Contents

- Overview

- Background: California Became a High-Price State for Gasoline Quite Recently

- Explaining California’s Gasoline Prices

- Dissecting the Retail Price of Gasoline in California

- Key Public Policy Considerations

- Conclusion

- Notes

I. Overview

When the United States experiences historically high gasoline prices, as it has recently, California prices often are the highest. In the aftermath of record-high gasoline prices during the summer and fall of 2022, many California politicians and media commentators claimed that those prices were evidence of “price gouging” by “profit hungry” oil producers and gas station owners. California Governor Gavin Newsom, a Democrat, led the bandwagon: “We’re not going to stand by while greedy oil companies fleece Californians. Instead, I’m calling for a windfall tax to ensure excess oil profits go back to help millions of Californians who are getting ripped off.”[1] Those are strong words, and they demonstrate either political posturing or a lack of understanding about how global oil markets work, the fundamentals of California’s gasoline market, and the institutions that shape prices and supplies in both the short run and long run.

This report, part of the Independent Institute’s series of briefings titled the California Golden Fleece® Awards, provides an overview of California’s gasoline market from oil production to refining, distribution, retailing, taxes, fees, and environmental regulations. The report is an entry point for people who want to understand the fundamentals of the market and how changes in public policies could improve its efficiency, reduce gasoline prices, and stabilize prices over the long term. The report also debunks myths and misconceptions about gasoline markets in the Golden State.

The investigation reveals that California’s gasoline market—throughout the entire supply chain—is competitive but also features isolated choke points, bottlenecks, and government interventions that result in a gasoline production and supply network that is slower, more rigid, and less adaptive and efficient than it otherwise could be. The overall effect is persistently higher prices at the pump and greater price volatility during periods of disruption. Those consequences stem from federal, state, and local policies by the U.S. Congress, the U.S. Environmental Protection Agency, the California State Legislature, the California Air Resources Board, the California Environmental Protection Agency, California governors, local boards of supervisors, and local city councils and mayors, among others. The responsible agencies thus have received the Independent Institute’s 14th California Golden Fleece® Award for policies that break the public trust by undermining competition and increasing consumer prices, all the while blaming and shaming oil and gasoline producers and marketers for problems that politicians and regulators have created through their policy choices.

At the outset, it is important to note that no magic fixes guarantee lower gasoline prices for California consumers. It is impossible to get around the fact that transportation fuels are scarce and valuable everywhere on the planet, which greatly constrains California’s policy options.

The typical tankful of gas reaches a California motorist only after ending a complex journey that may start almost anywhere in the world, including California. In the process, it passes through many markets with different institutions and interventions that together shape gasoline’s price to the final consumer. Knowledge of the supply chain can point us to intelligent policies that reduce the burden on consumers and away from ill-conceived policies that produce little more than politically motivated transfers of wealth.

This report has six sections. Section II explains the production structure of gasoline and presents data on gasoline prices and consumption, both nationally and in California. California became a high-price state for gasoline quite recently, and we begin to explore why. Section III examines the dynamics of markets, particularly oil markets. Prices at different locations for crude oil will tend to move toward parity as arbitrage occurs (the “law of one price”). Transaction costs represent obstacles that keep prices from equalizing in the long run along with local events that disrupt markets temporarily. It is fair to say that the sources of crude oil used to refine California gasoline can be, and have been, located almost anywhere in the world, including California.

At important points in the production process, however, California’s oil and gasoline industry is in some ways an isolated “fuel island” cut off from adjustment mechanisms that are available in other regions of the country. Market fundamentals and institutions explain California gasoline prices without resorting to conspiracy theories inconsistent with economic logic and the available data. After laying that foundation, Section IV breaks down the components of California’s retail gasoline prices. It also debunks a common “price gouging” explanation for high prices. Section V offers public policy considerations that would remove government obstacles to competition and to the adoption of new approaches, all of which keep California gasoline prices higher and more unstable than they otherwise would be in a more flexible regime. The policy choices of officials drive retail gasoline prices higher by 30 percent to 70 percent or more in the Golden State, acting effectively as a regressive tax hitting hardest the state’s poorest residents (the flip side of “environmental justice” policies that is too often ignored). Finally, Section VI provides a summary and conclusions.

II. Background: California Became a High-Price State for Gasoline Quite Recently

A. The production of gasoline.

The production and distribution of gasoline begins with crude oil, a liquid mixture of naturally occurring hydrocarbons found in underground reservoirs whose components vary with local geology. Once extracted, the crude oil is shipped to refineries where impurities are removed, and it is separated into products for further processing and sales.

A refinery is basically a boiling vat—small ones are called teakettles. The lightest components (fractions) of crude oil are gases like methane and acetylene, which are the first to boil off and are stored in airtight facilities. Liquids including gasoline are next, the latter on average accounting for about 50 percent of crude oil. Heavier and less valuable fractions, down to residual oil and petroleum coke, come next.

The mix of products that a given barrel of crude yields can vary, given changing market conditions (a barrel holds 42 U.S. gallons of crude oil weighing about 300 pounds). Also, different refinery designs and operating procedures are best suited to process certain types of crude, most importantly “sweet” or “sour” crude, defined by low or high sulfur concentration, respectively.

In most cases, gasoline moves from a refinery through pipelines to large storage terminals or tanks near consuming areas. Afterward, it typically is shipped by tanker trucks to smaller blending terminals that add corn-based ethanol (required by law) and, for branded gasolines, proprietary additives. Tanker trucks then deliver the “finished” gasoline to retail gas stations. As of January 1, 2022, the United States was home to 130 operable refineries, of which 5 were idle. Texas had 32 operable refineries (2 were idle), the most, and California had 15 (2 were idle), tied with Louisiana for second place, although all 15 were operating in Louisiana.[2]

B. California gasoline prices compared with those in other states.

Gasoline is relatively expensive in California, and almost everyone offers a different explanation. Some are grounded in economics, others in sociology, and still others in conspiracies. Most of the explanations appear to depend on oddly selective data. Even the state’s supposedly singular romance with the automobile may be overstated.

Gasoline spending per capita in 2021 was highest in sparsely populated Wyoming ($1,756) and lowest in urbanized New York ($754).[3] In 2009, California ranked 13th in per capita spending on gasoline, and by 2021 it had fallen to 21st ($1,338). The average increase in gasoline prices nationally from 2009 through 2021 was 30.7 percent, but California’s increased by 57.9 percent. The price of crude oil delivered to California also increased, but by a less extreme percentage.

A common misperception is that California gas prices always have exceeded those in other states. For example, a recent report by investor website MarketWatch correctly claimed that Californians paid nearly 70 percent more per gallon than the rest of the country and supported it with a graph summarizing self-reported prices from nationwide surveys.[4] But then its author went on to say,

California has pretty much always paid much more than the nation for gasoline at the pump, in part due to higher taxes and a more expensive blend of fuel, but an average price that’s nearly 70 percent more than most everyone else in the U.S. is a bit extreme.[5]

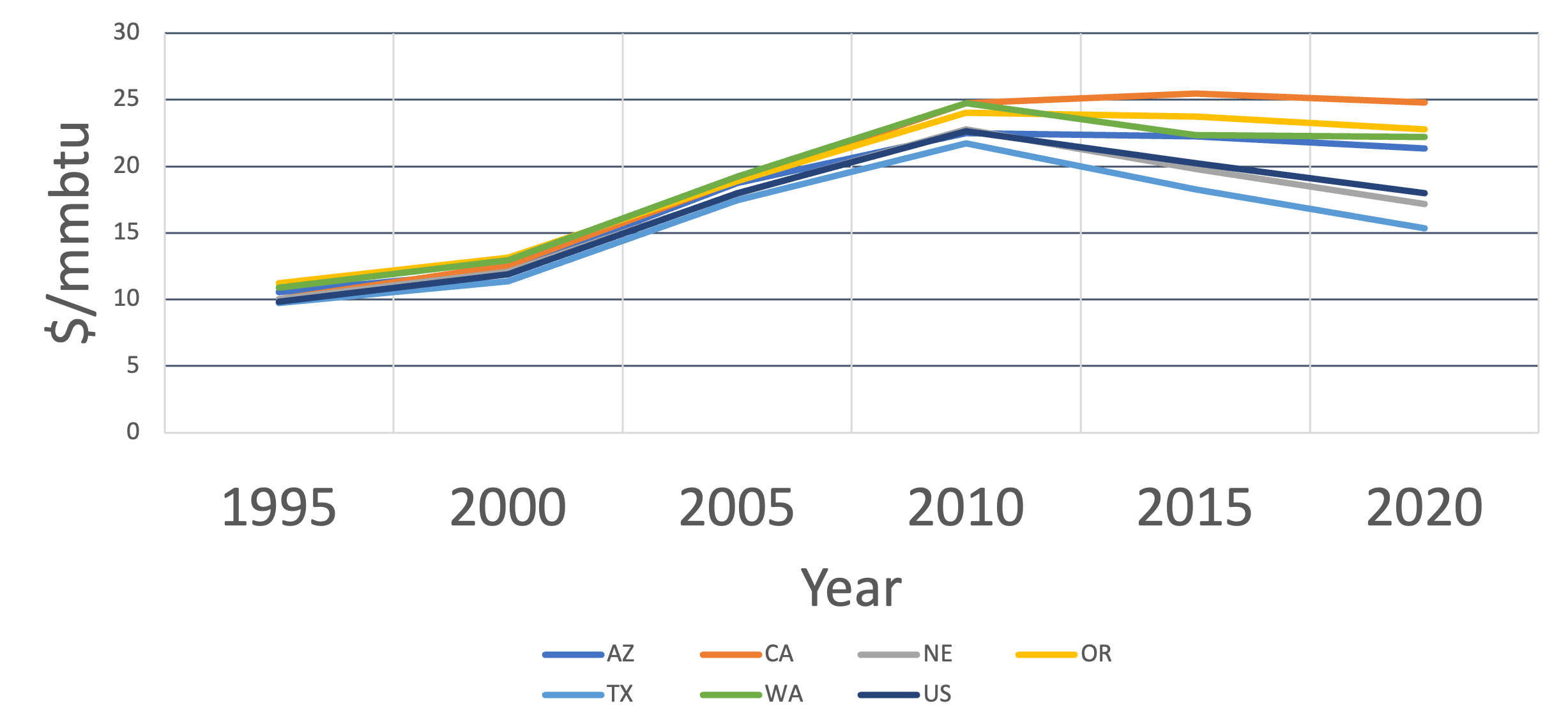

The first of those claims simply is inconsistent with history, but it raises the question of how a once-narrow gap has become so glaringly wide in recent years. Older data may be of interest, but most of what matters began in the 1970s. Figure 1 presents retail gasoline price data for some western states from the U.S. Department of Energy’s Energy Information Administration. To account for quality differences—octane levels, for example—prices are in dollars per million British thermal units ($/MMBtu). As shown, only recently, around 2010, did California persistently become the highest-priced western state for gasoline.

