The following was presented to the House Committee on Oversight and Government Reform on July 10, 2012

----------

Mr. Chairman and members of the Committee, I am John Goodman, president of the National Center for Policy Analysis (NCPA). A nonprofit, nonpartisan public policy research organization, the NCPA is dedicated to developing and promoting private alternatives to government regulation and control, and solving problems by relying on the strength of the competitive, entrepreneurial private sector. I welcome the opportunity to share my views and look forward to your questions.

The Patient Protection and Affordable Care Act (ACA) will radically transform the U.S. health care system.[1] Arguably the most radical piece of legislation ever passed by Congress, the law will affect everyone with private insurance, every senior on Medicare, everyone on Medicaid. The bill will create 159 new regulatory agencies.Its first 10-year cost is close to $1 trillion. It is intentionally designed to fundamentally alter the way medicine is practiced in this country.

In this testimony, I address the impact of the legislation on the economy.

Costs

The Congressional Budget Office (CBO) estimates the average annual cost of a minimum benefit package at $4,500 to $5,000 for individuals and $12,000 to$12,500 for families in 2016.[2] That translates into a minimum health benefit of $2.28 an hour for full-time workers with individual coverage and $5.89 an hour for full-time employees with family coverage.

The law does not specify how much of the premium must be paid by the employer versus the employee—other than a government requirement that the employee’s share cannot exceed 9.5% of family income for low- and moderate-income workers, and an industry rule of thumb that employers must pick up at least 50% of the tab. But the economic effects are the same, regardless of who writes the checks.

In another year and a half, the minimum cost of labor will be a $7.25 cash minimum wage and a $5.89 health minimum wage (family), for a total of $13.14 an hour or about $27,331 a year. You can see already that few firms are going to want to hire low-wage workers with families.

Economists have been studying the labor market for years and there are three principles that are well established in the literature:

1. Total employee compensation tends to equal the value of what workers produce— that is, what they add to overall output, at the margin.

2. Noncash benefits (e.g., health insurance) substitute dollar-for-dollar for cash wages.

3. If the minimum compensation required is higher than what workers are able to produce, they will be priced out of the labor market.

To confirm these principles, economists use sophisticated mathematical models and conduct elaborate statistical tests. But these conclusions are what ordinary common sense would predict anyway. Imagine you are an employer. You certainly aren’t going to pay an employee more than his value to the organization, and competition from other employers will tend to prevent you from paying less. If the government forces you to spend more on health insurance, you will spend less in wages in order to pay for the mandated benefits.

For above-average-wage employees, expect wage stagnation over the foreseeable future, as employers use potential wage increases to pay for expanded (and mandated) health benefits instead. At the low end of the wage scale, however, the effects of this new law are going to be devastating.

Ten-dollar-an-hour workers and their employers cannot afford $6-an-hour health insurance. If they bought it, only $4 would be left for cash wages and that would violate the (cash) minimum wage law. This is not a small problem. One-third of uninsured workers earn less than $3 above the minimum wage.[3]

Further, although health economists have known for decades that these are the workers that most need help in obtaining insurance, there are no new subsidies to help employees at places like Wal-Mart or McDonald’s or Denny’s buy health insurance. These workers and many others are at risk of losing their jobs.

Almost one in four teenagers is already unemployed (23.7%) and among black teenagers the unemployment rate that is more than one in three (39.3%).[4] The ACA will make these conditions worse.

