The role of government in the United States and other western democracies has expanded dramatically over the last century. Compared to its pre-twentieth century functions, government has taken on new and vast roles, including old-age pensions, government-provided health care, and a host of other programs that typically comprise a modern welfare state.

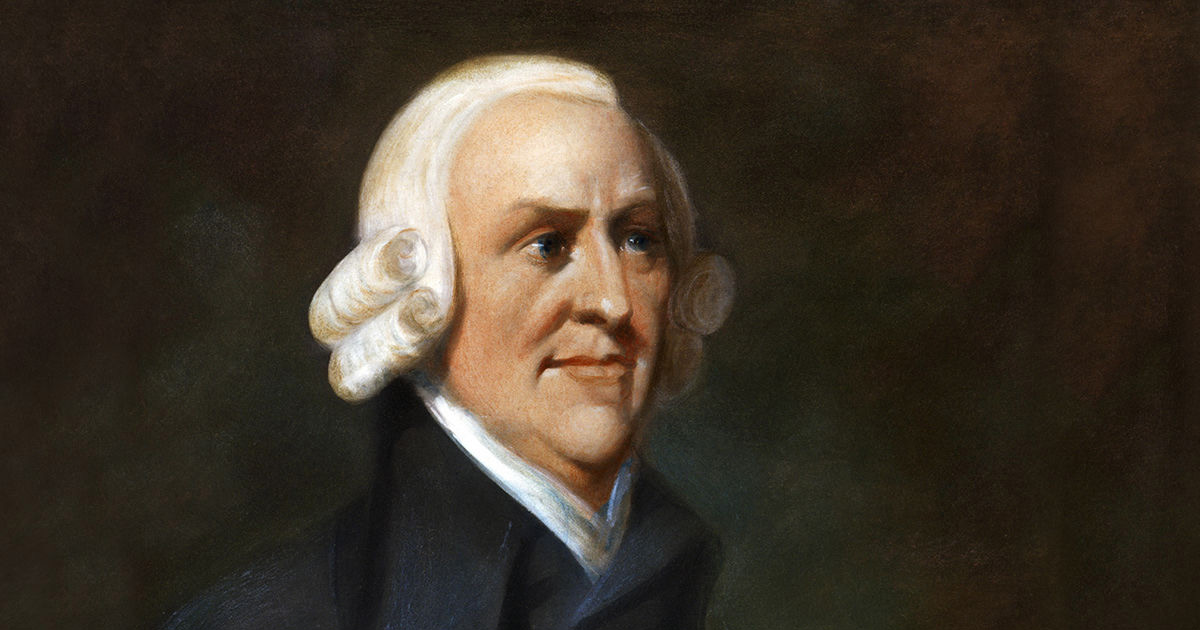

What would Adam Smith, the eighteenth-century Scottish moral philosopher, say about the expanded role of our modern government? For Smith, the ideal functions of government were few and well defined. In his classic work, An Inquiry into the Nature and Causes of the Wealth of Nations, written in 1776, Smith outlined three important government functions: national defense, administration of justice (law and order), and the provision of certain public goods (e.g., transportation infrastructure and basic and applied education). Clearly, government has grown beyond the bounds of these simple duties.

Some would argue that government has expanded because of necessity, that modern society requires redistribution of wealth for stability and regulation to constrain the excesses of an unfettered market. Many believe it is unrealistic for government in the twenty-first century to adhere to the limited roles envisioned by Smith. We have our doubts about these arguments. However, we raise a different but related question: if Smith is right that national defense, administration of justice, and public goods are essential to a free and prosperous society, might government’s expanded roles one day crowd out its traditional and essential functions to that society’s detriment?

When we examine evidence on this question, the findings are striking. We first categorize national government expenditures according to whether or not Smith would support them. Under the category Smith would support, we include expenditures on national defense, administration of justice, transportation, and education. We consider social expenditures on Social Security, Medicare, health, income security, and labor and social services beyond the bounds that Smith would support. Next, we examine trends in these expenditures.

Here are some of our findings:

- In 1962, expenditures that Smith advocated accounted for 54.4 percent of the U.S. budget. Yet, by 2005, this percentage had fallen to 27.6 percent, with the Congressional Budget Office projecting this percentage to fall to 22.0 percent by 2011.

- The trend for the social expenditure category runs in the opposite direction. In 1962, social expenditures accounted for only 23.4 percent of the U.S. budget, but by 2005, they accounted for 58.1 percent, and they are expected to account for 63.3 percent of the budget by 2011.

- When we examine state and local government expenditures, we find the same trends, though they are less pronounced than their federal counterparts. The trends show no sign of reversal for either level of government.

Our analysis shows that social spending is rapidly replacing expenditures on traditional government functions advocated by Smith. As a result, governments will find it increasingly difficult to provide and maintain traditional services without significant tax increases or larger deficits.

These observations are not lost on federal budgetary experts. The Congressional Budget Office (CBO) documents that the amount and composition of federal spending have “changed dramatically,” and that most of that growth has been in three programs: Social Security, Medicare, and Medicaid. These programs now account for 42 percent of federal expenditures. In total, mandatory programs now account for over half of federal spending. The CBO notes that health expenditures will increase much more than Social Security expenditures in coming years, and that “if past growth rates persist, spending for health care will eventually consume such a large share of the nation’s output that real (inflation-adjusted) spending on other goods will have to decline sharply.”

The consequences are clear. Continued higher rates of social spending will require higher taxes, larger deficits, or dramatic cuts in other government programs, such as those deemed essential by Smith. These, in turn, may cause “slow private capital formation, lower economic growth, and in the extreme...a sustained economic contraction,” according to the CBO. These outcomes are the opposite of Smith’s model for economic prosperity.

Despite these dire predictions and their resulting consequences, the political will for change is weak. And the longer these trends continue, the more difficult it will be politically to change them. Perhaps it is time for the American public and its elected officials to give more heed to the wise words of a Scottish philosopher who wrote some 230 years ago.