As might be expected, the annual state averages track one another’s turning points quite closely. But California persistently is the highest-price state and Texas the lowest. Figure 1 also shows that the price paths seldom cross. In other words, relatively high-price states do not later become low-price states, or vice versa. Transshipments of oil in response to border differences occur but are not major factors in explaining the broader picture.[6]

Figure 1 shows that prices in different states move together directionally, but the numbers present a puzzle. A casual look at post-2000 data reveals increasingly wide cross-state differences. Specifically, 2000 prices were lower and less dispersed than in 2020. The national average price (calculated over all states) was $11.91 per MMBtu in 2000, and in our group it ranged from $11.35 in Texas to $13.16 in Oregon. Twenty years ago, both Oregon and Washington exceeded California. By 2020, prices were up everywhere, but the changes varied greatly. The overall national average had increased by 51.2 percent, but California had surged by 97.5 percent, while Arizona, Oregon, and Washington increased by 70 to 75 percent. Nevada’s increase conspicuously was a bit slower at 41.7 percent, and Texas’s was 35.4 percent.

The lesson: Contrary to popular perceptions, California became a high-price state for retail gasoline quite recently, and important reasons, discussed below, can be found for believing that the state will continue to lead the nation. Since 2000, California’s gas prices persistently have exceeded those in other western states, and the gap between California and lower-price states has increased over time. Now we have something to explain, and the answers are found in the principles of economics and the institutions unique to California oil and gasoline markets.

III. Explaining California’s Gasoline Prices

A. What markets are and why they matter.

The accuracy of reported gasoline prices is not in dispute, but to explain them further, we must know some basics about markets in general, and then apply that knowledge to oil and gasoline markets.

Markets are places or institutions where prospective buyers and sellers examine their options and then decide what is best for themselves. We often say that prices are determined in markets, but it is more accurate to say that prices are discovered in markets through the interactions of myriad buyers and sellers.

The familiar supply-and-demand graphs of introductory economics classes are conceptual simplifications that guide economic analysis. Nobody knows exactly what the curves look like at any given time. Measurement of relevant factors is fraught with uncertainty, and nobody is likely to know how the factors will change as future events unfold. Adjustments toward market “equilibrium” take time and are the outcomes of transactions undertaken by people who have at best limited knowledge of one another, but they are not random.

In economic theory, a price “equilibrium” is determined at a price for a good or service that “clears” a market without any frustrated buyers who cannot find sellers and frustrated sellers who cannot find buyers. In reality, however, buyers and sellers are acting on and reacting to those same forces, but too much is happening for things to settle down to a single stable worldwide equilibrium price. Oil is produced and traded almost everywhere around the world, and payment and delivery of commercial quantities are decentralized. No gigantic, single physical location exists worldwide where all producers state their asking prices, and all buyers state their bids.

Getting closer to reality, assume that on a given day each of two trading posts has cleared but at different prices. Depending on available information and the costs of moving the good, buyers at the high-price venue will attempt to shift their purchases to the lower-price one, and sellers at the low-price venue will attempt to shift their sales to the higher-price one. Those activities are called arbitrage.

If the obstacles to transacting and shipping are low, prices will converge toward equality.[7] Generalizing that logic leads to the “law of one price”: that in a group of linked markets, equilibrium prices will tend toward a common value. Goods get reallocated, and so do traders. At equilibrium, if profit-seeking producers can earn profits and are free to open for business, they will do so, and prices will go to a new equilibrium, while those who take losses will exit the market. Consequently, the production of a given total output summed over the operating producers will be at the lowest avoidable cost. In economics, we say that this quantity is produced efficiently, and the value of alternatives forsaken—the opportunity costs—is minimized. If the number of producers is large enough[8] that each has little ability to influence price by its own actions, and buyers take the price as given, economists say that market participants are “price takers,” or that they operate in a “perfectly competitive” market.

The lesson: Depending on available information and the costs of moving a good—say, crude oil—prices at different locations will tend to move toward equality as arbitrage occurs (the law of one price). Significant obstacles to arbitrage, however, will cause oil prices to remain dispersed, or to grow more dispersed over time. We now have a basis for analyzing California’s gasoline market.

B. The law of one price: Oil prices around the world tend to converge.

In 2021, Californians consumed 12.4 billion gallons of “base” gasoline (a legal term applied to gasoline that meets certain specifications,[9] to which small quantities of additives were blended plus 10 percent ethanol (derived from corn) to comply with federal regulations (13.82 billion gallons of “finished” gasoline).[10] Total gasoline consumption in California has fallen since 2017 for reasons that include population declines, especially within the prime driving population; larger electric vehicle sales; higher gasoline taxes; and less workplace commuting as remote work has become more common, especially after the emergence of COVID-19.[11]

To understand prices, economists instinctively examine the markets wherein producers and consumers interact and how internal and external events impact those markets. Data on shipments confirm that crude oil is traded around the world and that over the long term, prices adjust with changing market conditions. The global market comprises thousands of producers, some large and others trivial relative to the total, some localized and others worldwide. Some producers, such as ExxonMobil, undertake drilling, refining, and retailing to varying degrees (economists call them “vertically integrated” companies), while others specialize functionally and/or geographically.

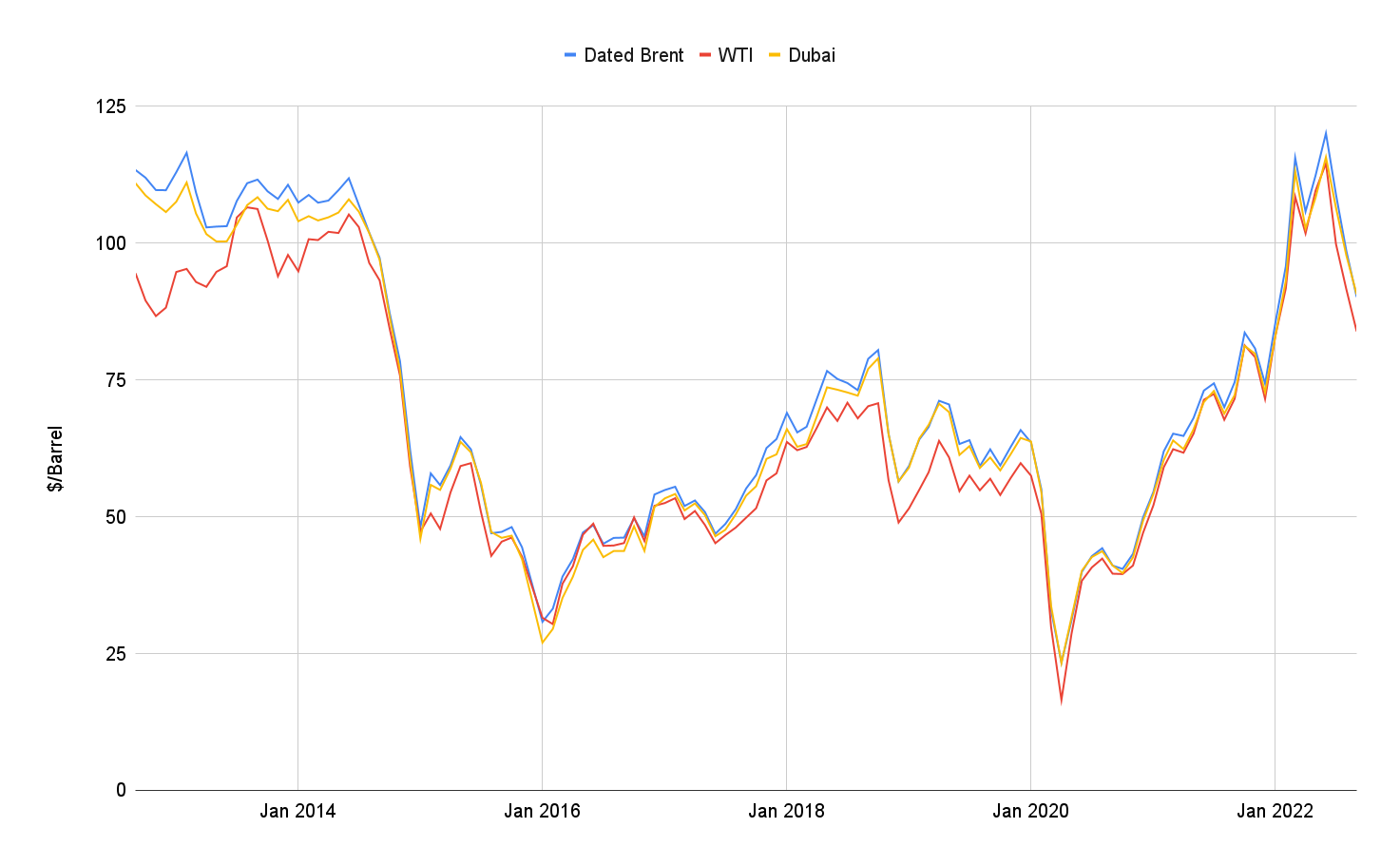

To explain gasoline prices, we begin by examining the market process of price convergence. Figure 2 shows prices for crude oil deliveries at three important locations during a 10-year period.