Taxes

Americans and American businesses will face more than $500 billion in 19 new types of taxes and fees over the next decade to fund health reform.[5] Some of the new taxes will be indirect and will be passed on to consumers in the form of higher prices, higher premiums, or lower wages. Families will pay other taxes directly. According to the Joint Committee on Taxation, about 73 million taxpayers earning less than $200,000 will see their taxes rise as a result of various health reform provisions.[6]

Tax on Medical Devices. Beginning in 2013, a 2.3 percent tax will be imposed on the manufacture and importation of medical devices. Devices typically sold by retailers to consumers— including toothbrushes and bandages— are exempt from the tax, whereas devices purchased from wholesalers by health care providers, such as tongue depressors and ultrasound equipment, will be taxed. Though seemingly small, the tax on medical devices will collect nearly $20 billion over the next decade. The tax will prompt the loss of about 45,661 jobs across the medical device industry, according to Diana Furchtgott-Roth, former chief Labor Department economist.[7]

Taxes on Capital. The Medicare payroll tax will increase by almost one-third for some people—from 2.9 percent today to 3.8 percent on wages over $200,000 for an individual or $250,000 for a couple. Much of this income consists of a return on investment for small business entrepreneurs. In addition, the 3.8 percent Medicare payroll tax will be levied on investment income (capital gains, interest, and dividend income) at the same income levels. Taxing capital is in general a bad idea. The reason: A tax on capital is ultimately paid by labor. By making the capital stock smaller, taxes on capital make workers less productive. And since workers tend to be paid a wage that reflects their marginal product, taxes on capital tend to lower employee incomes.

Implicit Marginal Tax Rates

Numerous provisions of the law impose high effective marginal tax rates on middle- and low-income families as income-based subsidies and benefits are withdrawn. There are also high marginal penalties for small business employers.

High Marginal Tax Rates for Families. Starting in 2014, subsidies in the health insurance exchanges will be available to families with incomes between 133% and 400% of the federal poverty line. The range is from $31,389 to $93,699 for a family of four.

