Since the Great Depression, macroeconomic theory has been a domain subject to intense controversy. The prime point of contention concerns the extent to which financial markets tend to be self-correcting. If they are, the worst economic fluctuations are likely due to interventions that are unpredictable, poorly formulated, or poorly implemented. If not, then macroeconomic instability is an inherent aspect of financial markets that should be actively corrected and prevented by a combination of regulation, fiscal policy, and monetary policy.

Unsurprisingly, monetary and fiscal history are no less subjects of fierce contention. In their path-breaking work, (1963) A Monetary History of the United States, 1867–1960 (Princeton, N.J.: Princeton University Press), Milton Friedman and Anna Schwartz proposed that macroeconomic fluctuations across this period could be explained by fluctuations in the quantity of money. The authors famously blame the worst economic downturn in American history on the contractionary policy of the Federal Reserve. With good monetary policy, the worst economic downturns simply won’t materialize.

Alan S. Blinder, in a hat tip to the fame of A Monetary History, has titled his recent book, A Monetary and Fiscal History of the United States, 1961–2021. Yet Blinder admits that, despite this “intentional homage . . . [t]his work is no sequel to theirs” (p. 4). Rather, he admits that “his framework is decidedly Keynesian” (emphasis in the original). His honesty is admirable. Blinder immediately follows, though, that “[r]ival doctrines to Keynesianism have come and gone over the decades covered in this volume: monetarism, new classical economics, supply-side economics, and others. But only one survived” (p. 5).

Thus begins a fruitful analysis that presents decades of conversation and controversy in macroeconomic policy and theory. The book covers developments in monetary and fiscal policy from John F. Kennedy to Joseph Biden. I do not wish to recapitulate each presidency in detail here. In attempting to summarize the book, Blinder himself notes that while “[y]ou can’t summarize sixty years of fascinating history in an elevator pitch.... certain themes do emerge from the historical narrative” (p. 369). Blinder summarizes these themes under the headings of “Monetary versus fiscal policy,” “Keynesian economics,” “Budget deficits,” and “Central bank independence” (italics in the original). Three of these themes can be summed up as discussion of the extent of interdependence between monetary and fiscal policy. The remaining theme, Keynesian economics is best understood in light of its role in the evolution of monetary theory and its application in policy. I investigate these themes, identifying analytical strengths of Blinder’s narrative, as well as blind spots. I focus first on the interaction of theory and policy.

Blinder excels at identifying tensions between the rhetoric of received political narratives and the reality of crafting and implementing policy. The author views the victory of monetarism during the 1970s as the result of misinterpretation of the cause of inflation. Blinder blames high and volatile inflation on negative supply shocks. Blinder explains this as “[i]nertia in the inflation process” and further supports this argument by noting that inflation and unemployment moved in the same direction during this period because both were driven by supply shocks. Falling productivity due to rising input costs simultaneously promotes higher unemployment and higher prices of goods. The timing of the supply shocks certainly matches the upswings in inflation in 1973 and ’79. However, it is difficult to explain an upward trend in the rate of inflation that spanned from 1965 to 1982 as depending wholly upon supply shocks and inflation inertia.

The traditional explanation for high inflation and unemployment in this period is that inflation expectations began to shift as monetary policy began easing for political purposes. Across the period, the rate of growth of the quantity of circulating currency consistently increased each year into the Volcker era. The decade-long trend of inflation across this period appears to follow this monetary expansion. Between 1965 and 1982, year-over-year rates of inflation and rates of increase of currency in circulation are correlated by more than 70% whereas correlation after 1982 has largely broken down as countercyclical interest rate policy has largely anchored inflation expectations. This same policy generates countercyclical movements in the rate of expansion of circulating currency. While Blinder’s explanation of fluctuations in the rate of inflation should be well received, his blaming of persistently high inflation on inertia appears to ignore the persistently increasing rate of monetary expansion across the era. The rate hovered around 10 percent in the latter part of the 1970s. Compared to the traditional monetarist interpretation of inflation during the 1970s, Blinder’s explanation is more a complement than a substitute. A significant portion of the volatility of inflation and interest rates appears to reflect supply factors rather than reflecting only uncertainty concerning the path of monetary expansion.

