The U.S. equity markets have whipsawed about, causing investors consternation because of the drops but also the volatility. Indeed, on August 24 trading in major equity indices was temporarily halted, including the first time ever for the S&P 500 Futures, while the next day saw the biggest downside reversal for the Dow since October 2008. As shocking as these developments may be to some analysts, those versed in the writings of economist Ludwig von Mises have been warning for years that the Federal Reserve was setting us up for another crash.

Mises (1881–1973) was a champion of the “Austrian School” of economics. The school of thought is so named because historically its members came from Austria, though nowadays there is a strong tradition of Austrian economics in the United States. (Mises himself taught at New York University for 24 years.) The most celebrated Austrian economist is Mises’s follower Friedrich Hayek, who won the Nobel Prize in 1974, primarily for his elaboration of Mises’s theory of the business, or boom-bust, cycle.

Although fans of the Austrian approach can cite numerous advantages over rival schools, in our times the most important distinction is the Austrian understanding of this cycle, which plagues modern market economies. Somewhat perversely, it turns out that if the Austrians are right, then the “medicine” administered during a slump by central banks around the world—including our own Federal Reserve—is actually poison.

According to Mises and his disciples, interest rates serve a vital function in a free-market economy. The legitimate market rate of interest signals the relative scarcity of savings versus investment opportunities. If the community is willing to defer immediate gratification by reducing consumption and saving more, then this frees up real resources. Rather than channeling steel, labor, and lumber into building another shopping center, those resources can be diverted into constructing a deep-sea oil rig.

In this example, the extra savings from the public manifests itself in lower interest rates, which give entrepreneurs the green light to invest in longer projects (such as the oil rig). Eventually the average standard of living will be higher, but only after the longer projects are completed and the finished consumer goods shoot out the end of the longer pipeline.

However, what happens if interest rates fall not because of a genuine increase in saving by the public, but rather because central banks flood the financial sector with newly created money? According to the Austrians, this typical remedy merely sets off an unsustainable boom. Entrepreneurs still get the green light to start longer-term investment projects, but the economy lacks the real savings necessary to bring them to fruition.

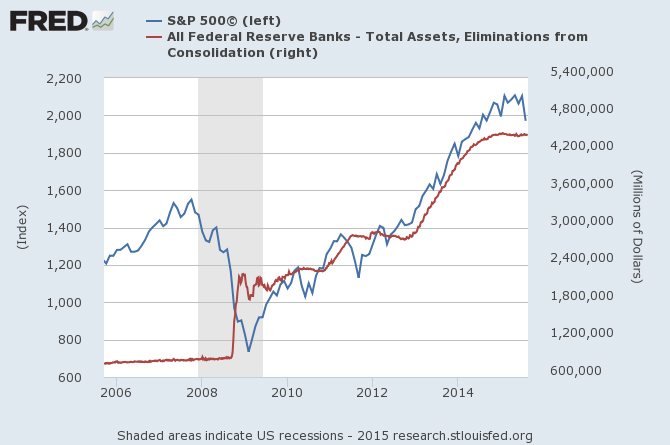

Such has been the condition of the United States and other major economies since the extraordinary interventions by central banks after the 2008 financial crisis. For example, the nearby chart shows the tight connection between the S&P 500 and the Federal Reserve’s balance sheet since the first round of QE (quantitative easing) in 2009:

As the chart indicates, the impressive bull market in U.S. equities has been tied directly to the Fed’s unprecedented asset purchases. Specifically, since the crisis in 2008 the Fed has purchased trillions of dollars of Treasuries and mortgage-backed securities (these were the so-called “toxic assets” of the financial panic), quintupling its balance sheet in just seven years. The purchases came in three waves of “quantitative easing,” and the chart shows that the U.S. stock market generally rose in synch with these purchases.

Now without an underlying theory of how the economy works, this chart could be either benign or alarming. For example, people who thought the economy was simply suffering from a shortfall of “Aggregate Demand” applauded the Fed for providing necessary liquidity.

On the other hand, most subscribers to the Austrian School have been warning that “printing money out of thin air” doesn’t make Americans richer. The Fed’s actions—including virtually zero percent short-term interest rates for years on end—have simply sabotaged the market’s normal mechanisms. The full bust that should have occurred in 2008 was merely pushed back, with the underlying malinvestments festering.

Yes, there was a crash in asset values in 2008, and the U.S. definitely suffered a recession, but the Fed’s actions quickly papered over these attempts to restructure the economy and place it on a firm foundation. The crash in the Chinese markets may have been the trigger to set off the recent fall in U.S. equities, but Austrians have been warning for years that the entire system was fragile.

The mainstream Keynesian paradigm guiding our central banks and the federal government have failed time and again. Policymakers and the general public should heed the writings of the Austrian School economists, and in particular the work of Ludwig von Mises. His wisdom will guide us through the inevitable crises that the “smartest guys in the room” have set in motion.