate is the inflation target plus average real GDP growth minus the average percentage change in velocity. Iran’s golden growth rate = 22% + -0.6% – (-5.3%) = 26.7%.

So, the average growth rate of the money supply (M2), which has been 27.9%, has slightly overrun the golden growth rate of 26.7% (see figure). This has resulted in an average realised inflation rate of 23.2% per year. Given Iran’s inflation target of 22%, overall, that’s a pretty good performance.

But, note the fact that since the Covid-19 pandemic in March 2020, the growth rate in M2 began to skyrocket, with a dramatic surge in credit to the private sector. At the end of 2020, M2 was growing at 38.7% per year. That rate dramatically exceeds the golden growth rate of 26.7% per year, a growth rate that would be consistent with the Central Bank of Iran’s inflation target of 22% per year. As a result, inflation, by measure, is soaring at 37.9% per year.

It’s clear that inflation is an Iranian nightmare. Not only is the current inflation rate one of the highest in the world, but the Central Bank of Iran’s inflation target of 22% is itself a real shocker. Indeed, for most Iranians, it’s unacceptable.

The best way for Iran to rid itself of its endemic inflation target is to install a currency board. A currency board issues notes and coins convertible on demand into a foreign anchor currency at a fixed rate of exchange. It is required to hold anchor-currency reserves equal to 100% of its monetary liabilities.

A currency board has no discretionary monetary powers and cannot issue credit. It has an exchange-rate policy but no monetary policy. Its sole function is to exchange the domestic currency it issues for an anchor currency at a fixed rate. A currency board’s currency is a clone of its anchor currency. Iran, an oil exporter, should logically choose the US dollar as its anchor currency. But, if Iran prefers an anchor that is not issued by a sovereign, gold is the answer.

A currency board requires no preconditions and can be installed rapidly. Government finances, state-owned enterprises and trade need not be reformed before a currency board can issue money. Currency boards have existed in some 70 countries. None have failed. So, a currency board would be a sure bet for Iran.