Matt Yglesias, Slate’s business and economics correspondent, is a lot like Dr. Evil in that he often laments that he’s surrounded by frickin’ idiots. This confidence came through in force in Yglesias’ recent post titled, “Stop Being Wrong About China Buying Our Bonds.” Ironically, not only is Yglesias himself wrong, but his analysis is downright impressive in the depths of its error. Contrary to Yglesias’ claim, the Chinese government’s enormous stockpile of Treasuries does indeed give it leverage over the U.S. government.

Yglesias’ post opens up with characteristic bravado when he writes:

No subject attracts as much wrong commentary from people in positions of authority and influence as China’s purchases of American government debt. Recent antics around the debt ceiling managed to bring about a new surge in wrongness on this subject, so let me set you straight about it once and for all.

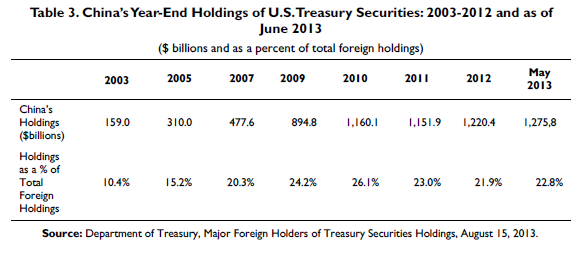

Before diving into Yglesias’ case, let’s review the basic facts. The following table is taken from an August 2013 Congressional Research Service report on Chinese holdings (which in context seems to mean Chinese government and central bank holdings) of U.S. debt:

As the table indicates, currently the Chinese constitute some 23 percent of the entire foreign holdings of U.S. Treasuries. Furthermore, the CRS report also indicates that between 2003 and 2012, the Chinese covered at least $40 billion of the U.S. budget deficit in a given year, with the exception of 2011 when China’s holdings of Treasuries slightly declined.

In this light, it’s understandable why so many analysts are alarmed. If for some reason the Chinese government should decide to halt its purchases—let alone dump its accumulated holdings—of Treasuries, surely this would have serious ramifications?

Yglesias argues that these fears are baseless; the situation depicted in the table above “doesn’t give China any leverage over the American government.” How does Yglesias reach such a counterintuitive conclusion? He first explains that at current exchange rates, Americans buy more goods from Chinese exporters than vice versa. This trade deficit by itself would mean more dollars chasing Chinese yuan in the foreign exchange markets. We’ll turn over the narrative to Yglesias’ own words:

Now in the natural course of floating exchange rates what would happen here is that the dollar price of Chinese money would rise, and this would increase the price of Chinese-made stuff in America and decrease the price of American-made stuff in China. That in turn would tend to discourage the flow of Chinese-made stuff to the United States of America.

But the Chinese government for various reasons wants to subsidize Chinese manufacturing. So they want to send those dollars they accumulate back to the United States....[W]hat they choose to do...is to purchase lots of US government debt. That’s a nice quiet way of limiting the extent of Chinese currency appreciation.

But that’s all it is. It’s not an investment...[I]t’s certainly not a favor to the United States of America. The American government doesn’t need China to provide it with American fiat money—we have plenty of American fiat money. [Bold added]

It’s hard to know where to begin in unpacking the problems with Yglesias’ glib position. One way to tackle it is to look at what is actually happening when the Chinese government chooses to buy Treasuries. Contrary to Yglesias’ description, it’s not really the case that American importers send U.S. dollars to Chinese exporters, who build up piles of American fiat money, and then have to find something to do with it. Rather, the more general case is that American importers (or the financial institutions acting on their behalf) go to the foreign exchange markets and buy Chinese money with their dollars first, then use the Chinese money to buy Chinese goods.

At the same time, if the Chinese central bank wants to acquire more U.S. Treasuries, it doesn’t walk around with hat in hand to various Chinese exporters, asking them to deposit the U.S. dollar bills they’ve accumulated. No, the Chinese central bank enters the foreign exchange markets, looking to buy U.S. dollars with Chinese money, in order to then buy U.S. Treasuries with American money. Thus, to claim that the Chinese government is effectively mailing back dollar bills—which is no favor to us since the Treasury can just print up more dollar bills on our end—isn’t even technically what’s going on.

Yet that’s just a minor quibble. The fundamental problem with Yglesias’ argument is that he ignores the impact on the United States if the Chinese chose to use their dollar holdings to buy American exports, rather than more Treasuries. In other words, the “favor” the Chinese are bestowing on Americans in general (and the U.S. government in particular) isn’t that they are handing over dollars in exchange for more Treasuries. Rather, the “favor” is that they keep sending us manufactured goods without asking for anything “real” in return.

In principle, the Chinese could sell their current holdings of some $1.3 trillion (as of May) in Treasuries, then use the dollars thus raised in order to buy exports from the United States. Then at least one of the following effects would kick in, or (more likely) they would occur in combination:

POSSIBLE EFFECT #1: By dumping $1.3 trillion of Treasuries on the market at once, the Chinese would force up U.S. interest rates. In other words, in the very act of selling, the Chinese might depress the market value of their holdings (a drop in bond prices means a rise in yield), and not get the full $1.3 trillion at current market valuations.

POSSIBLE EFFECT #2: The sudden (and presumably long-term) collapse of Chinese demand for U.S. financial assets would lead to a sharp depreciation of the dollar. Suddenly “cheap” imports from China would not be so cheap. Retailers such as Wal-Mart would not be able to sell lamps, TVs, and other goods as cheaply as they currently do. Crude oil, quoted in U.S. dollars, would suddenly jump in price. Most retail items would become more expensive for American consumers.

POSSIBLE EFFECT #3: The first effect #1 above could be offset to the extent that private American investors stepped into the breach and mimicked the role previously played by the Chinese, by expanding their holdings of Treasuries without asking for a higher yield. In this case, the dollar would still crash against the Chinese currency (effect #2 above). To the extent that the Chinese (and the rest of the world) just wanted to reduce their holdings of U.S. assets, period, this outcome would simply reverse the accumulated trade deficits up to this point; Americans would run a one-time $1.3 trillion trade surplus with China, busting their buns to ship them all sorts of goodies, for nothing—just to get back to even.

POSSIBLE EFFECT #4: The only way to completely offset both effects #1 and #2 above, is if foreign investors are willing to step into the breach and smoothly offset the Chinese unloading of Treasuries, without asking for a higher yield on the assets to induce them to expand their holdings. Only in this case would Americans be relatively unaffected; the immense holdings of Treasuries would simply have switched from China to, say, Japan.

Now I’m sure that Yglesias and other Keynesians would argue that the above outcomes are actually great, given our current “liquidity trap” conditions. My first retort is that Yglesias didn’t qualify his argument by reference to the current slump; he gave a general case that is either true or false regardless of the unemployment rate.

Furthermore, the Keynesian argument, if correct, leads to the conclusion that if the Chinese developed an unstoppable satellite weapon, and demanded that Americans send them $1.3 trillion in goods as tribute to avoid annihilation, that this wouldn’t affect us in any way. In fact, we would be grateful for the stimulus this provided to our economy, since sending them such tribute shows up (other things equal) as $1.3 trillion in “Net Exports” in the GDP calculations.

Paul Krugman, pining for a bogus alien invasion, might indeed go just that far, and hope for a military blackmail of the United States as the path to prosperity. Does Yglesias as well, or is he willing to reconsider his glib post about China?