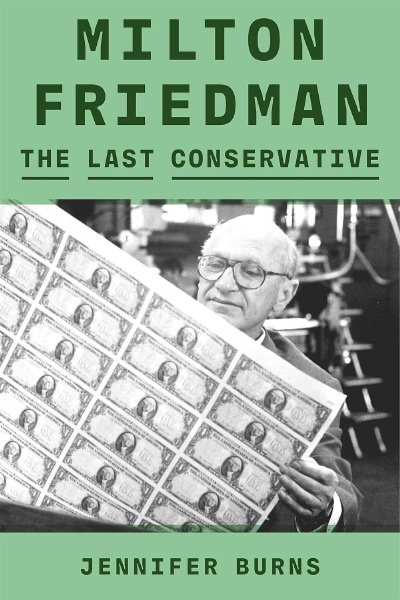

Stanford University historian Jennifer Burns has written a definitive biography of economist Milton Friedman (1912–2006). It is a most impressive work. The book is the product of Burns’s efforts to come to know and understand Milton Friedman and his role in twentieth century intellectual and political history. She approaches her subject with no agenda other than this. She writes as a dispassionate biographer and historian, avoiding the temptation to either place Friedman on a hero’s pedestal or to pull him down.

Throughout his career Friedman was viewed by many commentators as either a savior or a menace to society. Shortly after his death economist Alex Tabarrok wrote: “Great economist by day and crusading public intellectual by night, Milton Friedman was my hero.” Burns quotes Vaclav Klaus, President of the Czech Republic, on the inspiration he received as a young man living behind the Iron Curtain from Friedman’s advocacy of freedom, limited government, and free markets. From the other side, Burns quotes economist and former Harvard University President Larry Summers, son of two University of Pennsylvania economists and nephew of Paul Samuelson and Kenneth Arrow, both Nobel Laureates in Economics, as saying that in his youth Friedman was a devil figure in many ways. Most likely Summers learned this in his family.

Burns rightly suggests that Friedman’s life and career are a good entry point into twentieth century history, for he was present for the century’s major events and involved in its economic and political currents. Friedman’s parents (central European Jews) were part of the wave of European immigrants to the United States prior to World War I. He came of age during the Great Depression and made the economic crisis the focus of much of his scholarly work. He was among a group of statisticians who were a vital part of strategic defense research and planning during World War II as the Statistical Research Group, part of the federal Office of Scientific Research and Development. Friedman was present, as critic, for the Keynesian revolution in economics. He was trained by Institutionalist economists and retained Institutionalist sensibilities, which put him in opposition to the turn to mathematical modeling that was the complement of Keynesian economic theory. In the 1950s and 1960s Friedman laid the intellectual foundation for the shift toward economic and political conservatism that brought Ronald Reagan and Margaret Thatcher to office as President and Prime Minister of the U.S. and U.K., respectively.

Along with Friedrich Hayek, Friedman became a leading advocate for free markets in a time when the conventional social philosophy was an amalgam of progressive planning mentality and socialist ethics. The view from this perspective was that a free-market economy was an economy unmoored from efficiency and justice. If there ever had been a free-market economy, it was best left as a relic of the past. Big government was seen as both necessary for and a sign of social progress. Free markets would bring to mind nineteenth century “robber barons” or Dickens’s characters Scrooge, Bounderby, and Gradgrind. And it was widely presumed that the Great Depression proved the failure of free markets. Friedman navigated in these twentieth century currents, sometimes swimming against and other times with them. His powerful defense of free markets influenced politicians with whom he shared the opprobrium of journalists and academics—Richard Nixon and Barry Goldwater, in addition to Reagan and Thatcher. Most notoriously, Friedman, champion of freedom, was branded, widely and loudly, as the intellectual godfather of repression and terror under the Pinochet regime in Chile.

In the 1960s Friedman acquired celebrity status, thanks to his columns in Newsweek, popular books Capitalism and Freedom, Free to Choose, and Tyranny of the Status Quo, and the television series, Free to Choose. He was a figure about whom few people were neutral. So, it is especially valuable for us to have a biography that gets behind and beyond stereotypical images of Friedman and his ideas. We can be grateful for the dispassionate way Burns has assembled and interpreted the evidence.