WTI is the reference (“marker”) cash price for West Texas Intermediate crude oil, legally defined as oil meeting a range of criteria for “sweetness” (low sulfur content) and gravity (weight). The WTI price is for delivery at the pipeline junction of Cushing, Oklahoma, and prices for delivery elsewhere are relative to that price, called the basis. The basic transaction is a futures contract for delivery at a specified price and date, which obligates a seller to physical delivery or cash settlement.

Other marker prices are available, two of which are shown in Figure 2. The Dated Brent contract is for a basket of European crudes that meet preset criteria for energy content. A third location in Figure 2 adds Dubai prices to the mix, which closely track WTI and Brent despite the thousands of miles that separate Dubai and the other two locations. If we were to look at more data, they would show the development of the market as prices converged around the world with additional resources and additional places to trade them. It is unsurprising that prices are not perfectly correlated—local events can cause price disparities, as sometimes happens in California.

When transactions that exploit localized differences are reallocated, prices become better indicators of relative scarcity and abundance over wider areas. Changing prices facilitate adjustments to unexpected events.

The successful performance of crude oil markets that experience surprise “shocks” is perhaps best illustrated by attempts to cartelize oil markets by the Organization of Petroleum Exporting Countries (OPEC). Reaction to OPEC’s 1973 oil embargo was a textbook exercise in market economics: The price for a barrel of oil quadrupled, and prices at the pump roughly doubled. Non-member countries responded by producing larger amounts of new oil, exploration activities burgeoned around the world, and by the end of the decade OPEC’s influence on prices, if any, was difficult to spot. OPEC infighting destroyed a united front going forward. Over the longer term, producers innovated such new technologies as directional drilling and hydraulic fracturing, also called fracking. As time passed and technologies changed, new reactions to scarcity became possible. Natural gas went from a local by-product of oil extraction to an internationally traded commodity that moved globally on ultra-cold liquefied natural gas tanker ships and increasingly competed with oil.

The lesson: The data demonstrate that in mature global markets such as crude oil, prices will tend to converge over time and move together when events impact market participants. Transaction costs represent “obstacles” that keep prices from equalizing in the long run. Local events, such as refineries suddenly shutting down due to unexpected maintenance, a fire, or a hurricane, can disrupt markets temporarily—more so in California, as explained below.

C. Crude oil is supplied to California refineries from almost everywhere.

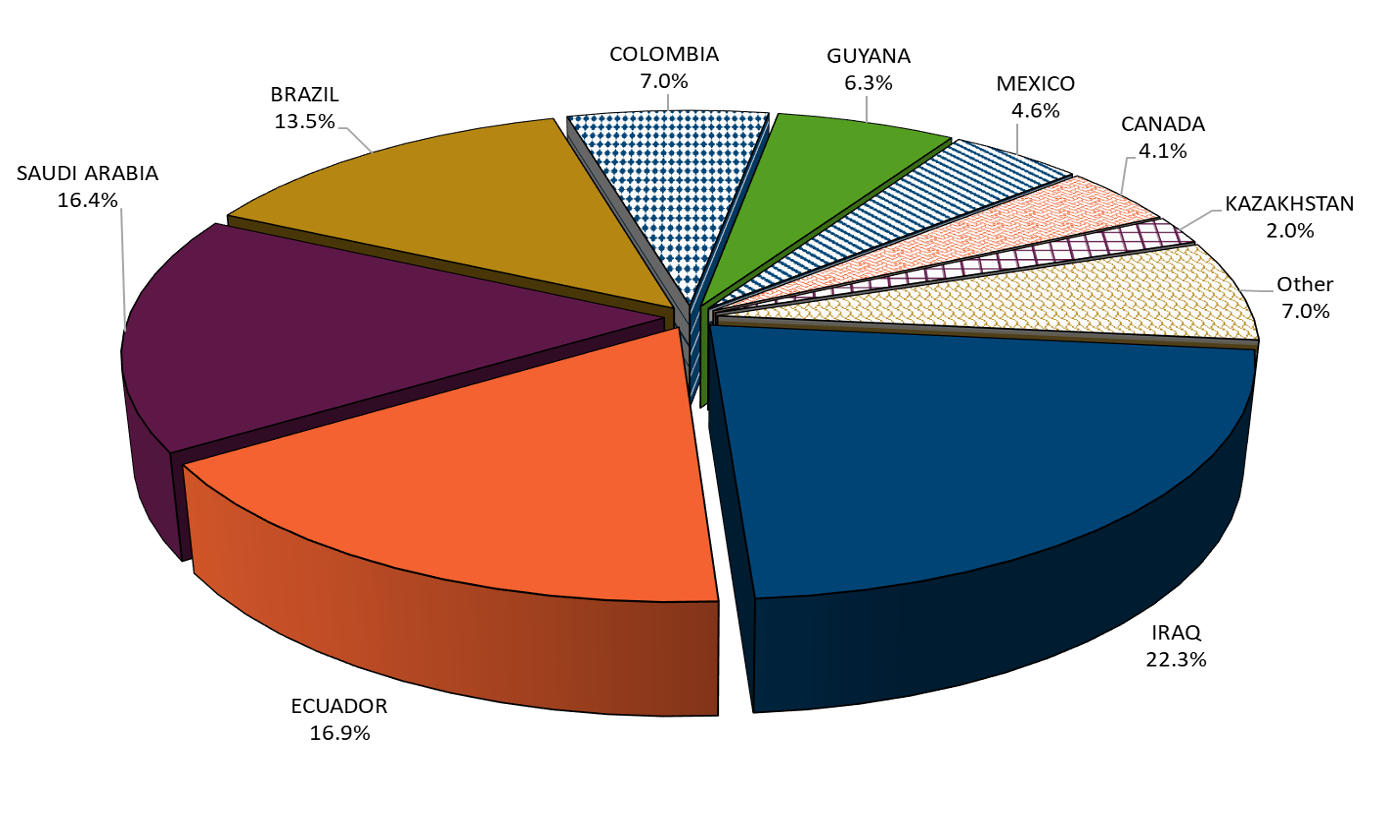

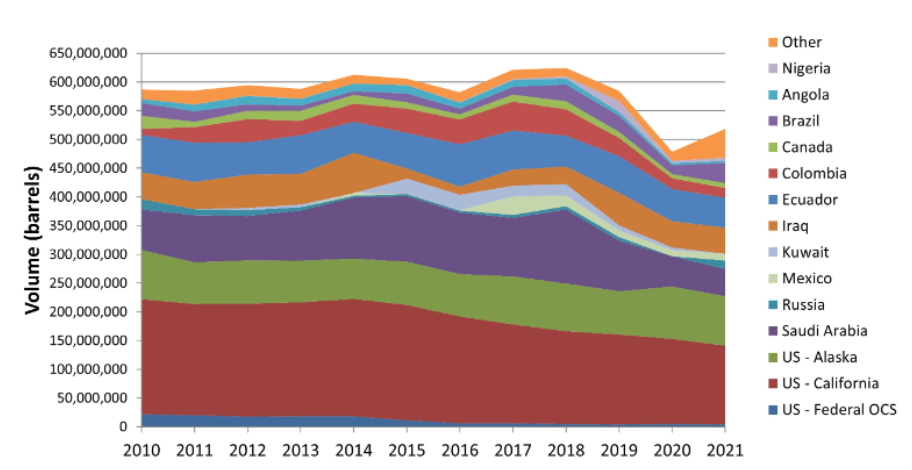

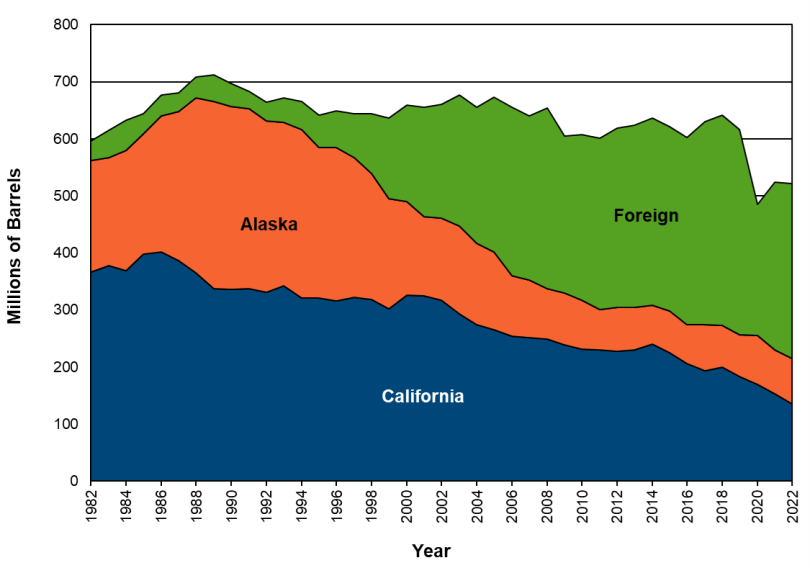

Since the crude oil market is global, both production and consumption in California generally are minor influences on world oil prices and outputs. California producers and consumers benefit from the existence of the world market. It thus is unsurprising to see its refineries purchasing their feedstocks from around the world. Some qualifications to the choice process merit discussion, the most important of which are state environmental rules that limit sulfur and carbon in California gasoline, but as a practical matter they impose few constraints on feedstock purchases. Figure 3 shows the diversity of the state’s crude oil imports delivered in 2022. Figure 4 tracks the various sources from 2010 through 2021 and includes in-state production, Alaska, and the federal outer-continental shelf. Figure 5 traces the relative amounts of foreign and domestic production (with Alaska broken out separately) from 1982 through 2022.

Perhaps surprisingly to many people, California’s most important source of crude oil in 2019 was California, 28.9 percent of the total processed in the state. Alaska accounted for another 14.9 percent of the total. Ongoing production declines and regulatory limits on exploration and drilling have reduced domestic oil’s importance in California such that by 2022 foreign sources dominated, especially Saudi Arabia, Ecuador, and Iraq.

