Two recent antitrust decisions highlight the importance of the confirmation hearings for the Bush administration’s top antitrust nominees, Charles James and Tim Muris. (If confirmed, James would be Assistant Attorney General in charge of the Antitrust Division of the Department of Justice. Muris, a law professor at George Mason University, would replace Robert Pitofsky as Chairman of the Federal Trade Commission.)

The first case involved alleged predatory pricing by American Airlines (a unit of AMR Corp.) against three smaller Dallas rivals. The Clinton administration’s trustbusters had argued, in effect, that American had slashed prices below cost in order to monopolize the market, then raised prices after several of its rivals capitulated.

In a striking rebuff, however, U.S. District Judge J. Thomas Marten recently ruled that American was entitled to engage in the same competitive practices undertaken by its smaller rivals, that is, to aggressively lower prices to meet competition in an attempt to hold or gain market share. So long as American charged prices that were not below relevant costs, the court held that the resulting competition and market outcome was perfectly legitimate.

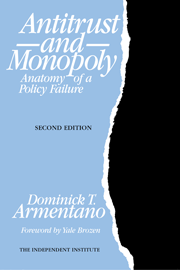

This courageous decision strongly supports the notion that aggressive price competition by firms regardless of size or market share is in the consumer’s long-run interest, an idea abhorred by the Clinton antitrust attorneys but supported by Messrs. James and Muris. And it is an entirely correct decision, essentially echoing The Independent Institute’s Open Letter on Antitrust Protectionism signed by 239 economists and me two years ago.

Any ruling or regulation that prevents any firm from matching the lower prices of any other firm is anti-competitive and anti-consumer. But, unfortunately antitrust has often been used in the past as a cover for special interests that would restrict the competitive process in the name of protecting and preserving it.

Firms, large or small, with cost advantages must be able to leverage those advantages into lower prices that attract additional customers. Alternatively, less efficient rivals, large or small, must suffer losses so that customers and resources can be efficiently allocated. If the Clinton holdovers at the Justice Department had had their way, American Airlines, by virtue of its market share alone, would have been forbidden from competing and offering more favorable terms to its own and any new customers!

Such absurdity would have sharply decreased the competitive process in the air carrier industry and, by extension, in hundreds of other contestable markets as well. Given my reading of their records, there is no way Bush’s antitrust nominees would choose to support this policy or push for an appeal of Judge Marten’s excellent decision.

Another recent antitrust decision is not so good for consumers. The recent ruling upholds a FTC preliminary injunction against the proposed merger of H.J. Heinz and Beech-Nut, a unit of Milnot Holding Co. of St. Louis. The decision effectively ended a combination of the nation’s second and third largest baby-food makers.

In its opinion, the Court of Appeals for the D.C. Circuit argued that there was no legal precedent for approving a merger to "duopoly" without a full-blown FTC review of the facts. The antitrust establishment feared that allowing the merger, regardless of any gains in efficiency or consumer welfare, would weaken merger review standards and open the floodgates for similar mergers in other industries.

The companies had argued (with some analysis supplied by Bush’s FTC nominee Tim Muris) that the merger was necessary to more effectively compete with Gerber, a unit of Novartis AG, that dominates processed baby-food with a 65 percent market share. Perhaps, perhaps not.

What is unfortunate about the ruling is that now we will never know whether consumers would have been helped or not by the merger. The information to decide that question could only have come out of the merger and competitive process itself. But, instead, the government and court intervention short-circuited that market process and substituted its own industrial "plan" for the private plans of shareholders and the purchasers of baby-food.

Antitrust history is littered with such pretentious substitutions. Almost none have worked out as government regulators intended. Open markets, though imperfect, almost always work better than courts or regulatory commissions.

The new Bush antitrust nominees are appropriately skeptical of government planning—especially the proposed dismemberment of Microsoft currently on appeal—and aside from issues such as blatant price fixing, are likely to be far more laissez-faire in overall antitrust enforcement. If we can’t abolish the absurd and archaic antitrust laws, the best we can do i