There is nothing dry or ponderous in Burns’s account of Friedman’s life and times. She brings Friedman’s story to life with a storyteller’s knack for a well-turned phrase to highlight insights and ironies. And many there are. One such example is in her discussion of Friedman’s test of the relative potency of monetary policy and Keynesian demand management in a paper with David Meiselman, and the exchanges that ensued with Keynesians. Burns writes that “with its strong language and sweeping claims, the Friedman-Meiselman paper conjured the very divide it identified; Friedman was not so much responding to a great schism in economics as creating one.... Along with A Monetary History of the United States, this paper helped Friedman set the larger agenda of the profession.... A pronouncement by Friedman created its own weather pattern in the profession, setting off a storm of claims and counterclaims” (pp. 294–95).

The book is in six parts, composed of fifteen chapters and an epilogue. The six parts follow the trajectory of Friedman’s life. “Origins” covers Friedman’s early life and education, in Rahway, New Jersey, Rutgers University, the University of Chicago, and Columbia University. “New Deal Washington” is an account of Friedman’s experiences between his departure as a graduate student from Chicago in 1935 and his return as a faculty member to Chicago in 1946. Professionally, these include jobs with the National Resources Committee, a New Deal planning agency in Washington, the National Bureau of Economic Research and the Statistical Research Group in New York, and as professor at the University of Wisconsin and University of Minnesota. Personally, he and Rose Director married in 1938. Friendships deepened with fellow Chicagoans Allen Wallis, George Stigler, and Aaron Director, Rose’s brother. Rose’s work on consumption economics with Dorothy Brady at the federal Bureau of Home Economics is highlighted. They, and later Anna J. Schwartz, were among the women who contributed in a large way to the scholarly work for which Milton received credit. “The Second Chicago School” covers the development of research and educational programs upon Friedman’s return to the University of Chicago. These were the elements of what came to be widely known as the Chicago School of Economics. “Conscience of a Conservative” covers Friedman’s entrance into political economics as critic of Keynesian theory and policies in the 1960s. “The Great Inflation” features the friction and eventual fracturing of Friedman’s relationship with his life-long mentor, Arthur F. Burns. As a young man, Burns was Friedman’s teacher at Rutgers and then his colleague at the National Bureau. The Burns and Friedman families were summertime neighbors in Vermont. Arthur Burns was more inclined than Friedman to be actively involved in the politics of economic policy. As Chairman of President Eisenhower’s Council of Economic Advisors, Burns tried to recruit Friedman to his staff. Friedman declined, to preserve his independence from partisan politics. Later Burns served as advisor to President Nixon and subsequently was made Chairman of the Board of Governors of the Federal Reserve. The Burns-Friedman friendship was strained by Burns’s opposition to the Nixon Administration’s Family Assistance Plan, that included a negative income tax, which Friedman had long championed. As Federal Reserve Board Chairman from 1970 until 1978, Burns supported President Nixon’s wage and price controls and presided over rising and volatile, money-fueled inflation. Friedman was blunt in his criticism of Burns, and Burns did not take it well. Jennifer Burns’s assessment of the two men’s personalities and relationship in the light of its breakup is insightful.

Burns states that her aim is to restore the fullness of Friedman’s thought to his image. To do so she has assembled an abundance of evidence, from archival collections of papers, correspondence and other records, to interviews with family members and Friedman’s associates, and primary and secondary published sources. In the book’s final part, “The Age of Monetarism,” Burns considers Friedman’s successes and failures from the perspective of his later life. As is the case throughout the book, she blends biography with economic and political history and history of economics. We also are privy to Friedman’s self-assessment along with Burns’s.

In the book’s epilogue entitled “Helicopter Drop” Burns considers the relevance of Friedman’s ideas to events and policies since his death in November 2006—the financial crisis and Great Recession of 2007–09, and inflationary policies that were paired with the COVID shutdown of the economy. “Helicopter drop” refers to a thought experiment that Friedman used, supposing there was a one-time drop of money on a community from a helicopter. What would the people do with it? They would spend it, according to Friedman, because it would not affect their permanent income. The Federal Reserve’s Quantitative Easing from 2008 through 2014 appeared for a time not to be inflationary. This apparent break in the relationship between money and spending gave new life to critics of monetarism. Burns provides a nice synopsis of the Fed’s unconventional policies and their likely effects. She also considers Friedman’s enduring influence on both the right and left of the political spectrum.