Imports from Saudi Arabia, which must be transported across the Pacific Ocean, are rising overall and today exceed the supply from Alaska, which is declining. Mexico’s history of oil field nationalization since the 1930s and its problematic political relationship with the United States have combined to reduce its actual and potential exports to the United States and California. Canada sends substantial amounts of crude oil to the Midwest and Northeast, but limited pipeline capacity leaves it with only a small fraction of California’s market.

Many factors influence the availability of oil from a particular country and the mix of suppliers at any given moment. Wars, legal disputes, regulations, supply chain disruptions, and technological breakthroughs all can change relative scarcities, relative prices, and supply schedules, and, thus, the optimal mix of suppliers.

The lesson: It is fair to say that the source of crude oil used to refine California gasoline can be, and has been, almost anywhere in the world, including California itself. The optimal mix of suppliers changes over time due to constantly changing events, technologies, and regulations, which are reflected in the relative prices of delivered crude oil and its delivery schedules.

D. Refining and retail in California: Island effects, volumetric interdependence, and evolution of the oil and gasoline industry.

The production of gasoline for California motorists takes place in a geographic and regulatory island. Fifteen refineries currently operate in the state, down from 21 in 2008.[12] Eleven produce gasoline and diesel fuels, and four produce specialty products. A rough match has existed over time between changes in fuel consumption and changes in California’s refining capacity. A look beyond the totals, however, reveals difficulties.

As discussed earlier, virtually all of California’s feedstocks are either produced in-state or delivered by seagoing tankers, whose rates and availability are determined in a competitive world market. About half the crude oil from the Trans-Alaska Pipeline is delivered by ship to California refineries, and the remainder that originates in Alaska goes to refineries in Washington state. Figures 4 and 5 confirm that the rest of California’s crude supplies come from a variety of places whose shares vary considerably over time. Crude oil flows are governed by many different types of long-term and short-term contracts, along with small volumes of “spot” (cash) transactions. A refiner generally can incur or discharge obligations either for cash or by exchanges of crude oil for refined products. Many ways are available for trading oil and refined products, and simple cash transactions are only a small subset.

California’s relatively small pipeline networks and storage capacities limit the state’s use of regional throughput for gasoline and blending components to less than 7 percent of total capacity. Since general agreement apparently exists that politics and economics are combining to shrink California’s oil consumption, there is little prospect on the horizon that pipeline capacity will be expanded in California. California refiners can send gasoline out of the state but have virtually no import capability. The state refines most of Nevada’s, and nearly half of Arizona’s, transport fuels.

Those constraints create scenarios wherein supply and demand can become tight. Little spare capacity further limits California’s ability to adjust to unforeseen events, and dependence on maritime shipping makes adjustments even slower and more expensive. Sudden changes, such as a refinery accident, can impose costs in California that would be mitigated by slack capacity and pipeline arbitrage in less constrained areas.

California’s ability to adjust is constrained by the law. In many regions of the United States, a refinery accident leads to temporary shortages and short-term price spikes. The shortfalls are relieved by local action, such as more outside deliveries through pipelines. But in California, where deliveries come by ship, the federal Jones Act (enacted in 1920) requires that transportation between U.S. ports be made on U.S.-flagged ships built in the United States and crewed largely by American sailors. Spare tanker ship capacity is limited, and the entry of additional shippers often is uneconomical.[13] The Jones Act hampers seaborne tanker shipments to California, increasing delays and reliance on trains and capacity-constrained pipelines.

Long-term supply issues might be minor given the world market. But local factors might cause significant short-run price spikes and supply shortages, which are less likely in less constrained parts of the country. California environmental regulations that require a special fuel blend mean that its refiners and retailers cannot simply purchase gasoline from other states, even if pipeline capacity was sufficiently in place.

The supply-demand balance in California determines the choices of producers and consumers, which are made under pervasive uncertainty. The details of those choices are critical because they determine the benefits that originate in markets and the distribution of those benefits. Transactions may be short- or long-term, may be seasonally variable, and can cover flows that are secure or not (“firm” or “interruptible”). They apply to different possible mixes of crude inputs and finished product outputs whose values depend on market prices, to name only a few dimensions.

Many factors also impact the market structures of refining and retailing, and their relationships. Gasoline sales involve a complex volumetric interdependence between oil production, refining, and retail gasoline distribution. Crude oil and refined products are costly and dangerous to store, and the underlying chemistry of boiling and evaporation limits the rates at which various products can be produced. Most important, the high costs of interruptions require that the entire process operate continuously. Minimizing long-term cost may entail storing crude rather than refining it immediately, or not releasing from storage a currently salable product because future operating costs might be higher if it were sold today. Inventories and “buffer” supplies are costly to maintain, but cost may be even higher if the operator must make rapid adjustments.

Continuous operation requires a dependable incoming stream of crude oil, in terms of both deliveries and the pricing of those deliveries. The refiner’s limited and costly storage capacity requires that the refiner have dependable outlets and prices for gasoline, which is most efficiently produced in a continuous stream. Recognizing the realities of the fuel production process helps to explain seeming anomalies that many observers have viewed as evidence of monopoly.

Volumetric interdependence motivates large refiners, also known as “majors,” to mitigate the risk of unsold output by vertically integrating “backward” into exploration and production of crude oil that they will use as scheduled. To solve their own inventory and continuity problems, refiners also contract with “independent” specialist producers like Apache and Devon for additional crude oil supplies or to reduce the costs of maintaining inventories.

Refiners have another problem: ensuring that motorists dependably will buy the gasoline they produce. A refiner with a reputation for predictable prices and available production might find itself in trouble if retailers unconditionally were free temporarily to purchase cheaper wholesale supplies when market conditions were advantageous, while at the same time expecting that the crude oil producer be a “supplier of last resort” in tough times.

One common solution balances the costs and benefits for oil producers and gasoline retailers by binding them into long-term relationships with franchise contracts that can be terminated only by mutual agreement. The refiner sets its price in the face of market conditions (including competition from other refiners) but cannot specify the price that a retailer legally can charge. Under a voluntarily entered contract with the refiner, the retailer is said to be “captive,” and, absent special arrangements, it can deal only with that refiner. The franchise contract, however, typically rewards efforts by gas stations to sell goods such as tires and minor repairs as allowed by the station’s parent brand, which itself has a reputation to protect by maintaining customer loyalty.

Relationships in the gasoline supply chain once were simpler and reflected different market realities. “Big Oil” comprised a relatively small number of vertically integrated firms that were self-sufficient (or nearly so) in crude and owned or controlled much of their own refining capacity. They sold much of their gasoline and other refined products through retail outlets that they owned or were linked with by franchise contracts. All of that is changing.

The post–World War II franchise relationship encouraged stations to market garage-related services and parts, which became valuable for the refiner’s long-term competitive position, relative to other refiners. As technology changed, those relationships became less valuable on both sides. Vehicles became more technologically complex and heavily regulated for pollution and safety in ways that benefited auto dealerships over corner gasoline stations, leaving retail stations with low-margin residual business (fixing flat tires, for example) and reducing their incentives to make gasoline-related sales efforts to win motorist loyalty.

On the other side, customers had become less loyal to established brands and increasingly sought low prices while retail margins on gasoline fell. The “service station” that once sold both gasoline and repairs is giving way to enterprises (“pumpers”) working to maximize income from low-price gasoline sales and downplaying services. Yet another consequence has been the rise of the “convenience store,” which is typically not operated by the fuel supplier and offers low-price gasoline to draw people into the store, where higher-margin merchandise is sold.

The chain of transactions and contracts that bring oil from original producers to final consumers is better viewed as the product of industry evolution rather than the outcome of a monopolistic conspiracy, and better explained as the outcome of choices made in competitive markets rather than monopolistic abuses. Changes in technology, competition, and environmental regulations have altered the industrial organization of the oil and gasoline industry worldwide—and will continue to do so. The transactions and investments that once defined the industry likewise have changed with time and will continue to evolve.

Economic models of competition begin as abstractions, but the example of gasoline shows that combining economic theory with data and institutional developments can lead to a better understanding of complex markets. The next section will dissect California’s recent retail gasoline prices, which will help us to analyze policies that would ease the plight of the state’s consumers.

The lesson: California is in many ways a “fuel island,” cut off from adjustment mechanisms that are available in other regions of the country. Supply shocks cause greater and longer-lasting price spikes in California because of the state’s unfortunate reliance on capacity-constrained pipelines and ships to move crude oil and gasoline. California’s strict environmental fuel standards (more on this below) make it impossible for gasoline refined elsewhere to be simply transported to California when prices rise. Contractual arrangements, such as franchise agreements and vertically integrated production and distribution structures, are not evidence of monopolistic behavior. Rather, they provide efficiency benefits to producers and consumers, especially as technology and regulations have changed.

IV. Dissecting the Retail Price of Gasoline in California

A. The costs included in the retail price.

The retail price for a gallon of gasoline in California reflects the factors discussed previously: crude oil, refining operations, distribution, transportation, retail operations, and “island effects,” which make arbitrage difficult and more costly, keeping prices higher than in other parts of the country. The price also includes various taxes and fees imposed by governments at all levels (more on this in Section V).

