Although many economists and stock analysts claim to have predicted the current recession, few can offer any proof in print. In truth, most were entirely blindsided by the swiftness and depth of the economic collapse and the portfolios of their clients paid dearly for it. Interestingly, some of these same individuals are now asserting that an economic recovery is at hand and that stocks and other financial assets are under priced. Hmm.

In the interest of full disclosure, this writer did explicitly foretell the current economic recession (“Economic Outlook 2008: Darkening Clouds” Press Journal, December 4, 2007). In addition, he has no clients whose IRA’s have been devastated by ignorance of the business cycle. Finally, he is not confident that any sustainable economic recovery is at hand or that stocks are currently a bargain. He could, of course, be dead wrong about that.

My skepticism about any sustainable economic recovery relates to two overwhelming realities. The first is that the massive infusion of government credit to the banks and much of the stimulus spending will simply perpetuate (and even extend) the consumer and business “malinvestments” created during the boom.

What short memories our policy makers have. Apparently they have already forgotten that it was years of Federal Reserve easy credit (and not the “free market”) that created the housing bubble that went bust last year. The last thing that over-extended consumers need now is more debt.

A sustainable economic recovery requires the credit dependent industries (housing, autos, construction) and their suppliers to shrink back to levels of production that are consistent with current incomes and current levels of savings. All of this is painful but necessary. And any government attempt to make (consumer) credit more available through bailouts, subsidies, and regulations is counter-productive to any real recovery.

The second factor in my skepticism about recovery and stock prices is that the massive increase in federal spending, financed either by new borrowing or credit from the Fed, will (must) eventually result in sharply higher interest rates. Interest rates will rise because of inflation or expected inflation or dollar depreciation. Lenders (especially foreign lenders) will not continue to purchase U.S. Treasury bonds at a nearly zero real interest rate; there is simply no historical precedent for this, ever. And when higher interest rates and lower bond prices arrive they will dampen some economic activity and attract some of the funds currently flowing into common stocks.

I am aware that some investors, earning almost nothing in their money market accounts, are worried that the stock market ship may have already sailed and that they are being left high and dry at the dock. Don’t panic. There will be other sailings when the economic waters are calmer and the destination more precise.

Economic recovery? Not so fast

Also published in Austin Business Journal Show More »

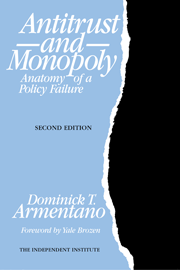

Dominick T. Armentano is a Research Fellow at the Independent Institute and professor emeritus in economics at the University of Hartford (CT).

Comments

Before posting, please read our Comment Policy.