Blinder recognizes that it was precisely this inflation that motivated growing independence of monetary policy from fiscal authorities. Widespread support for central bank independence is a relatively new phenomenon. The high inflation of the 1970s was motivated in large part by political manipulation, especially under Richard Nixon. Before rules-based policy became the norm, monetary policy was seen as a policy instrument like any other. Blinder notes that “Gardner Ackley ... who replaced [Walter] Heller as CEA Chair in November 1964, was even more blunt: “I would do everything I could to reduce or even eliminate the independence of the Federal Reserve” (p. 12). By the early 1980s, monetary theorists increasingly recognized that an activist policy not made predictable by a set of rules binding the monetary authority promotes costly countervailing behavior by investors. (For example, see Finn E. Kydland and Edward C. Prescott, 1977, Rules Rather than Discretion: The Inconsistency of Optimal Plans, Journal of Political Economy 85: 472 – 492.)

While Blinder does not clearly criticize the value of monetary independence, he does observe that “[t]o some observers that creates a democracy deficit,” though “a large number of observers over the last sixty years have seen Federal Reserve independence as a valuable contributor to superior macroeconomic performance” (p. 60). And although Blinder notes twice that Friedman opposed central bank independence, he certainly did not support an activist monetary policy. In his “Role of Monetary Policy,” Friedman instead emphasized the importance of promoting stability in monetary policy that would stabilize expectations of future policy (1968, American Economic Review 58: 1–17). If we take his k-percent rule seriously, it would seem that Friedman thought that monetary policy could simply be implemented by a computer. Ideally, Friedman preferred that monetary policy be separated from the influence of policymakers all together. Thus, it seems imprudent to place Friedman in the same camp as James Tobin. Yet, Blinder does so on two different occasions (pp. 221, 388)!