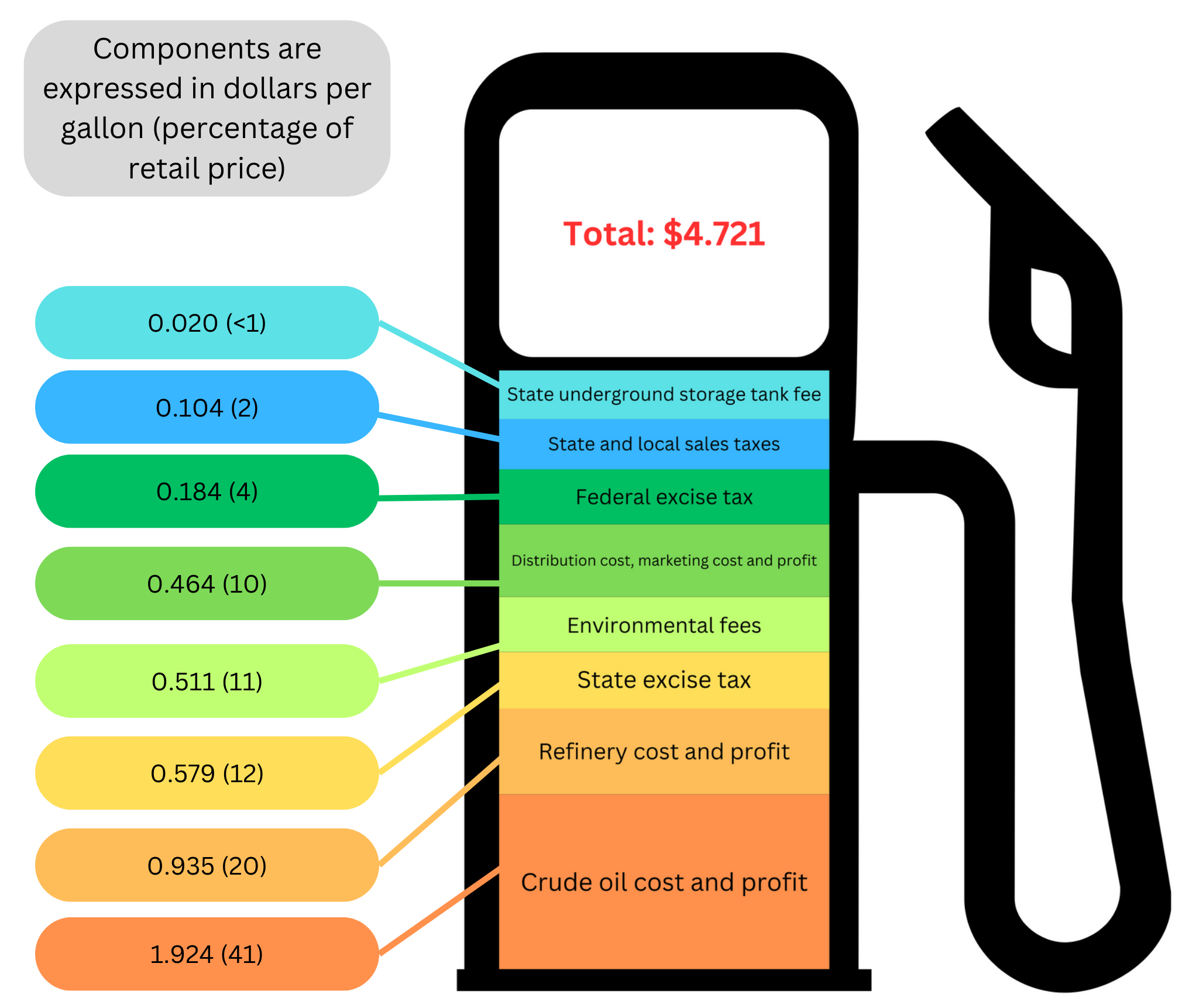

Figure 6 breaks down the average retail price for a gallon of branded gasoline in California on July 17, 2023, the most recent data available when this section was drafted.[14] The numbers are statewide averages that do not allow us to calculate the profitability of a particular refiner or retail outlet. (Even if the information would be helpful, more detailed data that could allow the tracking of individual stations also could facilitate collusion and violate antitrust laws.)

The average retail price per gallon of branded gasoline in California on July 17, 2023, was $4.721, about $1.20 (or 34 percent) more than the national average of $3.53 on the same date.[15] In recent months, California’s average gasoline prices have been about $1.20 to $1.50 above the national average per gallon. The difference was much larger during the summer and fall of 2022, during the peak of then record-breaking prices.

The sensitivity of gasoline prices to changes in costs often is summarized by “margins” indicative of cost pass-throughs and profitability. “Distribution margin” is the sum of distribution costs, marketing costs, and profits. It equals the retail price minus the wholesale price and the assortment of taxes and fees listed in the figure.[16] “Refiner margin” equals the wholesale price of gasoline minus the market price of crude oil. The latter, not presented in Figure 6, is a daily amount for Alaska North Slope crude oil published by the California Energy Commission.[17] Taxes and fees include state and local sales taxes, which are assessed as a percentage of cost; federal and state excise taxes, which are assessed per gallon; and an assortment of fees—for example, environmental fees, which originate from the state’s oil-specific environmental policies.

Branded wholesale gasoline is sold by a “major” company such as Shell and is likely to contain proprietary additives.[18] Unbranded gasoline is mostly sold by smaller, unaffiliated retail outlets and larger “hypermarkets” such as Costco.[19] Several “wholesale” prices exist for gasoline sold for resale. Most branded franchisees purchase gasoline in lots of 8,000 gallons at the location-specific Dealer Tank Wagon (DTW) price set by the refiner. DTW is not the same as the commonly cited “rack price” for delivery at a wholesale terminal, which covers fewer customer-related cost components than does DTW. Large end-users—e.g., trucking companies and “jobbers” who typically resell fuel in bulk—pull their supplies from wholesale racks. Most rack and DTW prices change daily at 6 p.m. based on movements of the spot market price.

As noted, California’s average gasoline price per gallon on July 17, 2023, was about $1.20 above the national average, in the range of typical price differentials during recent months. During normal times, the average retail price for a gallon of gasoline in California is 30 percent to 40 percent higher than the national average. But the difference can spike temporarily to 70 percent or more during periods of significant disruption in the supply chain (for example, on September 27, 2023, the price difference was 54 percent or $2.06 per gallon due to several supply shocks).

Comparing California’s percentage breakdown in Figure 6 with the national average breakdown[20] shows that California’s price differential of $1.20 is driven by three components: about 32 cents more per gallon explained by a higher state excise tax (26 percent of the difference), 42 cents more per gallon attributable to higher refinery costs (35 percent of the difference), and 51 cents more per gallon resulting from greater environmental regulatory costs plus other state and local taxes and fees, such as sales taxes (42 percent of the difference). As economic theory predicts, the crude oil price differential was just 2 cents per gallon, supporting the law of one price. In other words, higher taxes, stricter environmental regulations, and unique fuel island effects explain the higher gasoline prices in California compared with prices experienced elsewhere. The share attributable to fuel island effects surges typically during periods of sizable disruption, such as a significant break in the supply chain.

Higher gasoline prices in California of 30 percent to 70 percent or more, driven by specific policy choices (see Section V), act effectively as a regressive tax on Californians, hurting low-income families the most (this is the rarely discussed flip side of “environmental justice” policies). The lowest-income families in California (bottom quintile) spend 16 percent of their income on gasoline, compared with 2 percent for the highest-income families (top quintile); thus, higher gasoline prices disproportionately harm low-income families.[21]

The lesson: The cost of crude oil accounts for more than 40 percent of the price for a gallon of branded gasoline in California. Refinery costs account for another 20 percent, and the distribution margin, which includes gas station costs and profits, is 10 percent. Finally, nearly 30 percent is attributable to taxes and fees at all levels of government plus regulatory impacts intended to combat pollution, climate change, and “environmental injustice.” The per-gallon price difference between California and the national average is explained almost entirely as the result of higher taxes, more stringent environmental standards, and island effects unique to California. Crude oil prices play virtually no role in creating a price difference, except in times of specific and sudden market disruptions.

B. High gasoline prices and allegations of “profiteering” and “price gouging.”

The price of gasoline in California is a recurring subject of concern among politicians and members of the media, as occurred with allegations of profiteering and price gouging following the record gasoline prices of the summer and fall of 2022. Greed, however, cannot be the explanation because both buyers and sellers invariably are self-interested. No plausible reasons can be found for believing that producers, refiners, and retailers somehow became greedier overnight in the summer of 2022, and then became less greedy overnight, allowing prices to fall later in the year. Instead, the fundamentals of supply and demand changed during that summer and fall within California’s unique institutional regime, which explains the behavior of gasoline prices.

Selective data frequently are cited to substantiate allegations of greed and “windfall profits” by producers. Gasoline, however, can be relatively abundant or relatively scarce. The relevant question is whether oil and gasoline sellers persistently are more profitable than those in comparably risky businesses. It is not enough to present data on high prices or profits without showing that they resulted from activities beyond ordinary competition. If price fixing exists, it is subject to state and federal antitrust laws, and hefty profits await those who spot it and succeed in court. As we have seen, global markets tend to converge around a single price, and the recent U.S. experience is part of it. Prices around the world were comparably high in the summer and fall of 2022, and they moved in parallel, but the record fails to show evidence of monopoly.[22]

Nevertheless, the political reaction to high prices was unsurprising. On September 30, 2022, Governor Gavin Newsom directed the California Air Resources Board to make an early transition to mandatory use of lower-cost winter blend gasoline.[23] On the same day, Newsom noted that crude oil had fallen from roughly $100 per barrel at the end of August to about $85 per barrel during the following 30 days, while gasoline prices had risen from $5.06 per gallon to $6.29. He said, “We’re not going to stand by while greedy oil companies fleece Californians. Instead, I’m calling for a windfall tax to ensure excess oil profits go back to help millions of Californians who are getting ripped off.”[24]

Few if any reasons exist for believing that a windfall profits tax would do anything more than effect minor transfers of wealth among Californians. In 1980, the U.S. Congress and President Jimmy Carter enacted the Crude Oil Windfall Profit Tax Act. According to Ajay K. Mehrotra, a professor of law and history at Northwestern University, for a variety of reasons, “[m]ost economists declared it a colossal failure.” He went on to conclude that such excess and windfall profits taxes “rarely deliver on their promise of greater enduring tax equity.”[25]

Elsewhere in Sacramento, the chair of the California Energy Commission (CEC)—an appointed body with authority over energy conservation and development—noted on October 5, 2022, that while state fees and taxes were unchanged and crude oil prices fell by $10 per barrel, the price at the pump rose because refinery costs and profits more than tripled, from 64 cents per gallon to $2.18 per gallon in one month.[26] A letter from the CEC to oil executives requesting data from the companies contained allegations with little underlying numerical support.