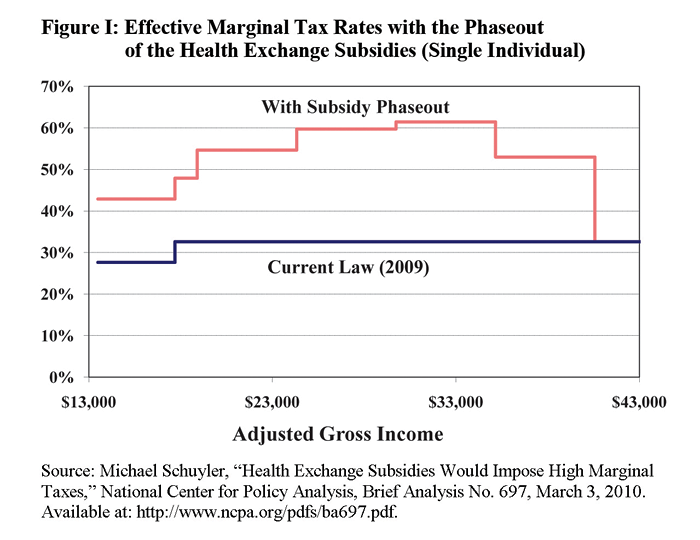

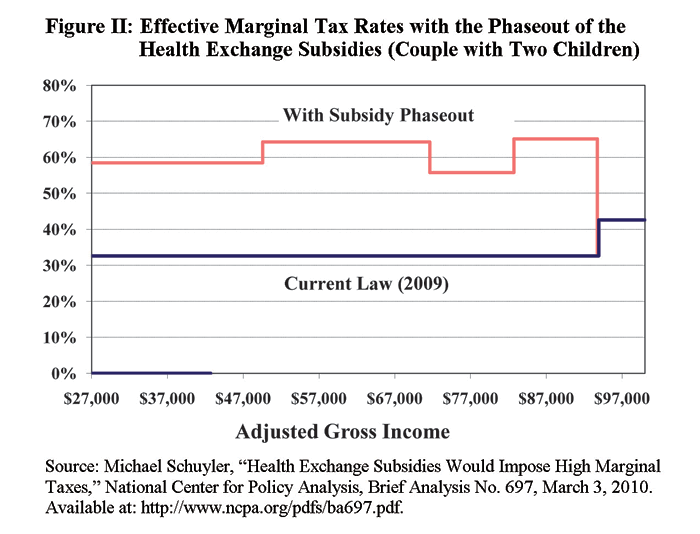

Figures I and II show the implicit marginal tax rates that individuals and families can expect to pay under the new law, on the average. The “marginal tax rate” refers to the steep withdrawal of health insurance subsidies (in the exchange) as income rises, as well as income and payroll taxes. Note that the highest marginal tax rates fall on moderate-income earners. As the two graphs illustrate, the Affordable Care Act will create marginal tax rates in excess of 60% for workers earning as little as $20,000 to $30,000.[8] These individuals will face a marginal tax rate substantially higher than the rate paid by Bill Gates or Warren Buffett.

Michael Schuyler, who produced these estimates, describes them as follows:

The charts actually understate the spikiness of the marginal rate “skyline.” They are drawn as though the subsidy smoothly phases out between the pairs of incomes for which CBO provides subsidy estimates. In practice, the phase-out would have “cliffs,” in which a few dollars of added income would cut the subsidy by hundreds or thousands of dollars, resulting in stratospheric marginal tax rates in the immediate vicinity of the cliffs.

What is the highest marginal tax rate a family could face? An analysis by Daniel Kessler finds that health coverage will cost $23,700 for a family of four headed by a 55 year old living in a high-cost region.[9] Although premiums for health insurance sold in the exchange are capped at 9.5 percent of income for families earning between 350% and 400% of poverty, there are no subsidies for families earning more than 400 percent of poverty. That means premiums would be capped at $8,901—resulting in a subsidy of $14,799 ($23,700-$8,901) for a family earning $93,699 (400% of poverty). But if the family earns $1 more ($93,700), they no longer qualify for a subsidy. Thus, $1 in additional income results in a subsidy loss of $14,700, for an implicit tax rate of 1.47 million percent.

As is well known by economists and policymakers alike, when people get to keep only one-third of each extra dollar they earn, they react in all kinds of ways that are harmful to the economy. They will choose more leisure and less work; they will substitute untaxed fringe benefits for taxable wages; they will disguise consumption as a business expense; and they will substitute unreported (and, therefore, untaxed) income for reported income.

High Marginal Tax Rates for Employers. Employers also face the equivalent of high marginal tax rate “cliffs” from provisions in the Affordable Care Act. Firms that employ fewer than 51 fulltime workers will be exempt from penalties for failing to offer health coverage. The fifty-first worker, however, could be a very expensive hire. For firms that employ 51 workers or more, failure to provide insurance will subject them to a tax penalty of $2,000 for each uninsured employee beyond the first 30 employees. Growing from 50 to 51 uninsured workers would subject employers to a fine of $42,000 [(51-30) x $2,000] for adding the last worker. This fine, however, will be much smaller than the cost of providing 51 employees with the insurance mandated under the Affordable Care Act. The fine is much smaller if a firm hires a significant number of part-time workers (those working less than 30 hours per week). In the example above, if 20 of the firm’s 51 workers were replaced by part-time workers, the firm’s penalty would fall from $42,000 to only $2,000.[10] One implication: Many workers who want full-time work may only find part-time work instead.

Bizarre Subsidies

The Affordable Care Act offers radically different subsidies to people at the same income level, depending on where they obtain their health insurance—at work or through an exchange. These subsidies are arbitrary, unfair, and in some cases even regressive. Along with the accompanying mandates, they will cause millions of employees to lose their employer plans and perhaps their jobs as well.

Subsidies With Perverse Incentives. Take the maids, waitresses, busboys, custodians and groundskeepers at a hotel, each making about $15 an hour. The only subsidy available for health insurance is the provision in the current tax code: employers can pay health insurance premiums with pre-tax dollars. Yet because employees at this income level make too little to be subject to federal or state income taxes, they will avoid only a 15.3 percent (FICA) payroll tax, amounting to a subsidy of about a $2,800 for family coverage.