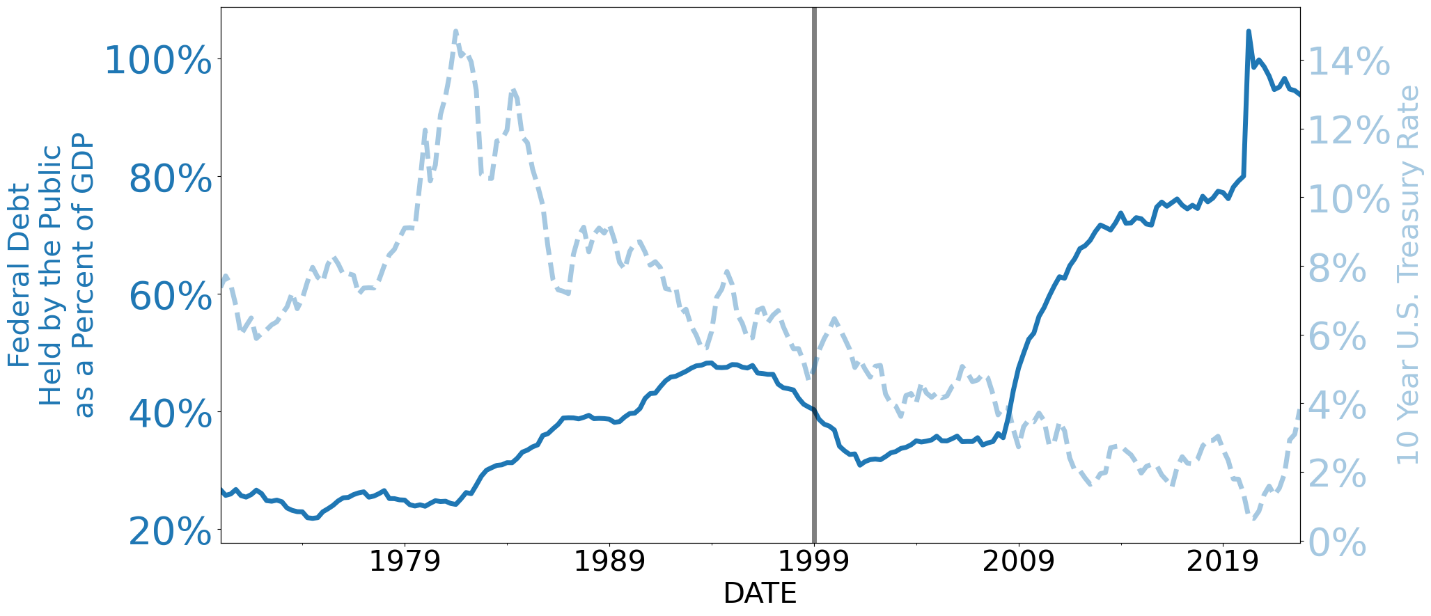

Perhaps most interesting is Blinder’s interpretation of macroeconomic policy under the Clinton regime. During Bill Clinton’s first term Blinder served on the Council of Economic Advisors and was appointed Vice Chairman of the Federal Reserve. Despite a battery of Keynesian policymakers, Clinton not only pursued deficit reduction—by 1998, Clinton had also reduced the national debt for the first time in decades. (And despite the fiscal rhetoric of Republicans, George W. Bush would quickly return the deficit to negative territory.)

The simultaneous occurrence of fiscal tightening and robust economic growth is not an obvious consequence of Keynesian theory. As a Keynesian, Blinder plays a bit of defense, noting that “[t]he fact that the Clinton boom began shortly after Congress passed a deficit-reduction package gave rise to some revisionist thinking” (p. 194) causing some to argue that the Keynesian fiscal multiplier is negative. This would mean that growing deficits are more than offset by a fall in private economic activity. Quite reasonably, Blinder asserts a different line of reasoning. Drawing from Stephen Turnovsky and Marcus Miller (1984, The Effects of Government Expenditure on the Term Structure of Interest Rates, Journal of Money, Credit and Banking 16(1): 16–33) and Olivier Blanchard (1984, Current and Anticipated Deficits, Interest Rates and Economic Activity, European Economic Review 25(1): 7–27), Blinder explains that “a credible reduction in expected future budget deficits could increase aggregate demand today ... [since] convincing investors that the national debt will be lower in the future would reduce long-term interest rates today” (p. 195). He and Janet Yellen, though, later argued that “‘this is not a formula that can be repeated at will’ ... [since this] ‘almost requires a prior period of fiscal irresponsibility’ that would have motivated a large debt and higher interest rates” (p. 195).

Interestingly, Blinder does not seem concerned about the effect of operating in the other direction as he retells the recent fiscal and monetary developments that accompanied the government’s response to crises in 2008 and 2020. Blinder observes that as the financial stress was growing in 2008, “[t]he old attitude that fiscal policy was too slow and unreliable to be useful was dying” (p. 267). He notes that the stance of policy makers began shifting by the latter part of 2008 as events convinced many that “[m]uch more fiscal and monetary stimulus would clearly be needed” (p. 266). And again in 2020, “deficit-financed public spending by the federal government” would be required (p. 346).

It is a curious fact that Blinder presents a graph of the federal debt as a percentage of GDP only as late as 1998 (pp. 176, 216). From a low of just under 31%, the federal debt held by the public has risen to just over 104% at its recent peak. As of the end of 2022, this value settled at just under 94% of GDP. With the recent monetary tightening, the Powell-led Federal Reserve is asserting its autonomy and priority of its mission to maintain a low and stable rate of inflation. Over the approaching decades, though, Congress will find itself in the difficult position of keeping a ceiling on this expansion. In 2021, the Congressional Budget Office projected that annual expenditures by the federal government will reach over 25% of GDP, driven primarily by future growing obligations in Social Security, healthcare, and interest payments. According to these projections, the implied take off in the federal debt would not occur until the latter part of the current decade. That would leave Congress about five years to resolve these problems. An inability or unwillingness to confront this problem by Congress can stoke concern from investors that would raise interest rates in much the same way that confidence of investors appears to have lowered interest rates during the Clinton years. Surely Blinder is aware of this approaching difficulty.