The CEC and other state agencies have failed to unearth data that would support a valid conclusion of monopoly or price fixing. Responding to an earlier inquiry in 2019 on the causes of price increases, a CEC report noted,

[it] does not have any evidence that gasoline retailers fixed prices or engaged in false advertising. Moreover, the CEC lacks the expertise to determine whether such behavior occurred. The California Department of Justice is well equipped to conduct an appropriate investigation.[27]

No evidence can be found that such an investigation was initiated or even proposed, or that there was any federal investigation to examine the possible role that antitrust laws might play.

As an example of the factors that must be accounted for to substantiate a charge of profiteering, consider the summer of 2022. Retail gasoline prices were high, but sales volumes were lower than expected. Nevertheless, station profitability during the summer driving season was roughly 70 to 90 percent higher than in the past three summer driving seasons. It was among the most profitable periods on record, as the growth in margins outweighed the decline in volumes.[28]

But a long-term perspective is required to properly analyze profitability because a retail gasoline station must cover both its fixed costs and its variable costs of operation over the long term to be viable. The lessons are twofold: risk-adjusted profitability must be examined over long periods of time rather than in isolated intervals, and high prices by themselves tell us nothing about risk-adjusted profitability over the long run.[29] The CEC has been quite aware of the basic issues and remains so.[30]

Markets take time to adjust, as market prices reflect changing information and expectations, but with variable lags. California officials appear to believe that they can outperform markets and recently began moving toward a state price control system. On March 28, 2023, Governor Newsom signed SBX1-2, a bill that, among other things, authorizes the CEC to set a maximum gross gasoline refining profit margin and establish penalties for violations by refiners in the CEC’s jurisdiction.[31] It creates a new watchdog agency within the CEC, the Division of Petroleum Market Oversight, to monitor oil companies and compel them to provide more information. It also introduces reporting requirements for spot market transactions and maintenance activities by refiners, both planned and unplanned shutdowns. Companies can be referred to the California attorney general for prosecution if found to be engaging in what the agency deems to be illegal practices. The CEC would be required, however, to consider a refiner’s request for an exemption from the maximum margin. The new law, which went into effect on June 26, 2023, specifies that penalty fees be deposited into a “Price Gouging Penalty Fund” in the State Treasury to be allocated to “address any consequences of price gouging on Californians.”

In August 2023, Governor Newsom appointed Tai Milder, an experienced former antitrust prosecutor at the U.S. Department of Justice, to head the newly created state watchdog agency, the Division of Petroleum Market Oversight. The agency will not be cheap; the CEC requested $321,000 annually to fund the new oil czar position, plus another $2.05 million to fund 10 job positions in the oversight division to ferret out oil profits in excess of acceptable margins and penalize the offenders.[32]

The lesson: Allegations of “greedy profiteering” and “price gouging” on the part of oil and gasoline producers often are hurled by politicians and media observers to explain California’s persistently higher retail gasoline prices, especially in the wake of the reduction in gasoline demand resulting from policy responses to the COVID-19 pandemic. But the greed explanation is not substantiated by economic theory or data. Greed is a constant among producers and consumers. They did not suddenly become greedier overnight, and then less greedy, allowing prices to fall. Instead, changes in gasoline prices are the result of changing market fundamentals within California’s unique institutional context. Regulatory interventions by politicians, in misguided attempts to remedy the effects of high prices, will make the situation worse by distorting price signals and reducing incentives to increase gasoline supplies.

V. Key Public Policy Considerations

In a competitive market, government interventions to “help consumers” are likely to fail, and the more competitive a market is, the greater is the likelihood of failure. That is a well-established finding in economics. When government officials impose a ceiling on the price that sellers of a good can charge in an area, but that ceiling is evaded easily by the sellers, the overall well-being of consumers will be reduced, owing to fewer exchanges, but the profits of the sellers will be little changed. Thus, a price control levied on oil producers or gasoline retailers in California would result in producers and retailers pursuing profit opportunities that exist in global markets or in other states.

Similarly, a windfall profits tax imposed by the State of California on oil companies would cause shifts in the sales of oil and gasoline to avoid paying the tax. It might result in a small transfer of wealth from sellers to consumers, but that could be offset by fewer resources invested in oil and gasoline supplies.

The upshot is that it is difficult to identify welfare-enhancing policy changes in competitive markets; therefore, policy changes intended to help California gasoline consumers must be tailored narrowly because sellers have opportunities elsewhere. This section highlights policy changes that would target factors largely unique to California, “island effects,” or both. Those factors result in higher and/or more volatile gasoline prices in California, compared with other states. Only policy changes that remove needless, artificial restrictions on an otherwise competitive market would have any likelihood of benefiting California consumers in the long run.

Crude oil:The expropriation of profits from crude oil producers would yield only small redistribution effects, if any, and potential negative effects on future investments and economic efficiency. Similarly, lifting current restrictions on exploration and drilling in California and elsewhere may increase oil production and offer greater economic liberty, but the benefits for California consumers would be minimal or nonexistent given the worldwide oil market and price-taking behavior.

The best path to boost crude oil production, lower prices, and stabilize prices over the long term, for Californians and consumers globally, is peaceful worldwide trade—avoiding wars and other conflicts, and opening markets to oil trade. This is not a California-specific recommendation, but it would benefit Californians and others around the world.

Refining and pipelines: Refining may also offer opportunities for improved outcomes in California. Additional refining capacity comes at a cost, and by many forecasts, California’s gasoline demand is likely to fall as its population declines, especially within the prime driving population; more people purchase electric vehicles; gasoline taxes rise; and workplace commuting declines. Those factors also mean that increases in California’s pipeline capacity, particularly pipelines into California, may not be cost-effective in the long run. It is important to match demand with refining and pipeline capacity, and indicators point to slower growth in demand, or even falling demand, in the future.

That said, blatant government restrictions on the expansion of refining or pipeline capacity[33] should be abolished to allow suppliers to take advantage of opportunities that emerge in the future, especially arbitrage opportunities, if they choose. This recommendation applies to crude oil and gasoline pipeline operations.

Moreover, the Jones Act should be abolished to allow any safe, available ship to transport oil and oil products on terms that are mutually agreeable to the parties, which would allow for more efficient arbitrage through greater seaborne shipping capacity in and out of California. The Jones Act has long been criticized by economists,[34] but if it is to be repealed, it will be the outcome of federal actions, not California actions. California’s congressional delegation should introduce a bill to repeal the Jones Act and lobby for this important change.

Environmental regulations: California arguably has the most stringent environmental regulations of any state, particularly its limits on greenhouse gas emissions. It is entirely possible, but not certain, that the environmental benefits of California-specific policies outweigh the costs. The optimal set of environmental regulations has been the subject of much debate, controversy, and analysis in economics and political bodies, and it is best analyzed on a case-by-case basis. But California’s environmental policies impose costs on crude oil producers and refiners, which are passed along to consumers and are largely unique to California.

Large oil producers, refiners, and distributors located in California are subject to the state’s Cap-and-Trade (C&T) Program, intended to reduce greenhouse gas emissions by establishing a declining annual limit or “cap” on total carbon dioxide emissions, as well as a system of permits or “allowances” that decline each year.[35] The program creates an economic incentive to purchase allowances (at an auction or from other emitters), implement a limited number of allowable offsets, or adopt new technology to emit less carbon. Each fuel supplier is required to surrender one “permit to emit” for each ton of greenhouse gas emissions that they emit during fuel production or when the fuel is burned.

California’s Low Carbon Fuel Standard (LCFS) is designed to reduce the carbon intensity of the transportation fuel stocks in the state. It affects oil producers and refiners and is intended to reduce greenhouse gas emissions by applying a system of “credits and deficits” to achieve the overall carbon intensity goal each year.[36]

California’s summer seasonal fuel blend, intended to reduce unhealthy ozone and smog levels, especially in the Los Angeles area, is more expensive for refiners to produce than the winter fuel blend.[37] The seasonal fuel blends plus California’s “reformulated gasoline” requirement (which is designed to burn cleaner) create a “fuel island” effect in California, since refiners and retailers cannot simply buy gasoline from other states in a pinch to meet demand.

Those environmental regulations, the most stringent in the nation, increase the price of gas at the pump. Yet, given political realities, they would be difficult to relax. The costs largely are unique to California. Stillwater Associates, a transportation fuels consultancy, estimates that the retail cost of C&T, LCFS, and biofuel mandates is about 54 cents per gallon at the pump.[38] Tack on roughly another 15 cents per gallon during summer months for the more expensive summer fuel blend.[39] California’s environmental regulations impose real costs on the gasoline supply chain, and those costs, which are not insignificant, are passed along to California consumers at the pump. Those regulations and the resulting costs should be regularly reviewed by the state legislature.

Oil drilling in California has also been curtailed, and new prohibitions have been enacted recently, ostensibly to combat climate change and advance “environmental justice.” As early as 1969, California stopped issuing new permits for offshore oil drilling in state waters.[40] In 2021, Los Angeles County supervisors voted unanimously to prohibit new drilling and phase out existing oil and natural gas wells in unincorporated areas of the county.[41] Also in 2021, Governor Newsom ordered the end of new fracking permits in California by January 2024, with a goal of stopping all oil extraction in California by 2045.[42]

In 2022, Newsom signed laws that create a 3,200-foot buffer zone between new oil wells and surrounding homes, schools, parks, and businesses open to the public, and require existing wells within buffer zones to install comprehensive pollution controls.[43] Also in 2022, the Los Angeles City Council voted unanimously to immediately prohibit new oil and gas drilling and to shut down existing wells within city limits during the next 20 years.[44] The city’s ban on new oil and gas drilling spawned lawsuits by oil companies alleging, among other things, violations of the state and federal constitutions.[45] Rock Zierman, CEO of the California Independent Petroleum Association, said, “[T]aking someone’s property without compensation, particularly one which is duly permitted and highly regulated, is illegal and violates the U.S. Constitution’s Fifth Amendment against illegal [taking of property].”[46]

Those curtailments of oil extraction in California are unlikely to increase gasoline prices for California consumers because of the worldwide market for oil. The exception, however, would be California oil that is less expensive after accounting for the transaction costs associated with purchasing and transporting oil from outside the state, because such California oil no longer would be available due to the oil extraction bans.