Now consider a standard family plan offered in a health insurance exchange. If these $15-an-hour employees are eligible for such a plan, the government will pay anywhere from 90 to 94 percent of the premium depending on the age of the employee and the region of the country. This government subsidy would amount to about $13,617.[11]

Which is better from the point-of-view of the employee: a $13,617 subsidy or a $2,800 one? If the hotel didn’t send its low-wage workers to the exchange and a competitor down the road did so, the hotel would face about 50 percent higher labor costs than its competitor.

Although low-and moderate-wage employees get generous subsidies in the health insurance exchange, higher income employees get no subsidy at all. If they obtain employer-provided insurance, however, they can take full advantage of the current tax law provisions. When the hotel buys insurance for a manager, for example, the premiums not only avoid the 15.3 percent payroll tax, but they also avoid a 25 percent federal income tax and, in some cases, a 5 or 6 percent combined state and local income tax. The upshot: through this tax subsidy, government is “paying” for almost half of the cost of the insurance.

Incentives to Restructure Business in Inefficient Ways. Below-average wage workers will want to work for a company that pays higher wages rather than offering a health insurance benefit. Above-average wage workers will have the opposite preference. In competition for labor, therefore, companies and entire industries will reorganize. Low-income workers will congregate in companies that do not provide insurance; high-income employees will work for firms that do provide it. Firms that ignore these worker preferences will not survive.

This implies two bad results: (1) much higher burdens for taxpayers as millions more take advantage of the subsidies than the Congressional Budget Office (CBO) has predicted and (2) an entire economy whose structure is based not on sound economics, but on gaming an irrational subsidy system.[12]

Subsidies That Are Regressive and Unfair. Quite apart from the perverse economic incentives the subsidies create, they are also arbitrary and unfair. A $31,389-a-year family (about 133 percent of poverty) getting health insurance at work gets less than one-fourth as much help from the government as a family making nearly three times that much income and getting insurance in the exchange.

Uncertainty

If current law remains unchanged, on January 1, 2013, American taxpayers will be hit with a large tax increase (mainly the expiration of the Bush tax cuts) and a major decrease in government spending (the result of last year’s budget deal) as well.[13]

All told, we’re looking at a $500 billion fiscal shock to the economy. Higher taxes and reduced spending might dampen economic activity and slow down the current recovery. You can think of the January 1st fiscal tsunami as a New Year’s Day “anti-stimulus” package. The Congressional Budget Office is predicting that the price we will pay for that package is a “double dip” recession.

But here is something even more disturbing. It turns out that uncertainty—not knowing what Washington is going to do about all this— is worse than the reality. Will President Obama and the Congress agree to put off the tax increases? Will they agree to delay the spending cuts? Not knowing the answers to those questions appears to have more impact on the decisions of businesses and consumers than if everyone simply agreed to go ahead and let the bad things happen.