Burns’s concluding assessment is that Milton Friedman has enduring relevance. Ideas and proposals of his that were scoffed at when he first made them in the 1950s and 1960s have acquired mainstream status. No economist would assert today that monetary policy is unimportant or deny that inflation is a monetary phenomenon. Rules for policy are accepted in principle, if not always in practice. School voucher programs, which Friedman first proposed in the 1950s, are widespread today. Memory has now faded of the Bretton Woods system of fixed exchange rates, which Friedman rejected in favor of floating exchange rates in 1950, when the program was first being implemented.

Friedman’s argument that the sole legitimate objective of corporate managers is to make profit for the shareholders has new relevance, as corporate managers pursue contentious versions of “social justice.” Friedman’s personal integrity also has enduring relevance in the current Hobbesian social and political culture. His integrity was manifested in his refusal to make personal attacks on his opponents, his willingness to discuss economics with anyone and everyone regardless of their social status, and his courage in standing for his beliefs without regard to their fashionable status. Burns quotes from Arnold Harberger’s eulogy at the University of Chicago memorial service, that Friedman had “no frills, no pettiness, no fear.” She also quotes, and echoes, Harberger’s expression of a Friedman belief, that a competitive market economy, with opportunity, and reward according to merit, is the best prescription for a free economy and free society.

Burns explains her identification, in the subtitle, of Friedman as the last conservative, a label that he did not accept himself and that may not come readily to mind to readers. Classical liberal and libertarian are the labels that are most often applied to Friedman’s commitments. Burns concludes that he was a conservative in two ways. First, his approach to economics was creatively conservative. He preserved ideas and methods of analysis that were being cast aside by others, shaping them into forms suitable for analysis of current issues. Thus, Burns says, he was looking backward and forward at the same time. The second way he was conservative was the role he played in the avowedly conservative political movement. This movement coalesced after World War II and only recently faced major challenges from the political right. Burns sees Friedman as the last representative of the conservative synthesis of belief in “free markets, individual liberty, and global cooperation” that has recently “cracked apart.”

Burns is critical of one aspect of Friedman’s conservatism. She faults him for treating racial and ethnic prejudice as a preference rather than as a moral evil and allowing his proposal for school vouchers to be used by Southern segregationists in the 1960s. Friedman opposed forced segregation and forced integration. Burns does not accuse Friedman of racism. She gives abundant evidence that he was not racist. But she charges that “Friedman’s opinions were nonetheless an apologia for racism” (p. 269). This raises the question of to what extent Friedman or any of us are responsible for the ways in which others use our ideas, products, or inventions.

It also points to an important aspect of Friedman’s conservatism that Burns does not treat. There were two strands in the post-war conservative movement, one traditional, communitarian, and religious, and the other progressive, individualistic, and skeptical. Friedman’s conservatism was the latter type, as discussed by the reviewer and Claire H. Hammond in (2013, Religion and the Foundation of Liberalism: The Case of the Mont Pelerin Society, Modern Age 55, (Winter/Spring): 35–51). This conservativism tended toward economism and scientism.

Burns credits Friedman with setting his economic ideas in a moral context. This is clearly true, and he was criticized for letting “ideology’ steer his economics. The moral grounding of Friedman’s economics was individual freedom. As important as freedom is, it seems to this reviewer that in light of the erosion of our social and political culture, naked individual freedom is being shown inadequate. It is inadequate to support science, free markets, prosperity, and racial harmony. “Privatize, privatize, privatize” is not sufficient. A more substantial moral ethic is required.

| Other Independent Review articles by J. Daniel Hammond | ||

| Summer 2022 | Evicitionism: The Compromise Solution to the Pro-life Pro-choice Debate Controversy | |

| Winter 2020/21 | American Conservatism: Reclaiming an Intellectual Tradition | |

| Spring 2020 | Malthus Was Not a Malthusian | |

| [View All (4)] | ||