Distribution and retail sale: As discussed previously, the distribution and retail sale of gasoline have changed in important ways as automotive and gasoline markets have changed. The old network of service stations that sold both gasoline and repairs is giving way to larger stations that specialize in gasoline and convenience items. The changes in the retail market have increased the economic efficiency of gasoline retailing and are what one would expect in a competitive market.

One troubling development, however, is that California leads the nation in the prohibition of new gas stations and new fuel pumps at existing gas stations, ostensibly to curb climate change and advance so-called environmental justice. In March 2021, Petaluma, California, became the first city in the nation to ban the construction of new gas stations, and it also prohibited existing gas stations from adding fuel pumps.[47] Thereafter, more local governments in California [48] prohibited new gas stations, including American Canyon, Calistoga, Cotati, Rohnert Park, San Anselmo, Santa Rosa,[49] Sebastopol, Sonoma County (unincorporated areas),[50] and Windsor, among others. Los Angeles is considering a similar ban.[51] California already has twice as many drivers per gas station as the rest of the country,[52] yet California is now leading the nation in the forced contraction of gasoline retail outlets, as opposed to contraction that occurs naturally in response to changing consumer preferences, technology, or other market developments.

A consequence of fewer gas stations is that many consumers must drive farther to fuel their vehicles, which not only consumes more gasoline, but it can also force consumers to use gas stations in more dangerous areas. Government restrictions on the establishment of new retail gas stations should be avoided to allow suppliers to enter markets that they perceive to offer emerging opportunities for convenient, safe, mutually beneficial exchanges with customers in the future.

Moreover, California’s notorious urban traffic congestion increases the labor hours needed to transport finished gasoline to gas stations, thereby increasing the price at the pump. Short of peak-load congestion pricing of existing roads or building more roads or both, no obvious solution to this problem exists except more nighttime deliveries of finished gasoline, which is increasingly common.

Taxes and fees: According to the Federation of Tax Administrators, California imposes the second-highest state excise tax on gasoline in the nation (trailing only Pennsylvania).[53] On July 1, 2023, the state gasoline excise tax was increased to 57.9 cents per gallon from 53.9 cents, the adjustment being based on California’s annual inflation rate. Alaska is home to the lowest tax, at 8 cents per gallon. California also levies an additional sales tax on gasoline purchases of 2.25 percent plus fees and any local sales taxes (the average state and local sales tax rate on gasoline is 3.7 percent). Those costs amount to about 9 to 10 cents per gallon, making California’s total gasoline tax bill of 62.9 cents per gallon the highest of any state in the nation. The federal government also levies an additional 18.4 cents per gallon of gasoline (an excise tax of 18.3 cents per gallon plus a fee of 0.1 cents for remediation of “leaking underground storage tanks”).

Lowering gasoline taxes and fees would reduce retail gasoline prices, assuming that all other factors impacting gas prices remained constant. The basic structure of gasoline taxes has changed little over the post–World War II period, although increasing proportions of federal and state excise tax revenues, originally intended for building and repairing roads and bridges, now are allocated to non-highway/non-roadway uses, such as subsidies for public transit. The degree to which that change in the structure of public finance reflects changes in the public’s relative valuations versus the influence of special interest groups is a politically contentious matter.

It would be possible to eliminate all gasoline excise taxes and instead finance highway, roadway, and bridge construction and maintenance by adopting tolls and/or mileage-based user fees. Different ways are available for implementing alternative financing arrangements, and pilot projects have been created to study the alternatives. The benefits of such an approach are: (1) drivers pay according to their road usage, and (2) electric vehicles do not escape payment as they do under a gas-tax-only regime.[54]

Consistent use of competitive bidding among private companies, without union-labor and prevailing-wage mandates, to fix and build roads and bridges could lower overall costs, allowing excise taxes or mileage-based user fees to be reduced over time. It costs California $44,831 to maintain each lane-mile of state roadway—the fourth-highest rate in the nation, which may explain why California’s gasoline excise taxes are so high, compared with those of other states.[55]

Switching from a gas-tax-based system to a toll and/or mileage-based fee system would lower the retail price of gasoline, but it would require drivers to pay a separate fee that is not reflected in the price at the pump. Fairness and efficiency advantages to mileage-based financing of roads and bridges make it worthy of further exploration.

The lesson: All told, the key policy considerations discussed herein would result in lower and/or more stable retail gasoline prices over the long term in California. Some of the policy changes would make retail gasoline prices less volatile during future disruptions and crises. Compared with other states, California’s gasoline market is overly constrained, rigid, and isolated, resulting in slow adjustments and sharp price spikes. Targeted policy changes discussed above would make it more flexible, interconnected, and responsive, from the crude oil producer to the corner gas station.

VI. Conclusion

California is exceptional in many ways, but the functioning of its gasoline market is in many ways typical, subject to the same laws of supply and demand operating in other markets and in other places around the world. Until about 20 years ago, California’s gasoline prices were in the midrange of all U.S. states. They have jumped to the top, however, a consequence less of market fundamentals than of conscious public policy choices by government officials at all levels. Those policy choices unfolded against a backdrop of world crude oil markets and changing retail structures.

Of the components of gasoline prices in California, world crude oil prices form the base (40 percent), as supported by the economic theory of markets and the data cited in the report. Californians have no choice but to live with world prices. Even if it were somehow possible, isolation from world markets would be disastrous for California drivers, households, and businesses. It would raise the prices of goods to consumers and lower their standards of living while delivering few, if any, benefits in return. Robinson Crusoe cogently showed us that self-sufficiency may be the most undesirable situation to be in. Greater interconnectedness helps consumers, and it would help California’s gasoline consumers.

Some gasoline price relief is possible for Californians, but it would require removing blatant government interventions at the federal, state, and/or local levels. Abundant data confirm that reductions in the unit cost of gasoline, whether caused by local, state, or federal actions, are passed through to consumers. Repealing the federal Jones Act would be a good place to start to create improved gasoline price stability in the long term, as more ships would then be allowed to move crude oil and gasoline, and more easily arbitrage supplies. Likewise, “island effects” could be minimized by allowing easier permitting of oil refineries and pipelines.

Turning to federal, state, and local environmental regulations, more stringent standards may bring the benefits of cleaner air and water, but whether they are worth their costs cannot be answered generically. California, in particular, has acted independently of the federal government to enact policies intended to reduce carbon emissions that originate primarily with the combustion of hydrocarbons. Carbon dioxide is emitted everywhere on the planet and mixed into the atmosphere, and is essential to life on Earth, but California produces amounts that are negligible relative to the total. Nevertheless, the state government has enacted regulations including a cap-and-trade program, a low carbon fuel standard, and specialty fuel blends to reduce the emissions of greenhouse gases and other pollutants independent of a coordinated international policy response. Those policies should be reviewed regularly because they impose significant costs on gasoline consumers, especially disproportionate harm on low-income families.

Moreover, California’s state and local governments have enacted restrictions on oil drilling, refineries, pipelines, new gas stations, new fuel pumps, and the gasoline itself, and also implemented a long list of taxes and fees. The cost of those policy choices acts as a surcharge on gasoline (at least 30 percent and growing) and is borne entirely by Californians, who could avoid it under different policies.

This report considers whether consumers are harmed by monopolies in the supply chain that stretches from crude oil production to their gas tanks. Few ideas are more politically popular than blaming high gasoline prices on conspiracies, unscrupulous “greedy profiteering,” and “price gouging.” The report demonstrates, however, that economic theory and logic dismiss such explanations for California’s higher and more volatile gasoline prices. Instead, our discussion of the industry and its downstream markets demonstrates that market fundamentals and regulations explain high gasoline prices in the Golden State.

The oil and gasoline supply chain exhibits complex volumetric interdependence, meaning that a low delivered cost of gasoline requires that refining be a continuous process. Refining, storage, distribution, and retailing are costly, and coordination between the stages requires complex agreements between parties with opposed interests that do not enforce themselves. Changes in the structure of gasoline markets over time reflect economic efficiency within a vigorously competitive market. Because what happens in that process is widely misunderstood, we described the industry in detail. Price controls, such as the law enacted recently by California politicians, and “excess profit” taxes do not help consumers and would only make matters worse, contrary to the views and actions of many politicians and media commentators.

This report offers key public policy considerations that would improve efficiency, lower prices, and reduce price instability. The policy considerations derive from, and target, blatant government restrictions—interventions in an otherwise competitive market—that are worthy of ongoing assessment to consider modifications or repeals of those interventions. Higher taxes (26 percent), stricter environmental regulations and fees (42 percent), and unique “fuel island” effects (35 percent) account for the difference between California’s higher average gasoline price and the national average (recently about $1.20 to $1.50 per gallon, or 34 percent above the national average, which can balloon to 70 percent or more during times of significant disruption). The price premium of $1.20 or more acts effectively as a regressive tax, hurting low-income Californians the most.

The policy considerations include lifting restrictions on oil exploration and drilling; expanding the freedom peacefully to trade oil and gasoline; reducing restrictions on refinery and pipeline capacity; repealing the Jones Act; reviewing California’s stringent and unique environmental regulations that increase gasoline prices; eliminating prohibitions on new retail gas stations and new fuel pumps at existing stations; and requiring competitive contracting and exploring innovative alternatives to gas-tax financing of highways, roads, and bridges.