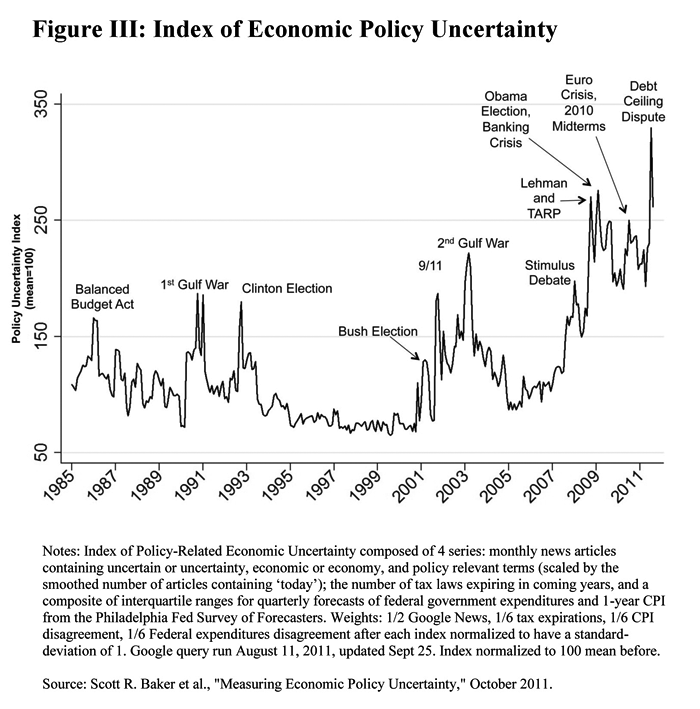

Historically, “uncertainty” has been a slippery concept in the vocabulary of economists. Everyone kind of knows what it means. But until recently there was no numerical measure. Economists at Stanford University and the University of Chicago developed an index of uncertainty and they have tracked it over time for several decades.[14] Here’s what they found. Their measure of uncertainty soared during the Obama years, where it has been at its highest levels in the past 30 years [See Figure III]. It’s not just uncertainty about what will happen next January that is a problem. Arguably, the economic policies of the Obama presidency are the problem. Public policy uncertainty alone is the apparent cause of a peak decline of 3.2% in real GDP, a 16% decline in private investment and the loss of 2.3 million jobs over the past five years.[15]

Here is what Nobel prize-winning economist Gary Becker has to say on uncertainty:[16]

[S]ome of the uncertainty during this financial crisis was avoidable if Congress and the president had not passed an ineffective stimulus package over a divided Congress, if they had resolved the budget deficit and debt ceiling issues (especially by trying to get entitlements under control), if agreement on tax policy toward broader and flatter taxes had been achieved, and if clearer policies were adopted about which companies would be allowed to go bankrupt and which would be bailed out.

This uncertainty is one of the reasons employers are not hiring like they have at the end of past recessions. When an employer hires a full-time worker, the employer thinks of the relationship as long term. During an initial training and learning period, the employer probably pays out more in wages and benefits than the company gets back in production. But over a longer period, the hope is to turn that around and make a profit.

When employers hire new employees, they are making a gamble. They are betting that, over time, the economics of the relationship will pan out.

The problem in the current economy is that hiring new workers and committing to new production has become risky. An employer who hires workers today has no way of knowing the company’s future labor costs; its building and facility costs; its cost of capital; or its taxes.

Employers could decide to drop their health insurance altogether; and if they do so they must pay a fine of $2,000 per employee per year. Yet if a lot of employers do this (and apparently a lot of them are thinking about it[17]), it is likely the federal government will respond by making the fine a lot higher.

Uncertainties about future tax and health care costs could be inhibiting permanent job growth, shifting more of the labor force to temporary and part-time employment. Overall, since 2007 there has been a net loss of 9.8 million full-time jobs, but a gain of 2.3 million part-time jobs. The increase in part-time employment is not entirely voluntary. About 31 percent of current part-time workers would prefer full-time jobs. According to the Bureau of Labor Statistics, from April 2006 to August 2011, the number of part-time workers seeking full-time employment increased from 3.6 million to nearly 8 million.[18]

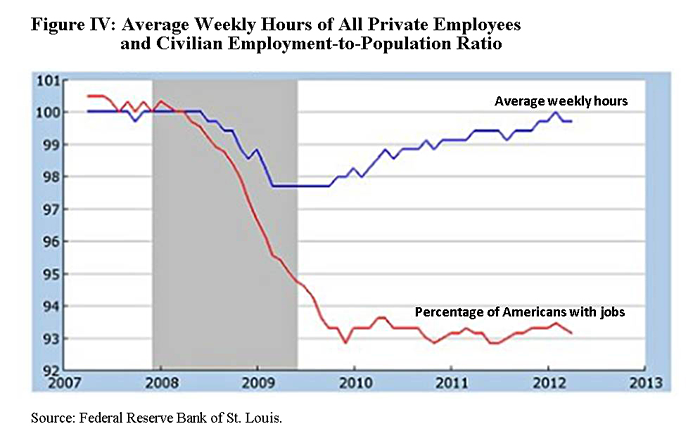

The red line in Figure IV is a monthly index of the employment-to-population ratio, normalized to a value of 100 in December 2007, when the recession began. In this series, each employee counts the same, regardless of how many hours worked. The blue line shows the average number of hours worked by employees with private sector jobs. In this series, only people with jobs are included in the calculation.[19]