While Blinder recognizes that Keynesianism lives on in altered form, he seems to dismiss the idea that monetarism is also alive. He asserts that monetarism has died not only in terms of academic adherents, but also in policy circles. After “the war with inflation [was] well on its way to victory,” writes Blinder, “Volcker and the Fed were ready to abandon any pretense of monetarism” (p. 132). Interestingly, as mentioned above, a comparison of year-over-year inflation and money growth between 1965 and 1982 yields a correlation of about 70%, but for the years from 1983 and onward, that correlation breaks down. The victory of policy over inflation seems to have changed the interpretation of short-run changes in the monetary base. Yet, the long-run trend of nominal income appears to be largely determined by expansion of circulating currency. If monetarism is dead in policy circles, it is certainly not because the relationship between money and inflation is dead.

As confident as Blinder might be in his assertion, monetarism, like Keynesianism, lives on in varied forms consistent with the heart of monetarist critiques of old Keynesianism. Perhaps Blinder misses this because he does not adequately defend Friedman. Although constant velocity is a convenient theoretical assertion for long-run analysis, in his “Quantity Theory of Money: A Restatement,” Friedman recognized that demand to hold money was dependent upon rates of return to investment in other assets (1956, Studies in the Quantity Theory of Money, Chicago: University of Chicago Press, 3–31). In other words, the velocity of money is anchored by interest rates that reflect expected rates of return on investment.

Friedman showed that, when velocity is treated as a function of the interest rate, his monetary theory is consistent with the IS-LM model developed by Keynesian John Hicks (1971, Monetary Theory of Nominal Income, Journal of Political Economy 79: 323–37). Curiously, among the nineteen solo and lead-authored articles that Blinder cites from Friedman, Blinder does not include Friedman’s Monetary Theory of Nominal Income. As in Friedman’s presentation, a widely accepted form of the IS-LM model presented by New Keynesian Greg Mankiw’s Intermediate Macroeconomics integrates the assertion of monetarist Irving Fisher that nominal interest rates reflect expected inflation and expected economic growth.His presentation predicts that short-run changes in real income are self-reversing as inflation rises and inflation expectations are integrated in nominal interest rates. Friedman embraces this same identity in his reconciliation of monetarism with IS-LM. And although Blinder recognizes that monetarists expect that expectations of tight monetary policy will lower nominal interest rates as “inflationary expectations should decline” (p. 121), he doesn’t interpret survival of this view as evidence of a monetarist legacy.

Naïve monetarism might have faded, but Friedman himself nuanced his theoretical views beyond the long-run assertion of the quantity theory. These nuanced views have fared well over the last half-century. There are even those, such as Scott Sumner, who openly consider themselves market monetarists. Sumner claims a monetarist lineage, following Fisher, Ralph Hawtrey, and Gustav Cassel. Sumner asserts that “Earl Thompson, Robert Hall, David Glasner, and Robert Hetzel” are intellectual allies with regard to the tenets of market monetarism and argues that Friedman himself would be sympathetic to market monetarism, especially in light of events that followed the 2008 Crisis (2021, The Money Illusion: Market Monetarism, the Great Recession, and the Future of Monetary Policy, Chicago: University of Chicago Press; What Would Milton Friedman Say about Market Monetarism? Mercatus Center). Barring Friedman, none of these authors are cited by Blinder. This lack of thoroughness in representing the subject of one’s critique is a real blunder for an otherwise magnificent history.

| Other Independent Review articles by James L. Caton | ||

| Spring 2023 | Crisis and Credit Allocation: The Effect of Ideology on Monetary Policy during the Great Depression and the Great Recession | |

| Winter 2022/23 | The Currency of Politics: The Political Theory of Money from Aristotle to Keynes | |

| Winter 2019/20 | American Default: The Untold Story of FDR, the Supreme Court, and the Battle over Gold | |

| [View All (4)] | ||