California officials demonize oil and gasoline producers and retailers for the state’s persistently higher gasoline prices. The shouts of “price gouging” are loudest during periods of price spikes, as experienced in the summer and fall of 2022. The leader of the bandwagon, Governor Gavin Newsom, helped create a new multimillion-dollar state agency to identify and punish “profiteers.” The agency can investigate all it wants, but it will come up empty because oil and gasoline producers are price takers in a largely competitive market. Ironically, the few choke points in the supply chain that deviate from competitive outcomes are the result of policy choices by Gov. Newsom and other officials over the years. The policy choices of politicians, regulators, and environmental lobbyists drive gasoline prices higher in California, not monopolistic behavior of producers. Higher gasoline taxes, stricter environmental standards, and unique fuel island effects are the culprits, and they hurt low-income families disproportionately in California. Consumers should blame politicians, not producers, for the persistently higher retail gasoline prices in California and their greater volatility during periods of disruption. Only policy fixes, not political grandstanding, will bring relief to consumers.

Notes

[1] Office of Governor Gavin Newsom, “Governor Newsom Calls for a Windfall Tax to Put Record Oil Profits Back in Californians’ Pockets,” news release, September 30, 2022.

[2] U.S. Energy Information Administration, Refinery Capacity Report, Table 1: Number and Capacity of Operable Petroleum Refineries by PAD District and State as of January 1, 2023.

[3] U.S. Energy Information Administration, U.S. States, “State Energy Data System (SEDS): 1960–2021,” released June 23, 2023, “Prices and expenditures”.

[4] Myra P. Saefong, “Why California Is Paying Nearly 70% More for Gasoline at the Pump Than the Rest of the Country,” MarketWatch, October 8, 2022. The data were collected from GasBuddy, a website that posts daily survey data obtained from customers of gas stations across the United States.

[5] Ibid.

[6] A 2022 editorial recommended that Southern California drivers cope by topping off their tanks in cheaper Arizona: “Only Tax Cut Would Reduce Gas Prices,” Orange County Register, October 5, 2022. The editorial based some opinions on interviews with this report’s coauthor Robert Michaels, but the views expressed there are entirely the opinions of the newspaper’s editorial board.

[7] Commodities like crude oil and gasoline frequently are moved through “paper trades” of financial instruments—e.g., futures and options contracts—that provide price discovery and adjustment mechanisms useful to market participants without actual physical delivery of the commodity.

[8] The number of producers does not have to be huge; models of oligopoly can yield competitive results with as few as three producers as long as the market is “contestable.”

[9] See “Base Gasoline,” Cornell Law School, source 42 USC Sec. 7581(4).

[10] California Energy Commission, “What Drives California’s Gasoline Prices?” September 2022.

[11] Paul Ausick, “Where Has California’s Gasoline Consumption Gone?” 24/7 Wall St., December 12, 2022.

[12] Data in this paragraph and the next two are from Bayan Raji, “Analysis: U.S. West Coast Market Fundamentals Behind Spot Gasoline Price Surge,” OPIS Blog, October 3, 2022.

[13] Petroleum Market Advisory Committee, Petroleum Market Advisory Committee Final Report: December 2014 to November 2016 (California Energy Commission, September 25, 2017), 21–23.

[14] Weekly tables are available at California Energy Commission, “Estimated Gasoline Price Breakdown and Margins,” July 17, 2023.

[15] Differences in gasoline prices across regions also reflect general cost-of-living differences. The agencies that report cost-of-living indexes at subnational levels warn that they should not be used to compare one region with another.

[16] Equivalently, distribution margin is calculated by subtracting the wholesale gasoline price and taxes (state sales tax, state excise tax, federal excise tax, and state underground storage tank fee) from the weekly average retail sales price per gallon.

[17] The market price of crude oil includes its own costs and profits.

[18] Publicly available studies do not provide estimates of the benefits of the additives or allow comparisons of the performance of different ones. Additives, however, allow us to determine whether a given gallon of gasoline is associated with a particular refiner.

[19] Prices of branded and unbranded gasoline are available from OPIS.

[20] See “National Average Inches Back Up as Oil Rallies to Highest Price Since Spring,” GasBuddy, July 17, 2023; U.S. Energy Information Administration, Gasoline Explained: Factors Affecting Gasoline Prices, “What Do We Pay for Per Gallon of Retail Regular Grade Gasoline?” February 22, 2023; and American Petroleum Institute, Gasoline Taxes, January 1, 2023. The comparison uses an average percentage breakdown of costs nationally during a 10-year period as the benchmark: distribution costs of 14.6 percent; crude oil costs of 53.9 percent; refinery costs of 14.5 percent; state and local sales taxes, environmental fees, plus underground storage tank fees of 12.53 cents per gallon; state excise tax of 26.16 cents per gallon; and a federal excise tax of 18.4 cents per gallon.

[21] Sarah Bohn and Daniel Payares-Montoya, “Gas Prices Stretch Family Budgets,” PPIC Blog Post, March 16, 2022.

[22] Historically, the U.S. Congress routinely asked the Federal Trade Commission to investigate high gasoline prices whenever they spiked. Despite several major investigations in different decades, no evidence of collusion or profiteering was ever found.

[23] The seasonal change in the fuel blend is a state regulatory requirement to alleviate air pollution.

[24] Office of Governor Gavin Newsom, “Governor Newsom Calls for a Windfall Tax to Put Record Oil Profits Back in Californians’ Pockets,” news release, September 30, 2022.

[25] Ajay K. Mehrotra, “Windfall Profit Taxes Have Benefits. But the Devil Is in the Details,” Washington Post, October 24, 2022.

[26] California Energy Commission, “CEC Chair David Hochschild Responds to Recent Gasoline Price Spikes,” news release, October 5, 2022.

[27] California Energy Commission, “Additional Analysis on Gasoline Prices in California,” October 21, 2019.

[28] Denton Cinquegrana, “Summer Gasoline Demand Struggled But Still Profitable,” OPIS Blog, September 21, 2022.

[29] OPIS has more information on the factors that underlie fuel pricing decisions, including OPIS Staff Report, “Fuel Buying 101: Futures and Spot Markets,” OPIS Blog, March 2, 2023; and OPIS Staff Report, “Pricing 101: Demystifying Retail Fuel Prices and Players,” OPIS Blog, May 5, 2023.

[30] California Energy Commission, “What Drives California’s Gasoline Prices?” September 2022.

[31] “SB-2 Energy: Transportation Fuels: Supply and Pricing: Maximum Gross Gasoline Refining Margin,” enacted March 28, 2023.

[32] Grace Scullion and Maya Miller, “As Gas Prices Creep Up Again, Newsom Appoints New Oil Czar to Watch for Price Gouging,” Sacramento Bee, August 3, 2023.

[33] Rosanna Xia, “Gov. Brown Signs Bills to Block Trump’s Offshore Oil Drilling Plan,” Los Angeles Times, September 8, 2018; and Lydia O’Connor, “California May Just Ignore Trump’s Opposition to Stricter Pipeline Rules,” Mother Jones, January 30, 2019.

[34] See, for example, William F. Shughart II, “Oil Trains, Pipelines, and Tanker Ships,” The Hill, December 10, 2014; and William F. Shughart II, “The Jones Act Must Be Repealed,” American Thinker, October 11, 2017.

[35] California Air Resources Board, Cap-and-Trade Program, “About” (undated).

[36] California Air Resources Board, Low Carbon Fuel Standard, “About” (undated).

[37] U.S. Energy Information Administration, Today in Energy, “Date of Switch to Summer-Grade Gasoline Approaches,” April 29, 2013.

[38] Leigh Noda, “California Gas Prices Blow Through Five Dollars” (Stillwater Associates, March 9, 2022); and Leigh Noda, “Sacramento Policymakers Drive California’s High Gasoline Prices” (Stillwater Associates, February 1, 2021). California’s nonpartisan Legislative Analyst’s Office arrived at a similar amount of 50 cents per gallon of gasoline. See Legislative Analyst’s Office, Transportation, Frequently Asked Questions, Transportation Taxes and Fees, “What Taxes Apply to Gasoline in California?” November 2022.

[39] Laurence Darmiento, Sean Greene, and Vanessa Martinez, “High Gas Costs Hurt California Drivers as Refiners Rake in Huge Profits: These Charts Explain,” Los Angeles Times, December 11, 2022.

[40] Kurt Snibbe, “How an Oil Spill Off California in 1969 Reshaped the Modern Environmental Movement,” Orange County Register, January 28, 2019.

[41] Drew Costly, “Los Angeles County Votes to Phase Out Oil and Gas Drilling,” Associated Press, September 15, 2021.

[42] Office of Governor Gavin Newsom, “Governor Newsom Takes Action to Phase Out Oil Extraction in California,” news release, April 23, 2021.

[43] Office of Governor Gavin Newsom, “Governor Newsom Signs Sweeping Climate Measures, Ushering in New Era of World-Leading Climate Action,” news release, September 16, 2022.

[44] Emma Newburger, “Los Angeles Bans Oil and Gas Drilling Within City Limits,” CNBC, December 5, 2022.

[45] Emma Newburger, “Oil Companies Sue Los Angeles Over Ban on Oil and Gas Drilling,” CNBC, January 11, 2023.

[46] Anne C. Mulkern, “Los Angeles Bans New Oil Wells and Will Phase Out Existing Ones,” Scientific American, January 31, 2022.

[47] Dominic Rushe, “This Town Is the First in America to Ban New Gas Stations—Is the Tide Turning?” The Guardian, August 17, 2021.

[48] Grace Toohey, “California Cities Ban New Gas Stations in Battle to Combat Climate Change,” Los Angeles Times, July 11, 2022.

[49] Paulina Pineda, “Santa Rosa, Largest US City to Ban New Gas Stations, Advances Local Effort to Combat Climate Change,” Press Democrat, August 23, 2022.

[50] Sonoma County, “Board of Supervisors Prohibits New Retail Gas Stations in Unincorporated Sonoma County,” news release, March 14, 2023.

[51] Linda Poon, “Will Los Angeles Join a Ban on New Gas Stations?” Bloomberg, July 11, 2022.

[52] Jinjoo Lee, “California Has a Gas-Price Mystery: Too High, But Why?” Wall Street Journal, January 20, 2023.

[53] Federation of Tax Administrators, “State Motor Fuel Tax Rates,” January 1, 2023.