University of Chicago economist Casey B. Mulligan had this to say about the labor market: [20]

By one measure, the labor market has not recovered at all. By another, the recovery is complete...Unlike the employment-to-population ratio, average work hours have largely recovered since 2009. Earlier this year, the average hours series reaches 100, which was its value for much of 2007.

Mulligan cites the ACA as a possible explanation for this phenomenon. The reason: Nothing happens to the employers’ health care costs if people work additional hours. There is a substantial increase in health care costs, however, if the employer hires one more worker.

[1] Patient Protection and Affordable Care Act of 2009, HR 3962, 111th Congress, 1st session.

[2] Many people will opt for more comprehensive plans. See Douglas W. Elmendorf, “Letter to Honorable Olympia Snowe,” Congressional Budget Office, January 11, 2010.

[3] Katherine Baicker and Helen Levy, “Employer Health Insurance Mandates and the Risk of Unemployment,” Risk Management and Insurance Review 11 (2008): 109–132. doi: 10.1111/j.1540-6296.2008.00133.x.

[4] “The Employment Situation—June 2012,” Bureau of Labor Statistics, New Release, July 6, 2012.

[5] Congressional Budget Office, “Estimate of the Effects on the Deficit of the Reconciliation Proposal Combined with H.R. 3590, as Passed by the Senate.”

[6] Keith Hennessey, “How Would the Reid Bill Affect the Middle Class?” December 10, 2009. For a discussion, see John C. Goodman, “Who is Taxed? Who is Subsidized? Senate Version of ObamaCare,” John Goodman’s Health Policy Blog, March 16, 2010.

[7] Devon Herrick, “The Job-Killing Medical Device Tax,” National Center for Policy Analysis, Issue Brief No. 106, February 15, 2012. The source of the calculations are by Diana Furchtgott-Roth and Harold Furchtgott-Roth, “Employment Effects of the New Excise Tax on the Medical Device Industry.” September 2011.

[8] Michael Schuyler, “Health Exchange Subsidies Would Impose High Marginal Taxes,” Brief Analysis No. 697, National Center for Policy Analysis, March 3, 2010.

[9] Daniel P. Kessler, “How Health Reform Punishes Work,” Wall Street Journal, April 25, 2011.

[10] “Employer Mandate Penalties: Calculations,” National Federation of Independent Business, undated.

[11] The Kaiser Family Foundation, “Health Reform Subsidy Calculator,” June 22, 2010.

[12] John Goodman, “Four Trojan Horses,” Health Alerts, John Goodman’s Health Policy Blog, April 15, 2010.

[13] Benjamin Page, “Economic Effects of Reducing the Fiscal Restraint That Is Scheduled to Occur in 2013,” Congressional Budget Office, May 2012.

[14] Scott R. Baker, Nicholas Bloom and Steven J. Davis, “Measuring Economic Policy Uncertainty,” White Paper, University of Chicago, October 10, 2011.

[15] Ibid.

[16] Gary Becker, “Why Has the Recovery in Employment in the U.S. Been so Slow?” The Becker-Posner Blog, May 6, 2012.

[17] Shubham Singhal, Jeris Stueland and Drew Ungerman, “How U.S. Health Care Reform Will Affect Employee Benefits,” McKinsey Quarterly, June 2011.

[18] Pamela Villarreal and Peter Swanson, “Temporary Employment: The New Permanent?” Brief Analysis No. 754, National Center for Policy Analysis, October 10, 2011.

[19] Casey B. Mulligan, “The Asymmetric Recovery,” New York Times, Economix Blog, May 30, 2012.

[20] Ibid.